Leadership in Fintech builds trust and reduces vulnerability

Article written by Dr Alex Zarifis

Fintech and sustainability

Financial technology often referred to as Fintech, and sustainability are two of the biggest influences transforming many organisations. However, not all organisations move forward on both with the same enthusiasm. It is, therefore, important to find the synergies between Fintech and sustainability. For this reason I carried out research on how leadership in Fintech builds trust and reduces vulnerability when combined with leadership in sustainability (Zarifis, 2024).

Leadership in Fintech and sustainability

One important aspect of this transformation many organisations are going through is the consumersʹ perspective. It is important to clarify whether leadership in Fintech, with leadership in sustainability, is more beneficial than leadership in Fintech on its own.

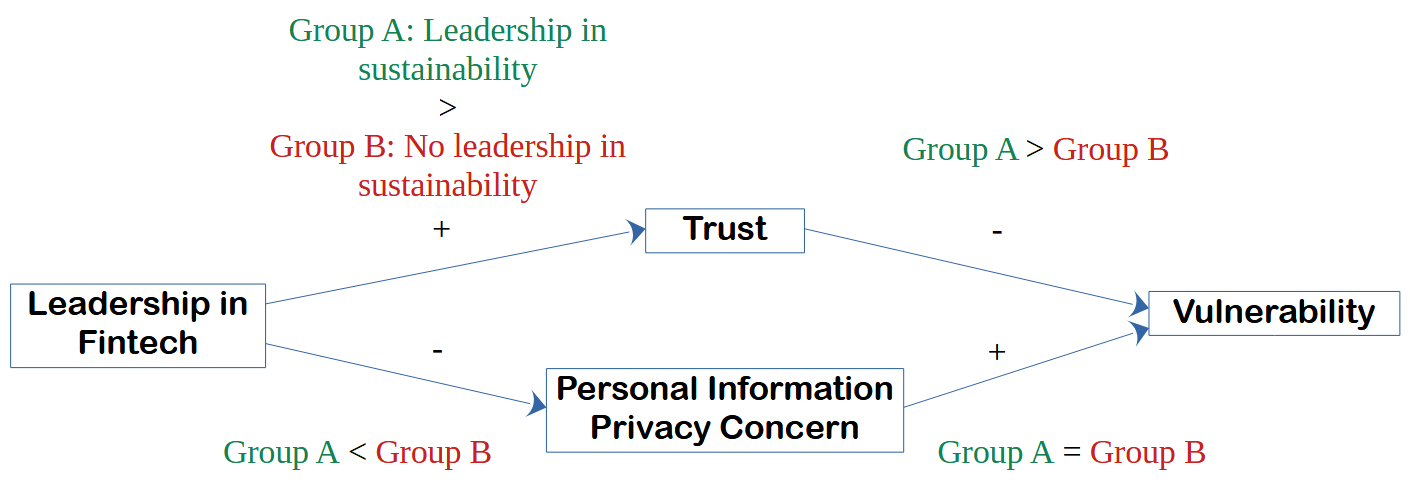

This research evaluates consumers”™ trust, privacy concerns, and vulnerability in the two scenarios separately and then compares them. Firstly, this research seeks to validate whether leadership in Fintech influences trust in Fintech, concerns about the privacy of personal information when using Fintech, and the feeling of vulnerability when using Fintech. It then compares trust, privacy concerns and vulnerability in two scenarios, one with leadership in both Fintech and sustainability, and one with leadership just in Fintech without sustainability.

The benefits of combining leadership in both Fintech and sustainability

The findings show that, as expected, leadership in both Fintech and sustainability builds trust more, which in turn reduces vulnerability more. Privacy concerns are lower when sustainability leadership and Fintech leadership come together; however, their combined impact was not found to be statistically significant. So contrary to what was expected, privacy concerns are not reduced more effectively when there is leadership in both together.

Figure 1: Model of leadership in Fintech, trust, privacy and vulnerability, with and without sustainability

Fintechs can use these findings to make consumers feel less vulnerable

An important practical implication is that this research finds that even when there is sufficient trust to adopt and use Fintech, the consumer often still feels a sense of vulnerability. This means leaders in Fintech must not just do enough for the consumer to adopt their service, but they should build trust and reduce privacy concerns enough for consumers to feel less vulnerable. These findings can inform a Fintech”™s business model and the services it offers.

Reference

Zarifis A. (2024) Leadership in Fintech builds trust and reduces vulnerability more when combined with leadership in sustainability”™, Sustainability, 16, 5757, pp.1-13. https://doi.org/10.3390/su16135757

Biography

Dr Alex Zarifis research and teaching are on the practical applications of technology in business. Before the University of Southampton, he worked at several academic institutions including the University of Cambridge and the University of Manchester. He is currently a research affiliate of the Cambridge Center for Alternative Finance (CCAF).

His research interests include trust, electronic business, artificial intelligence, blockchain, Fintech and Insurtech. He has over forty publications and his work has featured in journals such as Computers in Human Behaviour and Internet Research. He has explored cryptoassets such as cryptocurrencies since 2012. As part of this research, he published the first peer reviewed research on trust in digital currencies in the world in 2014.

Existing insurers and disruptors are utilizing Artificial Intelligence to create new business models

We can see that Artificial Intelligence (AI) is transforming many parts of our lives, but do we know where this journey is taking us? Insurers need some certainty on what their future will looks like. Some new insurers are trying new business models enthusiastically and then changing direction sharply, like a speedboat swerving to avoid a collision. The larger insurers, however, are like large cruise ships; they need to be able to see far ahead before they plot their course, and they don’t want to keep changing direction.

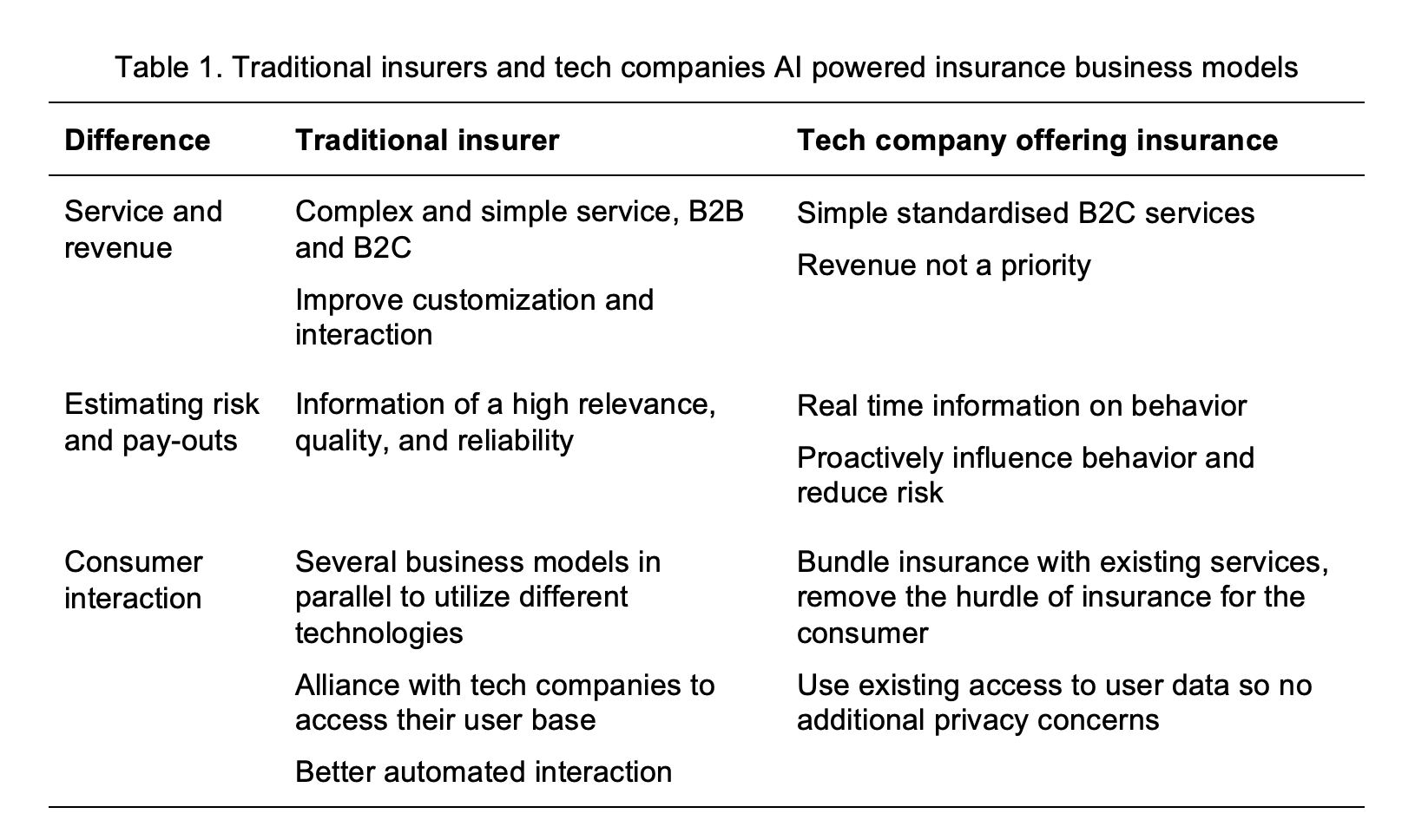

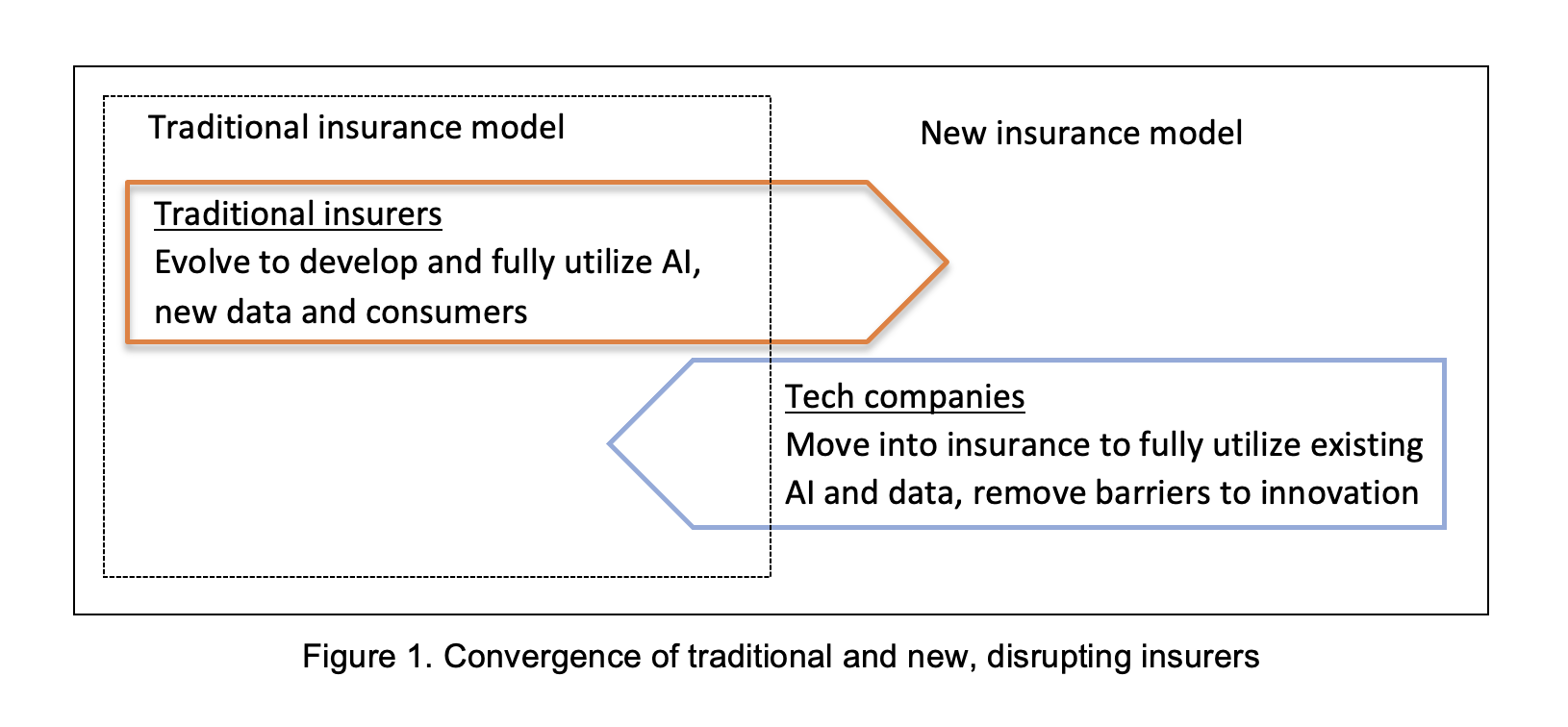

This research tried to identify the viable AI driven business models to help give some clarity. Some traditional insurers are just trying to be more effective with AI, while others reinvent themselves to fully utilize the new capabilities available. Tech-savvy companies from outside the sector like Tesla, are entering and disrupting it. Would these diverging paths continue, or would they converge in the future towards one, ideal, business model? This research focused on one example of a traditional insurer and one new tech-savvy disruptor and evaluated whether their models are converging.

AI is changing the insurance value chain, as illustrated in figure 1. Most new insurers, like Tesla, offer fully automated simple services. The traditional insurers offer some of their simpler services in this way. The more complex services are supported with AI, but a human makes the final decision. An example of this are audits for fraud, where the AI identifies unusual patters and cases for an expert to evaluate.

There are signs of convergence between the models of traditional and new insurers. First, there is convergence in technologies, such as the use of chatbots utilizing AI. Second, there is a convergence in processes, for example, the interaction with the consumer. Third, there is convergence in the strategy on costs and pricing.

However, there are two areas where there seems to be a limit on convergence, which seems to suggest the business models of the incumbent and the disruptor will remain distinct. These are: (1) evaluating risk and (2) the cost of attracting the user and profitability.

Despite some convergence, certain differences are likely to remain even after this transitionary period. This is because the two models have distinct competitive advantages. Traditional insurers no longer monopolize the capability of providing insurance, but they still have the existing user base and utilize it to evaluate risk. Technology-savvy companies that now offer insurance, have their own forms of engagement with their consumers, use different methods to evaluate risk due to their access to real time data, and do not prioritize generating revenue but instead utilize insurance to increase their user base, overcome barriers, and reduce the overall cost of their products and services.

Therefore, when insurers are thinking about how to utilize AI and plot their course through the turbulent, unpredictable times ahead, they should stay true to what they are. This is their comparative advantage.

Dr Alex Zarifis is a lecturer at the University of Nicosia in Cyprus.

This article is adapted from his paper, “Evaluating the New AI and Data Driven Insurance Business Models for Incumbents and Disruptors: Is there Convergence?” available from https://doi.org/10.52825/bis.v1i.58.