Fintech Zumo appoints Chief Technology Officer

Tim Sabanov has been appointed as Zumo’s first chief technology officer to pilot its plans for new product launches in the coming year. Zumo, the digital wallet and payment platform, now looks to discover new ways of democratising financial services, such as a debit card that converts cryptocurrencies to traditional currencies.

Nick Jones, co-founder and CEO of Zumo, said:

“Tim is a leader in blockchain technologies of truly global stature, and his experience will take our products to the next level.”

“We are so excited for him to take up the role and can’t wait to bring his plans to market.”

Tim is one of the brightest minds in Fintech, with his experience not exclusive solely to financial technology, but also creative design agency and stint as Creative Director at Kontrast Marketing. Since joining the organisation in January 2020, he’s pioneered the development of Zumo App, ZumoKit Enterprise Solutions platform, and most recently, the Zumo Smartfolio.

Tim said:

“Zumo is leading the field in providing technologies that democratise access to financial services. What makes Zumo different, however, is the non-custodial approach it takes in its platforms, meaning that whether you are a business operating on the ZumoPay payments platform, or a consumer on the Zumo App, you are truly in charge of your own finances.

“We are just beginning to realise the potential use cases of blockchain technology which is why I am delighted to take up this post and help further Zumo’s mission to bring the benefits of smart money to everyone.”

AutoRek wins best insurance system in bobsguide Awards

Scottish fintech AutoRek was awarded ‘Best Insurance System’ in bobsguide awards for the second time.

The awards recognise the strength of tech updates and their impact on the client experience. Autorek went through several rounds of assessment. The judges looked at user and market engagement, as well as specific criteria for each individual award.

Michael McCaw, editor at bobsguide, commented

“During an incredibly difficult year for the insurance industry, many market participants looked to their tech partners to contribute additional value and certainty across various processes and functions. The judges were particularly impressed with the standards set by AutoRek throughout 2020, in making sure their clients were well-informed and had access to leading data management and reconciliation technology.”

Lyn Canavan, Head of Marketing at AutoRek commented

“We are proud to have won Best Insurance System with bobsguide for the second time. We have focused our efforts on innovating our Insurance solution over the past couple of years and this award recognises the hard work and dedication of the whole AutoRek team. We are continuing to expand our global Insurance client base and are confident that these clients will reap the benefits of our end-to-end automation tool.”

Collaboration between Scottish fintechs FastP.A.Y.E and Inbest to support vulnerable employees

FastP.A.Y.E announced today that it has integrated Inbest benefits calculator to allow employees to make a benefits’ check within its flexible and ethical wage App.

This feature will allow employees in low-paid or insecure roles to learn about all the benefits and grants available to them before withdrawing income from their salaries. Employees will also be able to understand what they need to do to apply for their benefits and the organisations that can help them on their claims.

Ian Hogg, CEO of FastP.A.Y.E, said:

“As an ethical provider of salary advances, we recognise that a salary advance isn’t always the best option. Some may have outstanding benefits entitlement and in such circumstances we are delighted to be working with Inbest to guide employees to these benefits and avoid the need for an advance ”

Manu Peleteiro, CEO of Inbest, said:

“We believe that collaboration and specialisation are fundamental to reduce the amount of benefits unclaimed in the UK. We are delighted to work with FastPAYE to raise benefits’ awareness among employees on low-paid or insecure roles.”

Nicola Anderson, CEO at FinTech Scotland welcomed the initiative

“This collaboration between Inbest and FastP.A.Y.E continues to demonstrate the determination and focus from fintech innovators to find practical solutions that help support people facing financial vulnerability and address financial inclusion. Enabling easier ways for people to learn about potential benefit entitlements can offer an alternative to help maximise income and reduce longer term debt.”

Virgin Money selected Waracle as technology partner for business banking market.

Virgin Money have selected Waracle as their technology partner for Virgin’s first foray into the business banking market.

The partnership will see Virgin Money leverage Waracle’s deep expertise in mobile application design and development, with a particular emphasis on feature rich apps focusing on financial wellbeing.

Waracle are one of three technology partners selected for the project, with Virgin Money citing the app development agency’s financial services and software development expertise as key criteria in the decision.

Gavin Opperman, the Group Business Director at Virgin Money, said:

“The skills and capabilities which Waracle provide are very much in demand and are vital in helping us develop our innovative business banking proposition, both in terms of what we deliver and how we deliver it. We’re confident the cutting edge approach to technology the team will deploy will deliver great experiences for our customers.

“Waracle is a strong Scottish-based company and we’ve partnered with them previously on the creation of our augmented reality Currency Converter, which was a great success. The team’s collaborative approach and work ethic fits perfectly with our combined team, including an ecosystem of capability partners. I look forward to seeing the results of our latest collaboration.”

Waracle’s co-founder and Chief Technology Officer Mike Wharton cited the difficult economic environment in 2020 as a perfect time for financial services organisations to step forward to support businesses, adding

“the innovative banking proposition Virgin Money is bringing to the market will help the business community thrive”.

The launch of Virgin Money Business will be vital to the bank as it develops it’s Working Capital Health proposition which aims to transform the bank’s existing business current account offering into a financial wellness tracker for SMEs.

Waracle are part of the Fintech Scotland community, who support the growth of the Scottish fintech cluster.

New non-exec Chairman for Exizent as they take next step in evolution to make bereavement experience better for everyone

Start-up tech firm Exizent, whose innovative platform is transforming bereavement by connecting legal services firms with banks and the wider financial services community,, has further strengthened its team with the appointment of Mitchel Lenson as Non-Executive Chairman.

Mitchel was a long-serving Non-Executive Director at Nationwide Building Society before stepping down in 2019 and brings extensive financial services and technology innovation experience to the Board, gained through both his executive and non-executive careers.

His career spans over 30 years, with roles at Deutsche Bank, UBS Warburg, Credit Suisse First Boston and J.P. Morgan. He currently sits on the board of Currency Cloud, which allows the next generation of fintechs to quickly and easily build cross-border payments and FX functionality into their platforms, as well BioCatch, the global leader in AI-driven behavioural biometrics.

Mitchel, who has an MBA in international finance from City University Business School and a BA in Business Finance from City of London Polytechnic, says he is excited to be joining Exizent, whom, he describes as “a fine example of the role technology can play in improving an area that has been long overlooked.”

He said: “Exizent’s vision to improve the bereavement experience and fundamentally reduce the administrative burden on families is a proposition that really resonates with me, and I’m looking forward to supporting them on their journey.”

Nick Cousins, who is founder and CEO, says he is delighted Mitchel has decided to join Exizent, saying his extensive experience will be a huge asset as they move forward with their vision of improving the entire bereavement process:

“Mitchel brings a proven track record in financial services and technical innovation and his appointment is a key step in our evolution as we seek to make the bereavement experience better for everyone involved.”

Exizent is the first ever platform that connects data, services and the network of people involved when someone passes away. The company’s mission is to reduce uncertainty, increase speed and make the process far simpler.

The company was founded by former financial services veteran Nick Cousins and transformation and technology leader Aleks Tomczyk (pictured left). The business successfully raised £3.6 million in funding from several investors including FNZ, the global platform-as-a-service firm which reached unicorn status in 2018.

Legado finalist in Lloyds Banking Group innovation programme

Life organisation and legacy planning platform, Legado, has been included as a finalist in the Lloyds Banking Group’s innovation programme. LAUNCH Innovation Lab, powered by Lloyds Banking Group, seeks to identify new and leading-edge businesses that have created solutions which can support Lloyds Banking Group workplace pension members in preparing them for the future.

Legado was part of an initial cohort of 12 innovative businesses accepted onto the programme in October and has now gained a place as one of the final six. Legado will now work collaboratively with the Lloyds innovation team and the Scottish Widows workplace pension team to adapt its life-planning platform for use by members of the company’s corporate pension schemes, helping them organise their life documents and key information.

Legado will create a bespoke proof of concept which will include technical integration and some early testing with workplace pension members. The fintech scale-up will have its concept launched as part of Lloyds service offering, helping drive efficiency to workplace pension members and preparing them for life’s events.

Josif Grace, Founder and CEO of Legado said:

“During the initial phase of LAUNCH, we worked closely with Lloyds to understand the challenges faced in the workplace, which has given us insight to explore a proof of concept to be rolled out more widely.

“The bespoke Legado platform will enable Lloyds to enhance workplace engagement through the provision of a relevant, employee-focused, digital tool which is personalised to individual circumstances, helping ensure life-readiness at key life moments. Lloyds will also benefit from increased efficiency with readily available integrations and APIs enabling a seamless way to exchange HR related documentation.”

By providing relevant and useful digital tools and services, LAUNCH brings together the brightest new companies under its umbrella to ensure they take the right steps to meet customer’s goals. This includes providing corporate customers with the tools and support needed to engage with their workplace pension members.

David McLeay, Innovation Manager at Lloyds Banking Group commented:

“Legado’s platform is a truly innovative concept and is something we are eager to explore as a benefit for our workplace pension members. Technology and planning for the future go hand in hand, however when it comes to life organisation and legacy planning many of us still rely on physical documents. The digital transformation of this sector will bring it into the 21st Century. We want to be able to offer our workplace pension members access to the best services that will benefit them and their loved ones ”“ Legado has the opportunity to do just that.”

Lloyds Banking Group’s interest in Legado follows strategic investment from Prudential and FNZ, joining the company to disrupt and transform the way in which personal organisation and life planning takes place in the UK.

AutoRek recognised in RegTech100 list

Scottish fintech AutoRek has been chosen as one of the world’s most innovative RegTech companies in the the annual RegTech100 list. The list is pulled together by RegTech Analyst, a pre-eminent provider of data, research and analysis on the global RegTech market.

A panel of analysts and industry experts looked at over 1,000 companies and the finalists were selected for their innovative use of technology to solve significant industry problems or generate efficiency improvements across the compliance function.

Despite a very different 2020, AutoRek has seen a huge demand increase for regulatory reporting solutions, with many firms already implementing AutoRek.

Kemal Sangrar, Head of Product, AutoRek, said:

“AutoRek is delighted to be listed in the RegTech100 for the third consecutive year. This award is recognition of our commitment in delivering regulatory reporting solutions to the financial services industry and testimony to innovative strategy underpinning our product. We anticipate another great year ahead and are looking forward to the launch of our next big release, AutoRek 6.0.”

Mariyan Dimitrov, Director of Research, RegTech Analyst, added:

“At RegTech Analyst, we take pride in consolidating the RegTech100 list each year. With the RegTech industry still expanding and evolving, we have found it important that Financial Institutions are kept up to date with the most innovative RegTech companies out there and having gone through the process the last three years, AutoRek is certainly one of them.”

A full list of the RegTech 100 is available at www.RegTech100.com<http://www.

Tech firm Exizent on why Bereavement processes are not fit for the 21st Century

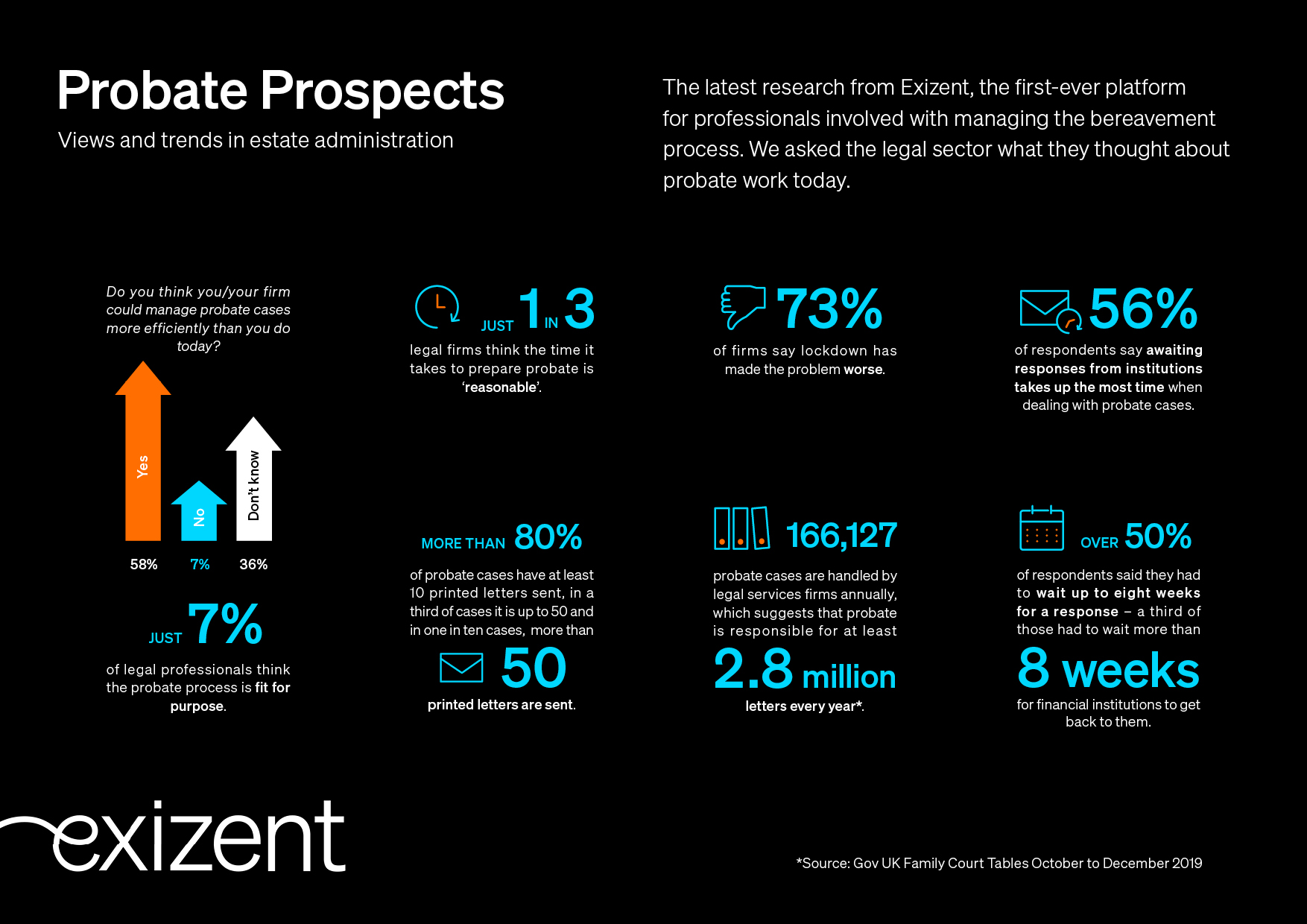

Exizent, the Glasgow based technology firm recently launched its Probate Prospects survey which revealed why bereavement processes need a radical overhaul.

It surveyed the legal profession who handle probate, the process of dealing with the estate of someone who has died. It found that even though most law firms (64%) either have specialist probate teams or people who mainly work on probate cases, the vast majority feel the processes are inefficient and could be enhanced by technology.

The top reason respondents gave for why they think probate cases take so long was waiting for financial institutions to get back to them’, with more than half (56%) saying this was the main hold up. More than half of respondents also said they had to wait up to eight weeks for a response ”“ a third of those had to wait more than eight weeks.

After waiting on institutions’, respondents said administration’ was the next most time-consuming part of the probate process, with more than a quarter (27%) saying this causes the most delays.

Exizent’s research also revealed that Covid-19 has exacerbated the problem even further. Almost three quarters of those surveyed said the lockdown has impacted their executory work, citing financial institutions taking even longer to respond as a result of working from home.

Nick Cousins, founder and CEO of Exizent said:

“Our research shows that a significant majority of professionals think the time it takes to process probate cases is unreasonable, and that administration and waiting on institutions is taking up most of their time, yet most (85%) don’t have any technology dedicated to managing probate while 18% don’t use any software at all. “People’s lives are increasingly dispersed and varied. Performing executry work with a growing number of banks and institutions is more complex than ever. Without standardisation and the right tools available, too much time is wasted on administration. What this means for families is frustration, long delays and unnecessary anguish in trying to piece together what’s required to administer an estate and release assets to beneficiaries.

“However, with the right technology in place, we know professionals involved with estate administration could cut down the time and cost involved with managing probate cases exponentially and make the bereavement experience better for everyone involved.”

The Exizent online platform is specially designed for executry teams managing probate. Exizent is working with major banks, share registrars, and other institutions to build standardised requests and responses, making it easier for legal services firms and institutions to work together to sort out what is needed and making the process more efficient and easing the burden on executors and families.

Cousins’ and co-founder Aleks Tomczyk’s own experiences led them to establish Exizent. They felt that the administrative tasks facing families after the death of a loved one should be far easier.

They have spent the last 18 months carefully designing, developing, and testing the product with innovative partners, and, in September, successfully raised £3.6 million in funding from several investors including FNZ. It launched fully to legal professionals this month.

Photo by Andrew Neel from Pexels

New Chief Financial Officer for fintech Autorek

Kenny Bain will join Scottish fintech AutoRek, a leading software provider to global financial services, as Chief Financial Officer. He will play a key role in evolving and scaling the company.

Bain was previously Chief Executive Officer of Rant and Rave and is very experienced in financial leadership and operational management with a proven track record of delivering substantial growth in the software and technology sector, in the UK and internationally. Prior to this, Mr. Bain worked for 14-year at Graham Technology, as Chief Financial Officer, Chief Operating Officer and EMEA Managing Director, as the business expanded across the US, Europe and Asia.

“We are delighted to welcome Kenny onboard. He brings a wealth of invaluable experience from the software technology sector, which will no doubt make an enormous contribution as we continue to build on the success of AutoRek within the UK financial services sector and internationally.”

Gordon McHarg, CEO, AutoRek

“I am delighted to join AutoRek at this exciting time and look forward to working with Gordon and the team to deliver further growth. The business has a fantastic culture, a highly engaged team, a market leading product and is passionate about customer success – all positioning AutoRek perfectly to capture the significant opportunities that lie ahead.”

Kenny Bain, Chief Financial Officer, AutoRek, added,

£9m investment for Scottish fintech Modulr

Edinburgh based fintech, Modulr, just announced a £9 million investment from PayPal Ventures. This fresh investment will help the company develop new products, recruit and reach new clients.

Modulr let companies easily implement new payment products and services within their customer journey. The fintech provides a full stack Payments as a Service API, whilst taking care of the complexities and regulatory overhead. Modulr has a direct access to the

Modulr works with platforms that serve small and medium-sized businesses. This year has been rich in news for the company with the onboarding of new customers despite problems caused by COVID-19. Modulr connected to the Back scheme, the Faster Payments scheme, Visa and Mastercard.

“This investment marks an important milestone for Modulr’s modern payments infrastructure. Modulr lowers the barriers to bringing payments into a platform, creating endless new possibilities for our customers while allowing them to focus on their core competencies. The investment from PayPal Ventures enhances our ability to execute on that vision.”

Myles Stephenson, CEO of Modulr

“More digital businesses are looking to incorporate payments into their existing user experience but either don’t have the expertise or the resources. Modulr is well-positioned to be an enabler of this trend and will undoubtably expand end-users’ access to fast, reliable and secure financial services. We look forward to working with Modulr as it helps to powers the next generation of digital businesses.”

Anil Hansjee, partner at PayPal Ventures

In total, Modulr has raised £63.3 million including investment from PayPal Ventures, Highland Europe, Frog Capital, Blenheim Chalcot and a £10m grant from the Capability and Innovation Fund.