BR-DGE announces partnership with leading travel organisation, Travel Counsellors

Payment orchestration scale-up, BR-DGE, has announced a new merchant partnership with leading independent travel company, Travel Counsellors.

This partnership will provide the business with access to a multitude of payment providers and alternative payment methods, from Open Banking to eWallets, via BR-DGE’s market-leading orchestration platform, ensuring a streamlined booking experience for all global customers. This will enable Travel Counsellors to utilise BR-DGE’s dynamic rules engine to build a multi acquirer strategy across its global business operations.

Jacob Spencer, Head of Commercial at BR-DGE, said

“We are excited to be working with Travel Counsellors to revolutionise its payments infrastructure with considerable benefits for its customers and business.

We have seen that the sector is on track for a strong recovery; Travel Counsellors was well placed to bounce back and has had a tremendous last six months with record bookings in FY22 as sales levels reach 140% of FY19.

Our research has shown that over 8% of online transactions in the travel sector fail. As demand returns, with consumers expecting a seamless booking experience and merchants aiming to lift margins, payment orchestration is vital to boosting the sector’s resilience and increasing conversion rates.”

Travel Counsellors is a global travel business, turning over £700m per annum and serving over 600,000 customers worldwide by booking over 300,000 itineraries each year.

Mat Hanson, Chief Financial Officer at Travel Counsellors added

“Our core strategic focus of continued growth and delivering a personalised service to all of our customers remains unchanged. Working with BR-DGE is another example of how we’re continuing to enhance our customers’ experience though the use of new technology. Continuing to provide a seamless booking experience remains pivotal and especially at a time when many of our Travel Counsellors are so very busy.”

A conversation about art and NFT with Trevor Jones

Season 2, episode 4

Listen to the full episode here.

The NFT movement seems to have taken the world by storm. For most people it came out of nowhere and when most people are grappling with the idea of digital currencies, they now have to deal with non-Fungible-tokens. Digital currencies are changing everything and not just the way we deal with money. However, it’s not just about coins anymore. Today, in the episode we’re speaking about how it’s affecting one of the oldest disciplines in the world. Art. And just like appetite for cryptocurrencies is going up and down (down at the minute) so might NFTs. However, one thing is for sure is that they are here to stay. On this episode we welcome on of the top 10 NFT artists in the world according to most NFT specialists, Trevor Jones. Trevor is Canadian but has chosen bonny Scotland to establish himself and his art. With him we’ll discuss his incredible story and his vision on this new world. This podcast will also be an opportunity to showcase the Stirling Castle Party.

Trevor Jones – a story of art and NFTs

I never planned on or expected to be an artist. Although I took art classes in high school in Canada (as I had a natural talent) it wasn’t until my early 30s that everything changed. I left my home country in my mid-20s with a backpack to explore the world, working mostly in hospitality to get around and ended up in Scotland a few years later on a UK ancestry visa. After making some bad decisions I spiralled into depression, and I hit an important crossroads in life. For some strange reason, I decided that art would save me’.

Proving one’s never too old to follow one’s dreams, I enrolled in a foundation course at a small school in Edinburgh and the following year I was accepted into Edinburgh University and Edinburgh College of Art for the 5 year MA Fine Art programme. Thankfully, I managed to escape the dark depths of depression by the time I graduated; however, I now found myself at 38 years of age, broke and armed with very little but a huge student loan and an art degree.

Moreover, after two moderately successful commercial gallery solo exhibitions, I came to the conclusion that it was near impossible to make a living as an artist. So, there I was, working two jobs; managing a small art charity and teaching part time whilst running an Airbnb year round at my flat, to make ends meet all while spending every other spare moment painting.

I realised that if I were to make my art career dream viable that I would need to somehow differentiate myself from all the other artists exhibiting in Scotland, which led me to exploring and integrating new technologies with my work. In 2011 I was investigating QR code oil paintings and by early 2013 I was employing augmented reality as one of the first professional painters in the world to use AR.

I was more than excited when it came to exploring art and tech innovation but unfortunately it appeared the Scottish art world felt almost the exact opposite to me. As constant rejection of my artworks continued to fuel my frustration with the institutions was mounting, I decided to troll the legacy artworld with various tech inspired stunts.

For example, after my AR painting was rejected once again from the annual Royal Scottish Academy open exhibition, I snuck into the RSA building the day before the opening to photograph all the works on display. That night I augmented over 60 paintings and digitally replaced’ them with my pieces. I counterfeited 25 invitations and turned up to the posh opening night with a bunch of friends with smartphones and tablets and my AR app turning the event into the Trevor Jones solo exhibition. Some of the old guard’ weren’t too happy with me after this stunt but at the same time I also managed to build a little excitement and momentum around my artwork.

Fast forward to 2017 and for once I had a bit of money in the bank after a successful AR solo exhibition ”“ one that I’d organised myself as commercial galleries were no longer interested in showing my paintings. I invested in Bitcoin and very quickly became consumed with the world of crypto. I began coordinating my next solo show, which was titled Crypto Disruption: The Art of Blockchain. Almost all the paintings sold to crypto enthusiasts internationally via bitcoin and eth (which completely boggled my mind at that time!) and it was by far my most successful exhibition.

Near the end of 2019 I dropped my first NFT, a collaboration with the late, great Alotta Money, which broke all previous NFT sales records and really put me on the cryptoart map. I think I was a bit of an anomaly, as an academically trained painter coming into this space filled with almost entirely digital artists; which again, likely helped to differentiate me from the rest.

Things have continued to go from strength to strength with the last couple years being quite literally life changing both creatively and financially. Along with my record breaking Bitcoin Angel open edition drop on Niftygateway, seven figure sales collaborations with Pak, Metacask and the legend Ice Cube, and hiring Stirling Castle in July to throw an exclusive party for 300 of my angel collectors, I’m now working on a commission which will be a gift for a very high profile individual who makes electric cars and rockets.

My dad always used to say to me, “Son, life’s a funny thing” and he wasn’t wrong. I guess I’ll now add to his words with, “Work hard, persevere, focus on being different and you never know where you may end up.”

Making Scotcoin available on the global market ”“ a significant milestone for Scotland

In the growing world of blockchains and cryptocurrencies, Scotcoin is taking a big step forward with the announcement of our partnership with ProBit Global, which will see us publicly list SCOT on its exchange later this year.

With a presence on the ProBit platform, holders of Scotcoin across the world will be able to exchange existing tokens and new users will be able to buy Scotcoin for fiat currency (such as British pounds, US dollars or euros) or other types of cryptocurrencies.

ProBit has an excellent reputation and a substantial international presence that will allow us to spread the word about Scotcoin to more people than ever before. The platform currently operates in more than 200 countries, supports over 45 different languages, and trades in more than 700 different cryptocurrencies.

ProBit will also play an essential part in marketing up to and after the listing by sending information about Scotcoin to its two million customers.

Scotland has around 10 million members of its diaspora worldwide, and many people are sending and receiving money regularly. Importantly, through Scotcoin’s own scotscan.io system, transactions happen instantaneously and without payment of gas fees. This could be a massive benefit for anyone wishing to add Scotcoin to their range of revenue acceptance mechanisms.

Listing the cryptocurrency ties directly into the broader mission of using Scotcoin as a force for good through the Scotcoin Project CIC, which is about people and helping deliver sustainable and improved quality of life for those in need.

This significant milestone will allow further development of the Scotcoin Project CIC ”“ including appointing a professional full-time management team to deliver our business plan ”“ which is focussed on working with preferred partners to deliver a variety of initiatives relating to clothing, food, accommodation, and the environment. We continue to seek suitable preferred partners.

Amid ongoing economic uncertainty, now is the time for Scotland to embrace the idea of a supplementary form of money to strengthen its businesses, charities, and communities, helping to sustain our recovery.

We look forward to welcoming more users to the Scotcoin network, supporting our wider ambition and ultimately playing their part in supporting good causes.

Read more and be part of this exciting journey here: https://scotcoinproject.com

Please go to scotscan.io and sign up for an @scot address

Scottish fintech Zumo gets funding to decarbonise crypto

Scottish Fintech Zumo, just completed its Zero Hero pilot project, a live trial to buy Renewable Energy Certificates to compensate the electricity usage of bitcoin bought via the Zumo app.

During this trial, a total of 850 megawatt-hours of electricity was compensated, the equivalent of an electric vehicle for over three million miles.

This is very important with 84% of customers feeling that the issue of environmental sustainability in crypto paramount and that they are more likely to use a crypto wallet that participate in reducing crypto’s environmental impact.

The results of this trial are available at ”“ Decarbonising Crypto: Towards Practical Solutions’

Innovate UK just awarded Zumo and Zero Labs a grant to further fund research into the decarbonisation of crypto. This RenewableCrypto project starts this month with a clear objective of finding practical ways in which wallets and platforms can scale the use of renewable energy.

Doug Miller, Co-Founder, Zero Labs, said:

“Zumo is demonstrating leadership in the Crypto Climate Accord (CCA) community in two ways: leading dialogues about how to estimate the energy use of BTC holdings and procuring clean energy to power Zumo platform customers’ holdings in a verifiable way. Zero Labs is thrilled to support Zumo with scaling a solution across its growing customer base to increase demand for clean energy around the globe and convert the wider crypto industry into a newfound source of demand for clean energy in voluntary markets.”

Kirsteen Harrison, Environmental and Sustainability Adviser, Zumo, said:

“The results of our Zero Hero pilot project are hugely encouraging, showing both what is possible and a significant appetite from customers for clean energy solutions. But this is just the beginning, and the story can only continue through the collaboration of all market participants ”“ miners, platforms and end users ”“ within the crypto sector. We hope that our new report will help continue to shift the dial from talk towards action.”

“Along with our partners at Zero Labs, we’re aiming to lead this charge and explore new, digital-led solutions that remove practical barriers to voluntary renewables procurement and verifying green credentials. With electricity being the most significant part of crypto’s carbon footprint, we have a unique opportunity as a sector to rapidly decarbonise.”

Why early payments could be the key to strengthening supply chains

Why early payments could be the key to strengthening your supply chain

Having a strong supply chain is one of the most powerful tools you can have in your arsenal. Creating a solid network of all the organisations involved in delivering your product or service to your end customer ”“ from vendors to producers, warehouses to retailers ”“ is critical to keeping things running smoothly. In fact, it can make or break your success.

But if there’s one factor that can help boost and strengthen supply chains, across all sectors and industries, that often gets overlooked, it’s the power of early payments.

Here’s why they could be the key to making your supply chain even stronger.

Building confidence and trust

It might sound simple, but don’t under-estimate the importance of having confidence in and being able to trust each and every member of your supply chain. Early payments can help build this confidence ”“ for both suppliers and customers alike.

If you’re a buyer, offering to pay early (for example in return for a small discount), signifies that you’ve got the cash ready and waiting, and are considerate of the fact that your supplier might benefit from a boost to their cash flow before the date their invoice is due.

For suppliers, being able to incentivise your customers to pay early by offering a small discount signals sound financial wellbeing. If you’re able to offer your services or products at a beneficial cost, it implies you’re not stretched to the last penny ”“ which gives customers confidence and reassurance that you’re not at risk and they’ll be able to keep buying from you.

Access to better deals

It goes without saying that, if early payment benefits both buyer and supplier, there could be great deals attached to paying up early. When either side is empowered to use early payment as a tool for negotiation ”“ whether that’s a reduction in price, a speedier delivery, or another mutually agreed benefit ”“ it can help move things along exponentially, and might even lead to longer term process changes in your supply chain that keep things really efficient and effective.

Reputation builder

If you’re a buyer that’s offering to pay early, you’re going one step further than avoiding a reputation as a nightmare customer that your supplier has to keep chasing: you’ll become a preferred choice.

When suppliers are stretched or at capacity, they’ll be in a position to choose who they work with. Customers or buyers with good reputations for paying on time (or, even better, early) are much more likely to make their way up the food chain of preference ”“ and might even attract more suppliers looking to work with them, as a result of word of mouth, too.

Growth on both sides

It’s no secret that, for the SMEs and start-ups that form a bulk of the UK’s suppliers, cash is king. Offering early payment can be a real cash injection that helps SMEs out with their cashflow. And good cashflow means more money to invest and grow.

But the benefits aren’t one sided. If you’re a buyer that’s looking to grow, you’ll need your suppliers to be able to keep up with your ambitions ”“ which will likely lead to an increased demand for goods or services. By paying them early and helping them grow, you’ll be helping them to help you grow, when the time comes.

Only as strong as your weakest link

When it comes down to it, your supply chain is only as strong as its weakest link ”“ and late payment has a habit of breaking the bonds that the chain relies on. In fact, according to a recent survey of 500 UK decision makers, 86% agreed that one single late payment affects everyone in the supply chain. And, out of the 31% of businesses that admitted paying a supplier late, almost half say it was due to a late or failed payment from their customer.

So, if late payment has a knock-on, negative impact on everyone in a supply chain, imagine the knock-on, positive impact that early payment could have, if things were reversed?

How Early Pay can help

If reading this has convinced you that building early payment into your supply chain is something you should be looking at, you’re in the right place.

Our CEO, Anthony Persse, thinks it’s time to turn the conversation about late payment on its head: “By shifting towards a more positive conversation about early payment’, we will do much more than simply improve payment performance. We will help create more jobs, deliver greater levels of investment and generate deeper social value with long-term sustainability at a time when the country needs it most.”

If you’d like more information visit saltare.io, or please get in touch with the team at Info@saltare.io and we’ll be happy to help.

The Identity Tooling Needed for Institutional Adoption of DeFi

Blog written by Kai Jun Eer, founder of fintech Onboard ID

In the past year, the term Web3 has become an increasingly used buzzword. The growth in different blockchain protocols and metaverse projects seem to have shed a light on how the new Web3 might look like. We are on the forefront of technology innovation, and we are really excited about it. Yet, it is important to remember that Web3 is not just about crypto and metaverse, but how we define a more user-centric internet. Behind every shining DeFi protocol or NFT project, there is an infrastructural layer supporting them.

Most of the current decentralised finance (DeFi) protocols are pseudonymous in nature (meaning each user is tied to an identifier but not to its real world identity). As these protocols start to grow into institutional adoption, inevitably they will need to comply with certain institutional regulations. One example being some of the users might now need to undergo the Know-Your-Customer (KYC) verification in order to continue interacting with these institutions through the DeFi protocols. I envision that as DeFi matures, the underlying protocol that facilitates the settlement / transactions would be fully decentralised and trustless, while specific use cases can be built on top of the protocol where some might introduce regulations.

A concrete example is Aave, one of the largest DeFi protocols deployed on multiple blockchains such as Ethereum and Avalanche. Aave first started out as a decentralised lending and borrowing protocol. Earlier this year, Aave launched a permissioned protocol (Aave Arc) that targets institutional adoption. The benefits that a blockchain can bring to speed up efficiency of financial settlements do not have to be limited to a fully decentralised setting. However, users that interact with Aave Arc have to undergo KYC in order to meet regulatory requirements.

As more DeFi protocols are becoming more regulated to expand their markets to financial institutions, does that mean that as an end user, each time I want to access a different protocol, I have to undergo a KYC verification again and again? Other than not user-friendly, it makes an already high barrier to entry in DeFi even less accessible.

A digital identity might help. Imagine if an end user only has to undergo the KYC process once, where it receives a digital identity which can be subsequently presented to the different DeFi protocols. With increasing awareness of data privacy and data ownership, users want to be in control of their own data. As an end user, I no longer want to delegate my identity data to a centralised data custodian (think Google ID), especially sensitive data such as what financial services I am accessing. There is a need for a privacy-preserving identity solution, which provides convenience yet still user-centric.

At Onboard ID, we are building the next generation identity tooling, where users are always in control of their own data. Once a user has undergone the usual KYC verification, it receives a cryptographic digital credential which contains the user’s verified identity data. The identity data is only stored in the user’s mobile phone and not in any central databases. An identifier of the credential is recorded on a public permissionless blockchain, such that when the user presents its credential, it is verifiable that the identity data in the credential comes from the trusted KYC provider. The reason our solution is user-centric is that during KYC reverification, data transfer only happens between the user and the verifier without passing through any third parties, not even us as the infrastructure provider. Therefore, users are always in control of how they want to share these data and with whom.

We are currently in beta testing. If your organisation is looking to get an edge in streamlining KYC reverifications, whether it’s in the fintech sector, looking to get into DeFi, or other more specific use cases, please get in touch at kaijuneer@gmail.com! Our vision is to contribute towards building a more user-centric internet, and we hope you could come onboard with us.

Payments & Transactions, the fintech opportunity

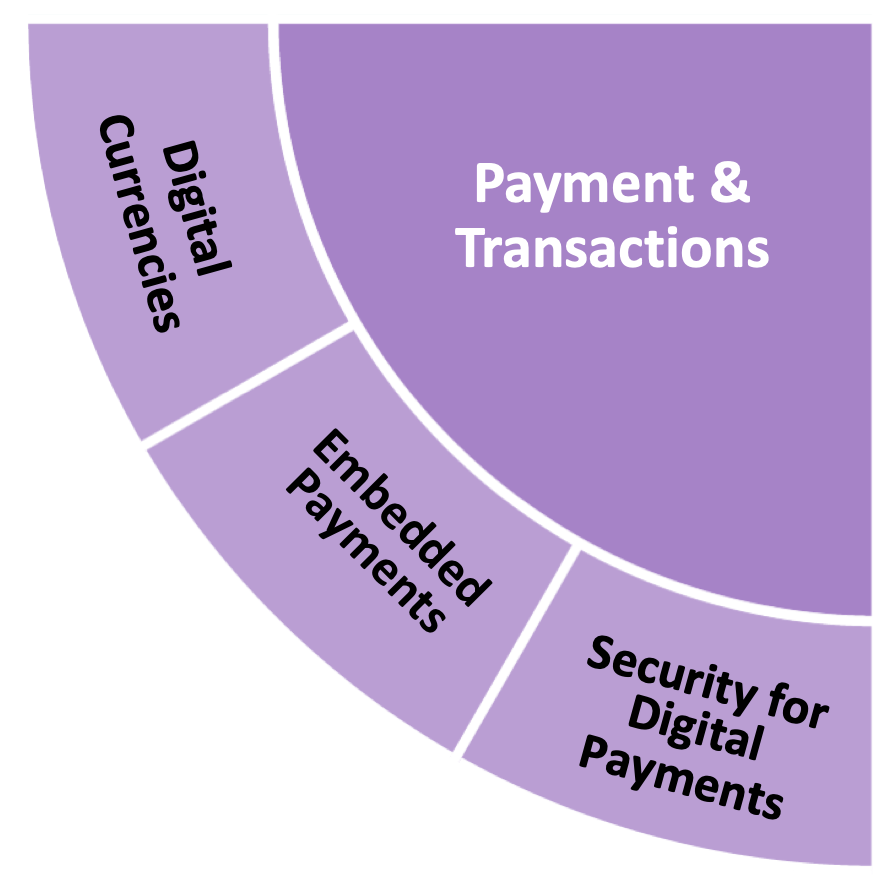

is discussing the key outputs in a series of blogs. This blog focuses on Payments & Transactions, which is one of the four key strategic priority themes.

is discussing the key outputs in a series of blogs. This blog focuses on Payments & Transactions, which is one of the four key strategic priority themes.

The way we pay for things is changing. Throughout the development of the Research & Innovation Roadmap, payments and transactions were referred to in the broad context of the transfer of value (either money, goods, or assets) in exchange for goods and services.

The Roadmap pinpoints the significant move from physical exchanges to digital transactions, and identifies several significant trends that could mean payments will change significantly in years to come. These changes will have a significant impact on the economy, and could also have a substantial impact on citizens and businesses, which is why the future of payments is one of the four priority themes identified.

The importance of Payments & Transactions

The pandemic accelerated the move from physical to digital in many aspects of our lives, including how we make transactions. Customers’ digital expectations and a shift towards more instant electronic payments are having a significant impact on our economy, and a new digital economy is emerging strongly, with major implications for consumers and SMEs alike.

Across the development of the Roadmap, when looking at the theme of the future payments we considered the topic of digital currencies and crypto currencies. These innovations present new ways for value to be stored and exchanged. It is clear there is a still a lot to learn about the potential, the impact, and the implications of cryptocurrencies as a method for mainstream payments. Stablecoin is a form of cryptocurrency that is linked to an asset that is stable in value, and stablecoins are generating significant interest for future payments and value exchange.

The UK Government has established a crypto assets taskforce, and the UK regulators are considering the benefits and risks on a range of issues connected to this topic, including a separate digital currency backed by a central bank. Since the publication of the Roadmap, HM Treasury has confirmed its commitment to the development of appropriate regulation for crypto.

As we further explored the payments theme, we identified technologies of particular interest, such as AI, blockchain and distributed ledger tools. Industry expressed interest about how these technologies could offer a completely different way to organise and manage payment systems, providing a route to real-time, cross-border payments worldwide. These developments pave the way for a potentially very different future of value exchange. According to the World Economic Forum, up to 10% of global GDP could be stored on blockchains by 2025.

Embedded payments is one of the hottest topics in FinTech in 2022, and was another area of particular focus. Technology is advancing the methods to embed payments in everyday experiences and allow customers and businesses to pay for purchases without entering bank details, credit, or debit card information.

Historically, the payments process has lived at the edges of experience for businesses. Payments were either taken in cash, or offline, with no real lasting insights into the customer and the goods or services they purchased. Technology businesses are now fully embedding software that enables a change to this experience, creating more choice and allowing businesses to have a deeper connection with customers. In addition to high profile examples such as Uber, many embedded payment innovations are emerging, such as in-car payments, smart fridges and connected homes.

Priority areas in Payments & Transactions

The industry contributors to this roadmap offered a view that the future looks set for significantly more change. Our analysis highlighted three topics of interest:

Digital currencies

- Cryptocurrencies and stablecoins

- Distributed ledger technology

Embedded payments

- SME market

- Retail consumers

Security for digital payments

- Cyber security

- Biometrics

Roadmap next steps: Payments & Transactions

A range of proposed next steps are laid out in the published Roadmap, which specifically identifies 10 actions relating to Payments & Transactions, and categorises each into one of three phases over the next 10 years. These actions are illustrated in the graphic below. The report also references 23 different stakeholders who can support the implementation of these actions, which are broken down into research projects and innovation calls.

More information about FinTech Scotland’s Research & Innovation Roadmap can be found here, where the full Roadmap can also be downloaded.

The FinTech Research and Innovation Roadmap

Season 2, episode 1

Listen to the full episode here.

In March 2022, FinTech Scotland released its 10-year Fintech Research & Innovation Roadmap for the UK.

In collaboration with leading universities, large financial institutions, fintech businesses, citizens, industry experts and senior officials this report explores the opportunities that will help the UK maintain its fintech leadership globally.

In this episode we explore what this roadmap means for Scotland and what the next steps are to deliver on the roadmap recommendations.

TranSwap receives EMI authorisation in the UK

TranSwap, a Singaporean fintech with a growing presence in Scotland just announced it had received authorisation from the FCA to conduct payment activities as an Electronic Money Institution (EMI) in the UK.

This will allow the fintech firm to offer its comprehensive suite of services, including global payments and collections, borderless digital wallets, cards & spend management, platform-as-a-Service (PaaS).

The company had recently opened its Global R&D Center in Edinburgh and is now well positioned to provide cutting edge fintech services for its customers globally.

TranSwap can facilitate borderless trade and investment activities through technology allowing companies from Asia, UK and Europe to expand in those markets the same way local firms would.

Scottish Government Trade Minister Ivan McKee said:

“This is a significant development for TranSwap and a further indication of the strength and level of innovation in Scotland’s globally competitive fintech sector.

“By receiving EMI authorisation, TranSwap will be in a position to support Scottish companies active in south east Asia and those looking to expand into this important market.”

Commenting on the significant milestone, Benjamin Wong, Chief Executive Officer of TranSwap said,

“We are excited to receive the EMI authorisation in the UK to scale our international business banking services for our existing customers and partners in Asia and potential customers in the UK. We very much looking forward to becoming the global business banking partner for businesses that are currently trading between Asia, UK and Europe.”

Appreciating TranSwap’s agile practices since its inception, Nicola Anderson, Chief Executive Officer of Fintech Scotland said,

“The fintech sector is adept at modifying business models and adapting in order to achieve better products and services. TranSwap brings new experiences to the FinTech Scotland community and consistently demonstrates its abilities across different international markets. We’re delighted to work with them and look forward to their successes.”