FinTech Scotland’s first anniversary heralds a growing fintech economy across Scotland

FinTech Scotland has confirmed that the number of innovative fintech SMEs based in Scotland has grown by three times to over eighty in the last twelve months.

The announcement comes on the first anniversary since the formation of FinTech Scotland, a joint initiative by a number of financial services firms, University of Edinburgh and Scottish Government.

The growth in the new fintech enterprises focused on reinventing financial services has been driven by both new start-ups and existing fintech firms moving to Scotland.

In addition, the number has also been bolstered by early stage Scottish technology firms expanding their proposition into financial services.

Since its inception FinTech Scotland has facilitated the growing fintech innovation by fostering the connection between entrepreneurs, large financial services firms, the universities, Government and public sector as well as a range of strategic stakeholders.

Examples of FinTech Scotland’s strategic enabling role have included:

- Developed fintech access to funding and business services with the appointment of a fintech commercial partner Vivolution in conjunction with Scottish Enterprise

- Connected fintech firms with over a dozen large financial services firms and members of Scottish Financial Enterprise to develop new routes to market

- Collaborated with Scottish Development International and Deloitte to develop global connections in Far East, Europe and USA for inward investment and exporting

- Supported the development of fintech entrepreneurial networks and accelerators hubs such as the University of Strathclyde Technology and Innovation Centre

- Developed fintech skills with Scotland’s universities, colleges such as Fife Fintech Skills Academy and student groups such as Glasgow University FinTech Society

- Close collaboration with the Financial Conduct Authority to support fintech firms regulatory understanding reinforced by a senior secondment to FinTech Scotland

- Grew the visibility of the Scotland’s fintech activity through the launch of new digital platformand over 80 fintech events including the FinTech Festival with Visit Scotland

- Developed financial inclusion and diversity initiatives working with consumer groups, social enterprises and bodies such as Equate Scotland

- Facilitated cross sector fintech innovation, for example, with Law Society of Scotland and Scotland IS Cyber team as well as Scottish Government and the CivTech initiative

Digital Economy Minister, Kate Forbes said: “Congratulations to FinTech Scotland for an immensely successful year. With Stephen Ingledew at the helm, FinTech Scotland has galvanised collaboration between Scotland’s universities, financial industry and public sector. Together, we are building Scotland’s reputation as a major global FinTech centre. I personally commend FinTech Scotland for their hard work last year and their vision for the future.

Commenting on the first year Stephen Ingledew, Chief Executive of Fintech Scotland said: “It has been a privilege over this last twelve months to lead the FinTech Scotland team and galvanise the broad range of support from across Scotland to support the growth of innovative fintech enterprises in this last year.

Our progressive, collaborative and inclusive agenda is certainly establishing Scotland as a major global fintech centre which can contribute to Scotland’s economic and social ambitions.

One year on there is still much to do but with a very supportive Board and strategic partners plus a range of stakeholders from private sector, Government and academia actively participating we can achieve the top ranking global fintech status “

Graeme Jones, Scottish Financial Enterprise Chief Executive, said: “FinTech Scotland has made a significant impact over the past 12 months by raising awareness of Scotland’s fintech capabilities and the opportunities available for new and existing businesses. Scotland’s financial services industry has always been at the forefront of innovation and I’m pleased to see this momentum continue. SFE and our members will continue to work collaboratively to support Stephen and his team as they strive to make Scotland a global fintech leader.”

The first anniversary was recognised on Tuesday the 8thof January at the Financial Services Advisory Board (FiSAB) meeting held at the University of Edinburgh, one of the founding partners of FinTech Scotland.

Picture taken at FiSAB on 8 January 2019.

Economy Secretary, Derek MacKay, Digital Economy Minister, Kate Forbes, Jim Pettigrew, FiSAB Co-Chair and Chairman of CYBG plc, Stephen Ingledew, Chief Executive, FinTech Scotland.

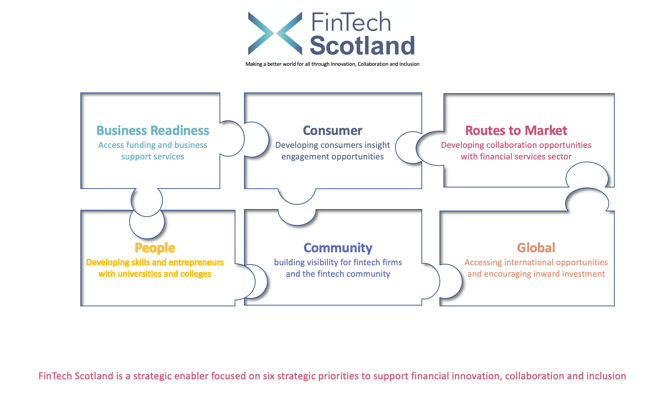

At the FiSAB meeting, Stephen Ingledew outlined the key priorities for FinTech Scotland in 2019:

New Hire for Data Lab MSc Project

Most people tend to wind down in the lead up to the festive period, but I’m not most people! In the weeks before Christmas, I accepted a brand-new role with MBN Solutions in Glasgow.

I am the Delivery Lead for MBN Academy, responsible for leading the delivery of critical projects like The Data Lab MSc. Placement Programme. I have over 3 years’ experience within recruitment, sourcing, talent acquisition and management within the Scottish business community. Moving into a delivery lead position is a challenging new position for me, but I have been able to utilise my previous experience to enrich and improve the processalready.

I’ve joined MBN Academy at a key stage in our development as we move towards a larger, more complex delivery model. My added expertise, knowledge and drive will enable us to deliver the very best quality of service to our community.

My role is to provide guidance to students throughout the MSc. Placement Programme in addition to supporting Host Companies as they join the initiative. I have already had the opportunity to assist with the delivery of Employability training sessions at participating Universities and advising potential Host Companies on the benefits and structure of the Programme.I’m so excited to be leading the delivery of this project, working alongside world-class students and industry leaders.

Last year, 73 students were placed in an industrial placement and the bar has been raised this year, with the target now being 100 students. This is ambitious but given that we are working with 11 Universities with a range of different courses this is achievable.

The Data Lab and MBN solutions are passionate about plugging the data skills shortage in Scotland and this Programme is aimed at giving the students their first taste of industrial experience, which in turn should give them the skills they need to succeed in the future. It’s very refreshing to see so many companies eager to work towards the benefit of Scotland.

The Scottish FinTech community have previously stepped up to the plate and engaged with this Programme, including HSBC, Clydesdale, RBS and Tesco Bank. Start up and scale- up companies like The Lending Crowd have also taken part in this in this initiative with great success. The students have added great value to leading edge and creative projects in FinTech companies and are set to continue the trend this year!

Virgin Money and other challenger banks have also embraced this Programme, showing that there are no real barriers to get involved, whether you are a company with 20 folk or 2000, there is nothing to stop you taking part!

The FinTech community is a vital part of the Scottish economy, by giving these students a taster of their world, they are adding more skills to already skilled and dedicated students. Moving forward, this is invaluable to both parties and will ultimately enrich both parties.

2018 in Review & Orca’s Big Plans for 2019

2018 has been a big year for Orca. We launched the Orca Investment Platform, secured another funding round, and expanded the business in personnel and location. Not to mention, plans have been put in place for the launch of the Orca ISA and the Self-Select’ portfolio builder, a complementary product to the existing Model’ portfolio.

Here is our 2018 timeline of significant milestones”¦

February 2018 – Orca Investment Platform Launches

In February, we launched the Orca Investment Platform, an aggregator which integrates with multiple major peer to peer lenders, enabling investors to spread their capital and risk across platforms, sectors, and borrowers.

This was a massive moment for Orca. Years had been spent building up to this point and a tremendous amount of effort had been invested by many, many people. Special thanks to those who supported us, you know who you are.

September 2018 ”“ Seedrs Equity Crowdfunding Campaign Launches

We ran our first ever equity crowdfunding campaign. Using the Seedrs platform and admittedly unsure of how successful the campaign would be, we were delighted to exceed our £500,000 target in under two days!

With more than 400 investors, spanning dozens of countries, the response from the crowd ”“ including Orca users ”“ has been an especially rewarding feature of the year.

December 2018 ”“ Orca Secures Over £500,000 in Equity Funding

Following the close of the Seedrs campaign, and with contribution from venture capital funds, angel networks and private investors, Orca secured £574,280.

The funds will contribute to Orca’s development and growth plans for 2019.

Now, 2019, here’s the big pitch”¦

Q1 2019 ”“ Orca ISA

The Orca ISA will be a first of its kind in the market where investors can build their own portfolio and hold it in an ISA. Current ISA rules stipulate that people can divide their tax-year ISA allowance of £20,000 between ISA (e.g, Cash, Stocks & Shares and Innovative Finance ISA) accounts however they wish. But, they may only subscribe current tax-year subscriptions to a single IF ISA each year. This means it is very difficult to build a diversified P2P portfolio which is wrapped in an ISA. Investors typically hold one P2P investment within an IF ISA, while the remaining P2P investments are held in taxable general investment accounts.

With the Orca ISA, investors can hold multiple P2P providers in a single IF ISA. Here are the key benefits:

- Invest in the Orca Model portfolio suitable for hands-off investors or Orca’s Self-Select portfolio for the more active investor

- Earn interest up to 6.5%

- Earn returns tax-free

- Diversify ISA money across multiple P2P providers

- Transfer old ISA money

- Invest ISA money at non-ISA P2P providers

The company is already building a Wait List of investors eagerly awaiting the launch of the ISA.

Q1 2019 ”“ Self-Select Portfolio Builder

In addition to the launch of the Orca ISA, we are also launching a new product to complement the existing Model portfolio product.

The Self-Select portfolio builder allows investors to implement their own strategies, selecting only the P2P providers and products they wish to hold in their portfolio. What’s more, investors can build their portfolio and hold it in the Orca ISA.

2019 ”“ Integrate New Lenders

Throughout 2019 we’ll be seeking to introduce new lenders to the aggregator, offering investors greater choice and diversification. Updates on this will come in the new year.

2019 ”“ On-board EU Investors

We are investigating how we can on-board EU investors, something which we believe will stimulate growth in the UK P2P market and offer EU investors a simple access-point to UK P2P lending.

To find out more about our exciting new product developments, click here

Finally, a special thanks to everyone who has invested with Orca, your support is very much appreciated; the value early adopters offer businesses is immeasurable and helps shape future product iterations, so thank you from the entire Orca Team. Have a fantastic 2019!

An Origo and Fintech milestone

By Anthony Rafferty, Managing Director of Edinburgh-based Fintech Origo

This month marks a proud moment for Origo and a distinct milestone in Fintech history, namely the 10thanniversary of the launch of the Options Transfers service.

Origo was established in 1989 as a not-for-profit organisation with the remit to help the industry improve its efficiencies, cut its costs and improve the service to consumers. The Options Transfers service was launched in December 2008 to help improve the transfer times for pensions for consumers and the industry.

And the market certainly needed improving. At that time transfers of pensions, largely between pension providers and from pensions into annuities, was taking on average 50 working days.

From launch Options Transfers immediately started to cut down those times. The current and long-standing average transfer time is now just 11 calendardays, including the time required for banks to process monies through BACS.

In developing the Options Transfers service, Origo worked closely with the industry to revamp what was a largely manual process, and re-engineered it through the creation of new frameworks* and technology. These new legal and technological developments were instrumental in swiftly helping to reduce the time taken to transfer.

But the work didn’t stop there. We established user and steering group forums, working with the pensions companies within the large Options Transfers community, to monitor and review their transfer performance, which continues to help drive further performance improvements even today.

And, following its success with pensions, Options Transfers was quickly upgraded to support individual savings account (ISA) and general investment account (GIA) transfers, as well as occupational transfers. It is also the only complete transfers service in the industry, enabling secure and speedy transfers of pensions, GIAs and ISAs.

The service also helps pension schemes and third-party administrators to effect bulk transfers of pension members, where for example a scheme changes administrator or an employer changes scheme.

Furthermore, the users of Options Transfers are part of a trusted community ”“ over 120 financial services companies use the service ”“ focussed on improving their operations and delivering better service to the consumer. The Options Transfers user group and steering group feed into the service to ensure we are delivering what the industry needs including complete readiness ahead of any regulatory changes, the Pensions Freedoms being a significant case in point.

Above all, Origo’s Options Transfers service is focussed on improving outcomes for the industry and consumers and we are proud that since launch, we have transferred over £160bn for the industry, saved the industry over £600 million and importantly, saved consumers over 225 million transfer days.

10 years of Options Transfers service: Top 10 facts

- Options has transferred over £160bn in pensions, ISAs and GIAs for the industry

- 3.25 million pension transfers have been completed since launch

- 40,000 transfers have been processed each month since pensions freedoms

- The average transfer through Options takes 11 calendar days

- The fastest transfer processing completed by a ceding provider has been less than a minute

- 1.2 million transfers by ceding providers took place in less than 4 days

- Options has saved consumers 225 million transfer days

- Options has saved the industry over £600 million

- Close to 120 financial services companies use the service

- Origo Options is the longest running complete pension and ISA transfer service.

*Since 2017, the Origo Standards and Common Declarations have been operated by Criterion. The Common Declarations are free to use: https://www.criterion.org.uk/what-criterion-offers/

Glasgow Credit Union chooses Soar

Written by Laura Hillhouse, Marketing Manager at Soar.

It’s an exciting time for fintech disruptor, Soar, who have announced that they have been chosen by the UK’s largest credit union to be their new technical partner.

We have been selected by Glasgow Credit Union to provide its members with the latest banking technology as they aim to compete more effectively with traditional players in the financial services sector.

Soar, who provides credit unions with a range of innovative technology, will offer Glasgow Credit Union’s 50,000 members, a new market leading mobile app and internet banking platform.

Our new tech offers members one place to manage their finances and features such as join, borrow and manage your money allow credit unions to gain invaluable member insights and provides a better opportunity to offer them relevant products.

Executive Chairman of Soar, Andrew Duncan, said:

This new partnership is a huge step forward to help credit unions embrace the most up-to-date technology that can have a positive impact on their business.”At Soar, we believe it’s important for credit unions to invest in technology to remain relevant as we move into 2019 and be able to compete with others in the financial services market. As well as providing must-have mobile technology for members, we also offer those working in credit unions a dashboard that supports their operations more efficiently.Paul Mcfarlane, Chief Technology Officer at Glasgow Credit commented on our partnership, saying:“Working in conjunction with Soar and with the continued support of our existing technology partners, we’re improving on our great service offering to create a first-class experience for our members. We chose to partner with Soar because of their innovative approach and were impressed with the way they embraced our members’ requirements.”

It’s an exciting new relationship for both Soar and Glasgow Credit Union and we’re expecting to launch our new technology during 2019.

Scotland’s Minister for Trade, Investment and Innovation visits fintech Origo

Blog written by Anthony Rafferty Managing Director at Origo.

Origo was delighted this week to welcome Ivan McKee, Scotland’s Minister for Trade, Investment and Innovation to our Edinburgh headquarters.

He visited to talk about the work we do on behalf of the UK financial services industry, in particular to see a demonstration of our world-leading solution for the Pensions Dashboard and to hear about the important work being developed in Scotland to make the Pensions Dashboard a reality.

The purpose of the Pensions Dashboard is to find and display an individual’s pension savings on one screen and is intended to encourage people to engage with and, where appropriate, take action on their retirement income planning.

In his official comment on the visit, Mr McKee pointed out that Scotland is

“a highly competitive business location, with investment built around the quality of our research and innovation as well as the skills of our workforce.”

He added:

“Origo looks set to reinforce our reputation as a centre of excellence for financial services and FinTech by transforming the sector’s operating efficiencies. This includes the introduction of their Pensions Dashboard which will allow members of workplace pension schemes to see all of their pension savings at the same time in one private, secure place.”

At Origo, we are excited by the potential for Pensions Dashboard to not only benefit millions of consumers and potentially improve their financial outcomes, but also to help to drive further innovation in the pensions market by facilitating an open pensions environment.

We have been at the heart of the Dashboard project since its announcement in 2014, responsible for helping develop and prototype the core technology ”“ the Pension Finder Service ”“ and we were selected to provide a prototype to the HM Treasury sponsored Pensions Dashboard Prototype Project, which was the project managed by the Association of British Insurers (ABI).

More recently we provided input to the Department for Work & Pensions’ Feasibility Study and we have continued to develop the technological solution to an advanced state of readiness ”“ testing to an anticipated 15 million users, for example.

Our remit from our foundation in 1989 (making us one of the UK’s longest established FinTechs in Scotland and the UK) has been to improve the financial services industry’s operating efficiencies, lowering costs for market participants and improving outcomes for consumers.

In this respect we work collaboratively with government, other industry bodies as well as product providers, platforms, financial advisers, portals and software suppliers, to find new ways to cut costs and make processes more efficient.

Other industry-critical work we have carried out, for example, has enabled significant reduction in the amount of time it takes to transfer pensions (from c.50 working days to an average of 11 calendar days) and ISAs, as well as delivering and servicing digital IDs for 8 out 10 financial advisers in the UK.

The Minister met staff around the building and we talked also about Origo’s aspirations for the future of FinTech in Scotland and the UK, which we believe is very bright indeed.

Global outlook #3 ”“ New Zealand ”“ Xero, Bringing great experience to accounting

This week in our Global Outlook series we spoke to Sam Daish, General Manager, Data Innovation at Xero, about the development of AI in the accounting sector:

Sam, can you tell us how your business has changed in recent years?

The fundamental change is one of scale. Xero is growing fast. So in the data space our scope to deliver innovation for customers is exploding. At the core of accounting software are products, services and functionalities to make routine accounting activity easier. Easier’ now equals automation. So our core skills around creating easy to use and beautiful products and features are being extended to include machine learning and AI, which also widens and deepens our client offering.

What has enabled this change?

Two things, data and our expertise in AI development. Data really enables us to power beautiful experience for our customers. We work closely with small businesses and our partners to create smart interactions. Machine learning is the engine that uses that data to create tailored experiences to all our customers.

We started our Machine Learning journey back in 2015 with one of our yearly hackathons called Xplore. Those events are all about freedom, fun and discovery.

During this Hackathon, our team, created a machine learning algorithm to streamline account code prediction for invoices.

Rod Dury, our founder, became really enthused by it and was quick to get resources aligned behind it. Rod often says that

“this new solution put Xero on a new pathway as we discovered a problem we didn’t even realise we had”.

The growth of expertise we have in AI today compared to three years ago is amazing to be part of.

What’s the type of problems you’ve been solving?

A good example is the development of customer data augmentation tools. In order to sign-up for Xero businesses only need an email address and an address.

Those are very often the only details we hold on the businesses of our clients. With machine learning we can augment that data automatically by looking at things such as business websites.

Our solution analyses the words used on the website and tag some attributes and areas of interest based on the language used.

For example, it is possible to derive the industry they operate in and whether they have physical shops or are purely digital businesses. That approach has kick started a range of natural language initiatives and changed the way we think about businesses.

What do you do with those data?

Well, it’s a massive lift in how we understand the businesses of our customers, and so what they might need from us. For example, many plumbing businesses are not only interested in plumbing projects. They might also need assistance with regulatory changes in the construction industry more widely.

They might have a retail shop as well as carry out design and plumbing work, so they are not only construction companies they are also retail and professional services companies. We can then develop appropriate tools for those businesses.

Can you tell us about more innovations happening at Xero?

Absolutely. Our data was telling us that small businesses didn’t have time to enter bills in our system. Following the same customer led approach we came up with the email-to-bills functionality that we previewed at Xerocon Atlanta. This optional piece of software will enable users to forward PDF bills from any supplier to their Xero account.

Our solution can recognise accounting figures, suppliers names, VAT, etc. We estimate a 25% time reduction when creating and editing a bill. And bills are just the beginning. Any automation that saves our small business owners time and improves reporting accuracy is worthwhile and worth exploring according to the Xero mentality.

Why is New Zealand a great place for financial technology companies to thrive?

The Fintech space at the moment is all about collaboration and connection – technology is moving at such a pace that you can’t focus on everything. Partnering allows you to access niche capabilities and we are seeing a lot of born from companies working together. It also doesn’t hurt having Fintech NZ pulling us together and making those connections.

Another key benefit for us is that we are able to watch and learn from what is happening in bigger markets like the UK or Australia, so that we can choose the best bits to implement in NZ and then potentially take global.<

While NZ is geographically distant from many markets, technology and diversity closes that distance very effectively. NZ really is a melting pot for so many ideas, experiences and people to come together, and technology helps connect that to the world.

Applied Fintech Project – Final Event and last update

Blog written by Elisabetta Trasatti, Vice President at UoG FinTech Society

Last Friday night, an entertaining final event at the Glasgow University Union concluded the first Applied FinTech Project (AFTP), organised by the UoG FinTech Society.

Almost one hundred people, including students, professionals and academics, attended the event. With two keynote speakers, a buffet dinner, and the UofG Jazz band playing throughout the evening, the project could not come to an end in a more successful way. In the words of one of the AFTP mentors,

“the event was very well organised: great location, very good and fitting music, and a great jury.”

In case you are hearing about the Applied FinTech Project for the first time, here is a quick run through the ideas and aims of the project.

The AFTP has been designed as an experiential learning opportunity for students, who got the chance to work in teams on a hands-on FinTech case over the course of four weeks.

The project was launched in September with an Information Session at the University and immediately gained the attention of students from different degree subjects and years of study. When reviewing applications, the UoG FinTech Society board was immediately impressed by their quality. Applicants ranged from Computer Science to Engineering, to Economics, Philosophy, Business and Psychology students, and all showed great interest in FinTech, as well as a strong desire to develop their team working and communication skills.

The 25 selected participants, both Undergraduate and Postgraduate students, were divided into 5 teams and given a case provided by the startup Orca Money regarding its expansion strategy in the EU. The teams also got the chance to participate in a workshop organised specifically for them by Deloitte and were assigned a mentor to guide them throughout the project. The mentors, working at Previse, Castlight Financial, Deloitte and Morgan Stanley, both communicated with the teams via email and met with them in person, in order to talk through the challenges the students were facing in their research and give them useful advice.

Last Friday, the teams’ presentations clearly showed all the hard work and dedication that each one of them had put into the project. Not only they presented their findings, but also produced a detailed written report which the judges could read through to get a better understanding of their solutions. As with the mentors, the UoG FinTech Society could not be prouder of having such a great board of judges, of both academics and professionals, participating in the final event.

Another tremendous feature of the evening was the chance for attendees to hear two inspiring keynote speakers. Stephen Ingledew, CEO at FinTech Scotland and Keith O’Donnell, Technology Innovation Lead at Morgan Stanley, provided insights into the Scottish FinTech ecosystem, the current and future trends in FinTech and the ways in which large companies like Morgan Stanley are encouraging innovation in this sector.

The project participants all seemed to enjoy the event and provided positive feedback also regarding the case, their respective mentor and the overall experience they got from participating in the AFTP. As one of the participants stated,

“it doesn’t happen every day to have people say Hey, I worked on an EU expansion strategy for startup X during my second year of university!’ (Imagine saying this in an interview!).”

As it has proved to be such an enriching experience for the students involved, the UoG

FinTech Society hopes to see the Applied Fintech Project become an established society tradition for the years to come. Reaching and involving even more students in the project is one of the society’s main aims, for which the students’ feedback is shaping up to represent a very effective marketing tool:

“How to absorb business knowledge, make new friends and communicate with industry experts in one month? Join the AFTP!”.

Fintech Workshop – trading internationally

-

Market analysis

-

Market entry

-

How to sell online internationally

-

An insight into opportunities in Germany and The Netherlands

-

One-to-one support from SDI’s experts on key areas including trading internationally and digital marketing

-

Plus, it’s the ideal setting to network with other like-minded Scottish businesses

The Applied FinTech Project at the University of Glasgow – update

Article written by Elisabetta Trasatti, Vice-President of the University of Glasgow FinTech Society

The Applied Fintech Project (AFTP), organised by the University of Glasgow Fintech Society, is shaping up to be one of the society’s greatest achievements since being established.

After being launched in September, the project is rapidly approaching its final steps, with the final event being in about two weeks.

The Applied FinTech Project has been designed by the society as an innovative opportunity for University students, who often feedback the lack of practical and experiential learning opportunities in their studies. The aim of the project is in fact to give students the chance to work on a “live” business case and come up with a solution in their team which the business can benefit from.

The case has been kindly provided by Orca, an Edinburgh-based Fintech startup which operates in the peer to peer lending industry. The society has been in close contact with the Orca team during the past months to decide which type of business case would best fit the AFTP challenge, with a particular focus on how to make best use of the diversity in the participating teams.

In fact, apart from receiving far more applications than expected, the UoG FinTech Society was impressed by the variety of degree subjects, years of study and backgrounds of the applicants. The 25 selected participants’ degrees range from Business to Computer Science, to Engineering, Psychology, Data Science and Law just to name a few. Another impressive feature in the teams’ composition is the fact that there are two Postgraduate students in each team. This is impressive considering the usual difficulty for student societies to actively engage Postgraduate students.

The project provided the teams with significant support throughout the working month on the case. In fact, each team was assigned a mentor or a pair of mentors, who could be contacted at any point during the project to get advice and help with the case.

A special mention in the support given to the teams goes to Deloitte, which has been AFTP event supporter. The team at Deloitte has not only provided mentors for two of the five teams, but has also organised a successful workshop at their Glasgow offices in which all the project participants received an insight into Deloitte’s work in automation and RPA solutions, as well as tips and advice on how to approach the AFTP challenge.

In two weeks, on Friday 16th November, the five teams will have the chance to present their solutions to a board of judges, composed of both academics from the University and professionals who have developed their competence and expertise in FinTech through their work in companies such as Morgan Stanley and Deloitte, as well as startups such as Previse and Orca.

Stephen Ingledew, CEO at FinTech Scotland, will attend the event as a keynote speaker and Keith O’Donnell, Data Engineer at Morgan Stanley, will also offer his contribution to the event as a speaker.

The evening, which will be at the Glasgow University Union, will be accompanied by live music performed by one of the University of Glasgow Music societies. Guests will also be able to network over a buffet dinner and drinks, thanks to the society receiving sponsorship from the Adam Smith Business School.