Eika Makes Major Investment in EedenBull

Norwegian banking group Eika announced a large investment into Scotland based fintech EedenBull. Eika’s member banks will have access to EedenBull’s existing and future solutions and thereby increased competitiveness in the payments market..

EedenBull was founded in 2018 by a team of payments experts from around the world and expanded into Scotland with. the opening of their new office on September 2019. EedenBull already has a large number of customers in Europe and is now launching its new and innovative payments and spend management programme through more than 65 banks in the Nordic region for more than 9,000 businesses. The company is said to onboard a new customer every 4 minutes.

EedenBull’s solution gives companies simplicity and control for managing employees’ purchases made on their behalf. The solution includes payment cards, a web-based and mobile app management module.

“To us, it is important to create partnerships with players who possess specialist expertise in their areas, as the collaboration with EedenBull is an example of. This investment is strategically important to the Eika Group and our member banks for us to strengthen and secure our ability to compete effectively in the complex world of payments going forward.”

CEO Terje Gromholt of Eika Kredittbank

“The investment made by Eika and the partnership that follows is a testament to our ability to provide significant value to banks and their customers through combining our expertise and experience with payments with access to and utilization of new technologies. We are excited about the opportunity we have to not only embrace change in the way consumers and businesses think about payments, but continue to take a leading role in setting the agenda and driving change”

EedenBull CEO Nicki Bisgaard

Soar and Acquired enter partnership

Another great example of partnership between fintech firms has been announced today. This is partnership with a purpose as the main objective is to enable ethical finance companies to compete more effectively with mainstream providers.

Scottish fintech Soar and London Payments Technology Platform Acquired.com collaborating to help credit unions and other ethical organisations provide better and transparent services.

Award winning fintech, Soar, has developed a cutting edge banking technology platform which is already being used by 10 credit unions around the UK. With the partnership with Acquired they will be able to provide more services including automated reconciliation and for the first time – complete transparency over the entire payment life cycle.

“This is an important partnership for us and a statement about how we intend to improve business processes for our ethical clients. It will also allow their customers to view, manage and pay for a variety of services through one mobile and desktop application.

Our clients will not be playing catch up with mainstream players as they are now enjoying the latest cutting edge tech, which is a match for any organisation in the financial services sector.”

Soar’s founder and CEO, Andrew Duncan

“Acquired.com was born in the highly regulated Consumer Finance sector and has always been committed to helping businesses serve their customer better. We believe that credit unions play a key role in offering fair and transparent banking and credit products to communities all around the country, which we are delighted to play a part in.

Using our award-winning payment technology, Soar’s clients will be able to gain a much better insight into their customers using our rich payment data.”

Rob Clark, Managing Director of Acquired.com

In the last quarter Soar has been awarded over half a million pounds of research and development grants and this new partnership is seen as a further boost as the company looks to expand throughout the UK and into overseas markets.

Scottish Young Edge winners HubSolv ranked 33rd in UK’s top tech list

Technology directors gathered from across the UK last week on November 7th for the Deloitte Technology Fast 50 awards ceremony in London; one of the UK’s foremost technology awards programmes. The directors from Glasgow-based firm HubSolv Limited, Fraser Hamilton and Lewis Black, were among the guests, following Deloitte’s recognition of HubSolv as one of the top 50 fastest-growing technology companies in the UK.

HubSolv was one of the three Scottish firms to have made it to the influential list and ranked 33rd in the prestigious Technology Fast 50. The rankings are based on percentage revenue growth over the last four years, and HubSolv has experienced 1,058% growth.

The team at HubSolv have come a long way since its foundation only five years ago, when they designed their specialised software for the niche industry of personal insolvency. In 2015, the firm won a Scottish Young EDGE award ”“ a grant prize that recognises the most promising firms and businesses with directors under the age of 30. The following years saw the Glasgow team further developing tech solutions and extending their product portfolio, growing their client base and tripling their workforce.

“We’re thrilled to have ranked 33rd in the UK Technology Fast 50. Since we embarked on this journey back in 2014, we have strived to innovate and evolve our product offer, which aims to digitise processes for the industry. Deloitte’s ranking is a recognition of our achievements and denotes HubSolv’s accelerated growth as we concurrently progress with our software solutions.”

Fraser Hamilton, co-founder at Hubsolv

The Deloitte Technology Fast 50 awards came back in its twenty-second year. This year, the competition saw fintech businesses comprising 30% of the winners and fintech companies dominating the top three places. Revolut ranked first on the list; while Credit providers OakNorth and Dividebuy achieved second and third place.

“As part of the growing fintech community, it’s been very encouraging for us at HubSolv to see the pace of growth across the sector and a strong performance from fintech businesses, who have managed to thrive in spite of the recent waves of economic uncertainty in the country. These are exciting times for our team; we have promising plans in the pipeline and a talented, high-skilled team in place to support our growth and innovative development. We’re looking forward to seeing what 2020 holds for HubSolv.”

Fraser Hamilton, co-founder at Hubsolv

Digital Asset and Blockchain Technology Partners launch Sextant for DAML

Digital Asset and Blockchain Technology Partners announced the availability of Sextant for DAML with early adopters Quantum Materials Corp

Counterfeit goods are a $1.8 trillion criminal industry with vast economic and human consequences. Using the latest in nanotechnology, smart contracts and blockchain, Quantum Material Corp (QMC) partnered with Digital Asset and BTP to deliver a platform that will allow manufacturers and buyers to determine absolute product identity.

QMC has released Quantum Dots, nanoscale particles so tiny you could line ten thousand of them across the diameter of a human hair. By varying properties such as wavelength QMC are able to produce billions of unique optical signatures. Impossible to copy, these can be incorporated in the production of almost anything, from aircraft components to luxury handbags.

These unique optical signatures are only useful, however, when paired with the technology that enables them to be read and identified securely. This is where Digital Asset and BTP have stepped in.

To verify an optical signature, an immutable and cryptographically secure digital twin is required – the perfect use case for blockchain. Combining their expertise in getting blockchain projects into production and generating real business value, Digital Asset and BTP partnered with QMC to provide a platform that will enable customers to verify the authenticity of their optical light signatures as simply as using a hand-held scanner or smartphone application.

By combining DAML, the leading smart contract language created and open sourced by Digital Asset, and Sextant for DAML, BTP’s blockchain management platform especially designed to deploy DAML onto distributed ledgers and databases, QMC has been able to get to market fastest and produce real value.

For more detail, check out the latest DAML blog

Agrud Unveil Expansion In Global Market Analysis Capabilities

Agrud is part of the Scottish fintech community and are the people behind Stella, a powerful global market analysis engine.

Operating between Edinburgh, Kolkata and Singapore, Agrud is pleased to announce an expansion in the way it helps financial institutions and the mass affluent stay well informed in an increasingly complex market environment.

Combining a lifetimes’ investment experience, an innovative approach to data modelling along with purpose-built natural language generation (NLG) technology, Agrud’s UI’s already cater to the needs of over 10,000 investment professionals globally.

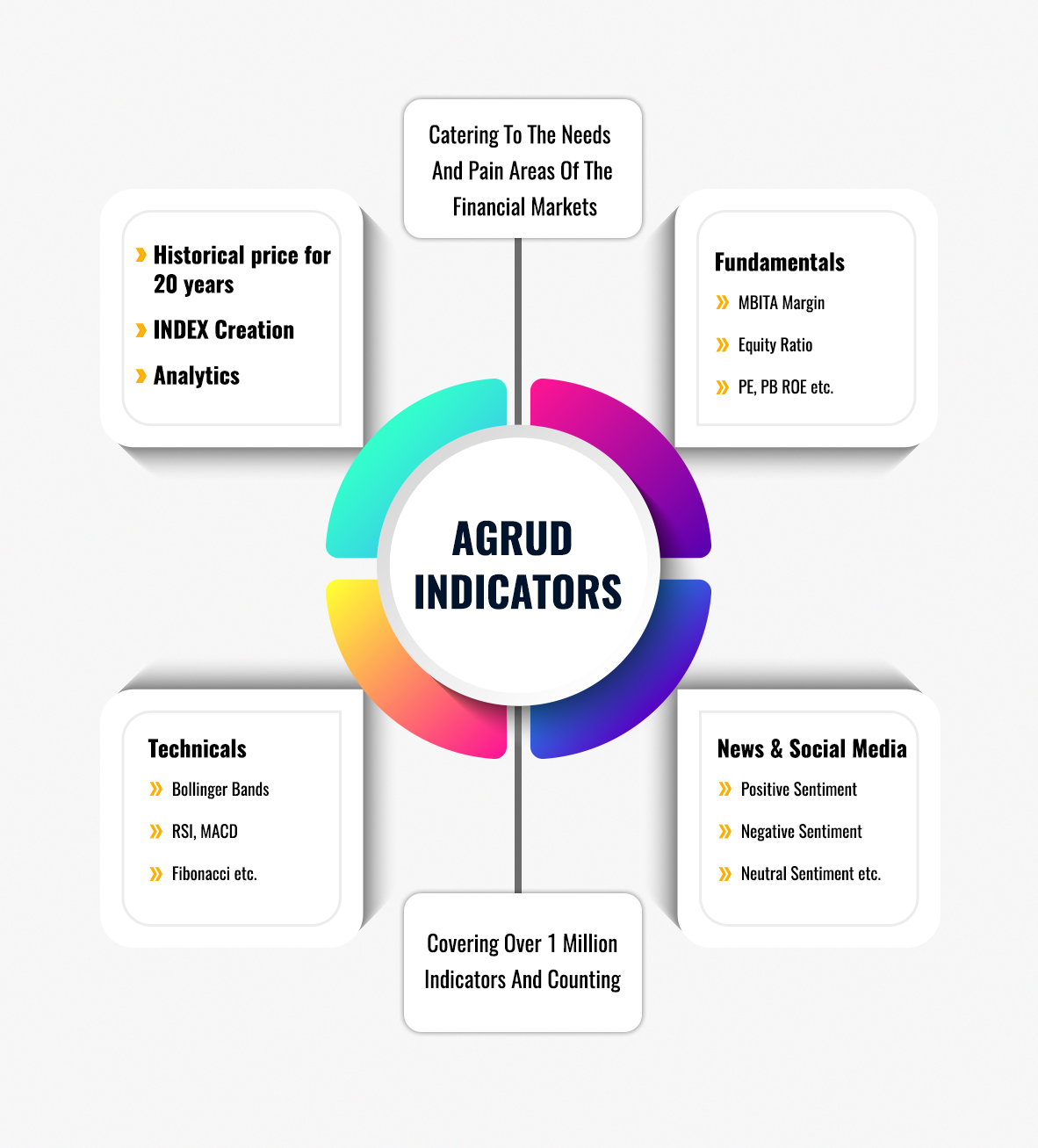

Traditional means of market analysis are falling short in their ability to take full account of the vast quantity and variety of data available today. Whilst price data, industry reports and statistical analysis are still fundamental tools in the investors arsenal, Agrud’s development of its Indicators’ system represents a landmark depth and breadth of automated written-word insights.

Over one-millions real time data points are able to be drawn upon for fact-creation’ about market activity, from technicals and fundamentals to insights on behaviors on all major social media platforms. Around 20,000 indicators can be used in the creation of insights around any particular entity.

The transformation of this vast quantity of facts’ into useful narratives is where our NLG system comes in. Insights are crafted into easily-readable sentences, and ordered so as to prioritize what matters most to the user.

The real-time acquisition, aggregation, interpretation and delivery of valuable information is the mission.

“Information empowers, and by making premium quality global market analysis more openly available you provide opportunities for growth. Too many are excluded by the crazy price tags of the traditional providers.”

Co-founder and CEO Sayanta Basu

Partnership announced between LendingCrowd and ICAS

Scottish fintech LendingCrowd have signed a strategic partnership with the Institute of Chartered Accountants of Scotland (ICAS). The partnership effectively makes LendingCrowd ICAS’s preferred partner in its Business Loans category.

With this partnership ICAS will provide LendingCrowd with a new channel to tell their network of member accountants about alternatives to traditional bank lending and their benefits. In exchange, LendingCrowd will give a special discount on client fees to ICAS members.

The partnership will last for an initial period of three years, until 2022.

Commenting, LendingCrowd founder and CEO Stuart Lunn said: “We are delighted to announce this strategic partnership with ICAS, which brings real opportunities for us all. It is a fantastic platform for us to showcase the benefits of alternatives to traditional bank lending, and for ICAS members to then utilise these benefits. It marks another important step forward in LendingCrowd’s growth story, five years after we launched. We look forward to working closely with ICAS and making this partnership a real success story.”

Commenting, ICAS Chief Executive, Bruce Cartwright CA, said: “We are pleased to have entered into a strategic partnership with LendingCrowd and secured a new, exclusive benefit for our members. Through our partnership, ICAS members’ clients can now claim 25% off LendingCrowd business loan fees. We look forward to working with LendingCrowd over the coming years.”

Video – Temple Melville speaks about Scotcoin

Scotcoin was originally created in 2013 and has been Scotland’s very own digital currency for over 6 years . It is one of the longest lived country currencies.

Scotcoin comes in two parts : Scotcoin the digital currency, and The Scotcoin Project CIC which is the educational and distribution arm of the coin. We decided some considerable time ago that a new blockchain was required which would be both KYC ( Know Your Customer) and AML ( Anti Money Laundering) compliant. We have spent the last two years working towards a solution that will be both robust and last at least as long as Bitcoin. We have what we call our 5 Pillars.

These are:

1. An efficient and cost effective migration process,

2. A robust blockchain solution,

3. Un-issued surplus coin creation (for reward and future distribution),

4. Access to an efficient secondary market or markets and

5. Crucially, a reliable and durable delivery partner with likely longevity.

We have no doubt that these “pillars” will stand the test of time and answer all the problems thrown at them. We are working with world class companies to deliver our new blockchain and coin.

Our existing holders will be well rewarded for their early adoption and receive bonuses subject to conditions.

Our chosen area of investment is the charity eco-system, and we are already engaged with several charities and are looking to reward volunteers in all areas who seldom if ever receive acknowledgement.

We are actively looking to donate Scotcoin to people for working with us. We are also looking for merchants who are prepared to accept Scotcoin for their services, particularly in the IT and digital eco-systems. All areas of business are acceptable. Merchants will receive a signing on bonus and ongoing help and promotion.Please send an email to temple@scotcoinproject.com for further information and to receive your free SCOT. We are always available to give talks on the Blockchain, on Bitcoin and on Scotcoin.

Fintech ShareIn launch new Payments Product To Address Gap In The Market

Edinburgh based fintech firm launched a new specialist payment product called ShareInPay for platforms holding ISA money.

ShareIn operate investment platforms for clients such as Triodos Bank, the Dutch Ethical Bank, Crowdlords, Residential Property investments and Energise Africa.

ShareIn has been an Innovative Finance ISA Manager since Dec 2016 and many of their investment platforms offer Innovative Finance ISA products.

CTO and Co-Founder, Andrew Pickett says. “We needed a solution for our platforms to hold Client Money that wasn’t e-money. We searched everywhere and couldn’t find an API driven Client Money solution. So we decided we needed to build this ourselves.”

ShareIn obtained the regulatory permission to hold Client Money from the Financial Conduct Authority earlier this year.

CEO, Cook said “To say holding Client Money is difficult is a little bit of an understatement. There are few things in the Financial Regulatory environment more important than holding other people’s money.”

The launch of ShareInPay marks the start of a modular software approach for ShareIn to enable investment business more generally. Modules that work together or separately with an existing platform.

For more information contact:

Jude Cook, ShareIn Ltd, +44 7956123405, jude@sharein.com

LendingCrowd crowned Best P2P Business Lender

Edinburgh-based fintech lending platform LendingCrowd has been crowned the UK’s Best P2P Business Lender at the first ever Growth Finance Awards, held in London.

LendingCrowd, which is the only SME lender of its kind headquartered in Scotland, was recognised for its “best-in-class digital platform, transparency, as well as ample resources for both borrowers and lenders”.

Founder and CEO Stuart Lunn said: “To be named Best P2P Business Lender is testament to the significant strides we have made since our launch in 2014. LendingCrowd exists to help alleviate the funding gap facing the UK’s vital community of SMEs, and we’re delighted to have received this recognition at the Growth Finance Awards.”

The award was presented to Stuart and LendingCrowd Chief Marketing Officer Darren Cairns by Simon Bonney, partner at category sponsor Quantuma.

The Growth Finance Awards, organised by Intelligent Partnership and hosted by television presenter Claudia Winkleman, were designed to highlight the role of the finance community in supporting the growth ambitions of SMEs across the UK. More than 300 guests attended the black-tie event, which took place on Wednesday 11 September at the Royal Lancaster Hotel in London.

Guy Tolhurst, Managing Director of Intelligent Partnership, said: “Just to be recognised as a finalist is a great achievement in itself, but to take home a prize is a truly impressive accolade. I look forward to next year’s event and continuing to educate growing businesses about the wide variety of financial options that are available to them.”

Since its launch in late 2014, LendingCrowd has facilitated more than 740 loans to SMEs across the UK with a total value of £65 million, with more than £15 million of lending in Scotland.

LendingCrowd has also been named as a finalist in the Impact and Investment category of the Scottish Financial Services Awards, organised by Scottish Financial Enterprise and sponsored by EY. The shortlisting is in recognition of the unique £18.75 million funding partnership that LendingCrowd has created with Scottish Investment Bank and Dutch entrepreneurial bank NIBC to fund the ambitions of SMEs across Scotland and the rest of the UK.

Autorek and the Automation Revolution

AutoRek have just announced that they had partnered with Worldwide Business Research (WBR) to generate an industry report. The report will be focusing the state of automation and data management within the financial services sector.

The survey includes feedback from 100 individuals within the operations, IT, business change, finance and data management business functions. They were asked how automation will affect the financial services industry in the next 5-10 years.

Key findings include:

- The majority of those interviewed are implementing blockchain, semantic data management, machine learning and automation

- Respondents think that AI is likely to impact product development and innovation the most.

- 46% of respondents are looking for new technologies to assist data governance.

Investing in the Automation Revolution’ will launch at Sibos London between 23rd”“ 26thSeptember.