Financial Regulation Innovation Lab (FRIL) Responsible Innovation Case Study: Ask Silver

FRIL: Stopping Scams Before The Payment Goes Through

At FRIL, practical innovation protects people. The Optimising Consumer Outcomes Innovation Call brought together fintechs, regulators, academics and banks to tackle real issues that affect millions of people across the UK.

Ask Silver, co‑founded and led by Alex Somervell, uses AI to stop scams before people lose money. The team’s passion, sparked by personal experience of financial harm, lies in protecting people from financial and emotional harm caused by scammers. Winning one of five funded FRIL innovation awards helped Ask Silver to hire earlier, accelerate product development and launch the Metro Bank Scam Checker sooner – delivering protection to customers sooner than planned.

“Engaging with FRIL gave us access to industry leaders from NatWest to Barclays to Tesco Bank. That insight into their challenges meant we could tailor what we built and get feedback as we built, rather than in isolation.” — says Alex, Co-founder & CEO, Ask Silver.

The Challenge : Protecting People from Scams

Scams and fraud are a growing national problem that harm people’s finances, confidence and wellbeing.

Fraud and scams are among the fastest-growing threats in financial services. In the UK alone, consumers lost £12.4 billion last year, 41% of over 50s in the UK have been scammed in the last five years and fraud accounts for over 40% of all crime.

The FCA’s Consumer Duty raises the standard for firms to protect customers, prevent foreseeable harm and deliver fair value. Many firms find meeting these expectations difficult because of legacy systems and manual processes. Stopping scams quickly – ideally before a payment is made – is a clear, measurable way to protect customers and meet regulatory standards across the UK.

For consumers this means clearer information, fairer treatment and stronger protection so

fewer people lose life savings or suffer emotional harm.

| For Industry | For Consumers |

|---|---|

| Consumer Duty isn’t just regulation, it’s about putting people first. It ensures financial firms act in customers’ best interests, helping prevent harm, exploitation, and financial crime before it happens and ensuring every interaction leads to fair, positive outcomes. | It means being treated with fairness and respect – with products they can trust, clearer information, and stronger safeguards against financial harm or scams. |

FRIL’s Formula for Change

FRIL’s Optimising Consumer Duty Innovation Call set seven practical challenges about improving consumer outcomes using technology and data. By pairing early‑stage fintechs with banks, regulators and academics, FRIL created a fast feedback loop for testing real solutions. Funding support plus direct access to decision‑makers allowed innovators to iterate quickly and scale solutions that benefit us all.

FRIL’s approach shows what’s possible when innovation and regulation work hand in hand. It proves that technology can help financial services not only do better, but be better: fairer, smarter, and more inclusive.

The Case Study :Ask Silver

Ask Silver gives people a fast, easy way to check messages, emails or links for scams. Users send content and receive an instant, human‑centred judgement and guidance so they can decide what to do next.

Ask Silver’s foundation is deeply personal to its founder:

“My dad was scammed, he lost almost £150,000 – most of his life savings. He was vulnerable for a number of reasons. Then three friends in their early 30s, all in tech, were scammed too, losing tens of thousands each. It shows that scams are a problem that affect everyone.” — Alex, Co-founder & CEO, Ask Silver.

Ask Silver’s core product is a scam-checker AI. A user sends a message, email, or website link. The system analyses it and responds with guidance. Ask Silver is delivering real impact so far in stopping scams before payments are made:

- Over 20,000 scam submissions analysed.

- Incidents reported to the National Cyber Security Centre and authorities.

- Many users avoided financial loss and learned how to spot scams.

- Broad media coverage that raised national awareness across BBC, ITV, Telegraph and

- Daily Mail

“Lots of people use it when they’re unsure. They do a quick check with us, get that instant second opinion, and it often leads them to do further research themselves to validate what we’ve said.” — explains Alex.

Ask Silver is live on WhatsApp and planning a roll‑out to web, app and video analysis so more people across the UK can access help in the way they prefer.

Ask Silver stats

| Sector | FinTech/Fraud Prevention |

| Employees | 6 |

| Location | London |

Impact of FRIL: Delivering safer digital finance

FRIL enabled Ask Silver to turn early support and industry links into national impact.

“We won £50,000. That was huge for us at the time as we’d only invested about £100,000 to get this far. That funding allowed us to hire two developers earlier, pushing development forward months sooner than we otherwise could have.” — says Alex.

How FRIL support translated into impact for the UK:

- How FRIL support translated into impact for the UK:

- 2 x developers hired ahead of schedule

- Building tools ahead of schedule (e.g. a Facebook Marketplace scanner)

- Expediting security and feature development

- Gaining validation that supported subsequent fundraising

- Being able to get Ask Silver out there to support more customers, more quickly

“We moved quicker than we would have otherwise. We built features earlier, hired earlier, and engaged with people in banks who we’d have struggled to meet.” — explains Alex.

For industry partners this meant that they could also pro-actively help customers:

“The goal is to ultimately stop scams. We want to be the most consumer- and human-focused anti-scam, anti-fraud product and company available on WhatsApp, web, and app, analysing not just text but video.” — adds Alex.

With FRIL’s connections and credibility, Ask Silver moved faster and gained proof points that helped scale their approach, making protection available to more people across the UK.

“If FRIL hadn’t been there, we’d have delayed hiring, faced less investment and taken longer to get that additional proof point and validation.” — says Alex

Outcomes – Turning Ambition into Action

As a result of the few months of collaboration with FRIL, Ask Silver achieved significant milestones.

- £50,000 FRIL grant secured

- New partnerships formed with major banking institutions

- 2 developer hires accelerated

- Product development accelerated, bringing protection to more people sooner

Case study conclusion

Practical regulation plus focused innovation protects people across the UK. Ask Silver shows how a small, human‑centred AI product can have a national reach: preventing financial loss, educating the public and supporting banks to meet higher consumer protection standards. When regulators, industry and innovators collaborate, technology becomes technology is not just a tool, but a source of safety – and a force for good.

Download the Ask Silver case study.

New fintech programme aims to help Scotland’s ageing population financially prepare for later life

FinTech Scotland is aiming to help address the growing link between people’s financial situation and their health in later life with the launch of a new initiative that will accelerate innovation through the development of new research, technologies, and services.

The Finance and Health Lab will bring together financial services firms, fintechs, academia, government, health specialists and policy leaders to enhance understanding of the drivers of later life financial vulnerability and to co-design solutions that could improve the financial wellbeing and resilience of people across Scotland. The programme is being enabled by funding from the Scottish Government and delivered in collaboration with the University of Edinburgh and Edinburgh Innovations, its commercialisation service, leveraging their innovation and research networks.

By fostering collaboration amongst partner organisations, the lab will support the ideation of new ventures, prototypes, and pilot projects, strengthening Scotland’s innovation pipeline and competitiveness in the global fintech market. It will also generate research that will shape future service models, product development, and policy that support good financial and health outcomes.

Participating organisations will collaborate on solving a number of challenge areas, with end outcomes potentially including making digital financial services more accessible and supportive for older people, creating personalised tools that help individuals plan for health events in later life, and strengthening financial confidence and decision-making.

The four-month programme will include a National Conference on innovation in finance and health and calls for projects targeting high-priority issues related to later life and financial wellbeing. In addition, participants will have opportunities to showcase new prototypes, understand data, undertake research, produce policy papers, and exchange knowledge through a series of webinars, roundtables, and other platforms.

A range of studies have drawn a direct link between household wealth and the likelihood of poor health in older age. For example, according to the Institute for Fiscal Studies (IFS)(2023–24), 54% of women aged 55–64 in the lowest third of the UK’s wealth distribution reported at least one mobility issue, compared to just 20% in the wealthiest third.

The UK has a longstanding retirement savings gap. Office for National Statistics figures suggest the average pension wealth in the UK for people between the ages of 65 and 74 stands at just under £146,000, equivalent to just over 4.5 years of ‘comfortable’ retirement income by the Pensions and Lifetime Savings Associations’ standards.

Aleks Tomczyk, Chief Executive at FinTech Scotland, said:

“The retirement savings gap is a longstanding challenge in Scotland and across the UK – and it is only going to grow in importance as more people live longer and, therefore, need more money to fund themselves in later life. The Finance and Health Lab will bring together the best minds from across different sectors to find different types of solutions – whether that is policy, research, or technology – and set out a way forward for ensuring people can have a good retirement, minimising the adverse impact that poor health or limited finances can have.”

Dr Andrea Taylor, chief executive officer at Edinburgh Innovations, added:

“Scotland is the ideal test bed for an initiative like the Finance and Health Lab, with a strong fintech ecosystem, globally recognised universities, and a thriving financial services sector. The solutions that emerge from the programme could make a significant difference to people’s lives and further cement our position as a world leader in collaboration and innovation between the public, private, and education sectors.”

A spokesperson for the Scottish Government said:

“Scottish Government committed £5 million this financial year to support the growth of our key innovation clusters as drivers of economic development in areas with huge value potential, including fintech and life sciences. This project, as an important element of a broader suite of cluster development projects, will strengthen cross-cluster collaboration and contribute to the enhancement of innovation and economic growth of these key clusters.”

Read more about the Finance and Health Lab.

Cloud for financial services: An Industry Report on the Opportunities and Challenges

By Pinsent Masons & the Financial Regulation Innovation Lab (FRIL)

A decade ago, the “cloud in financial services” conversation was framed by caution, with the sector focused on navigating a series of hurdles to adoption. Today, the cloud is no longer a novel proposition cautiously assessed, but rather an indispensable component of the operational fabric and strategic future of financial services. The hurdles have, in many respects, become pathways, enabling unprecedented speed and innovation.

This report by Pinsent Masons, published in partnership with the Financial Regulation Innovation Lab (FRIL), revisits the cloud journey for financial services with a focus on the nuanced and complex reality facing financial institutions. Drawing on a series of candid “Chatham House” interviews with senior leaders across major financial institutions, technology providers and advisory firms, it explores the current dynamics of the market. The report is also supported by survey data sourced from more than 30 businesses operating within the financial services sector.

The interviews and the data reveal that the old hurdles have not disappeared, and some, like data residency, persist as challenges despite the context evolving. The primary drivers for moving to the cloud are now strategic – (1) the continuing need to escape the drag of legacy systems, (2) demand for pace and agility in segments being reshaped by AI, and (3) the realisation that the cloud can be a powerful tool for enhancing, rather than diminishing, operational resilience.

New and complex challenges have also surfaced. The initial promise of cost savings has proved elusive for some; governance and the maturity of shared responsibility models have struggled to keep pace with adoption; and regulators are focused on what they see as a continuing key concern – concentration of risk among a handful of hyperscale providers. As the sector stands on the cusp of an AI-powered technological wave – a wave that is dependent on the cloud – the lessons from the past decade are more critical than ever.

Navigating the Advice Frontier – Supporting informed consumer decision making.

The Future of Wealth Innovation Call launches.

This challenge is about finding new ways to support consumers in making informed financial decisions, delivering more accessible and tailored wealth support, while staying within evolving regulatory expectations.

This Innovation Call sees 21 cutting-edge fintech businesses selected to collaborate directly with leading financial institutions, professional services firms, regulators and academics using data-driven innovation that can bridge the “advice gap” an improve outcomes for millions of customers.

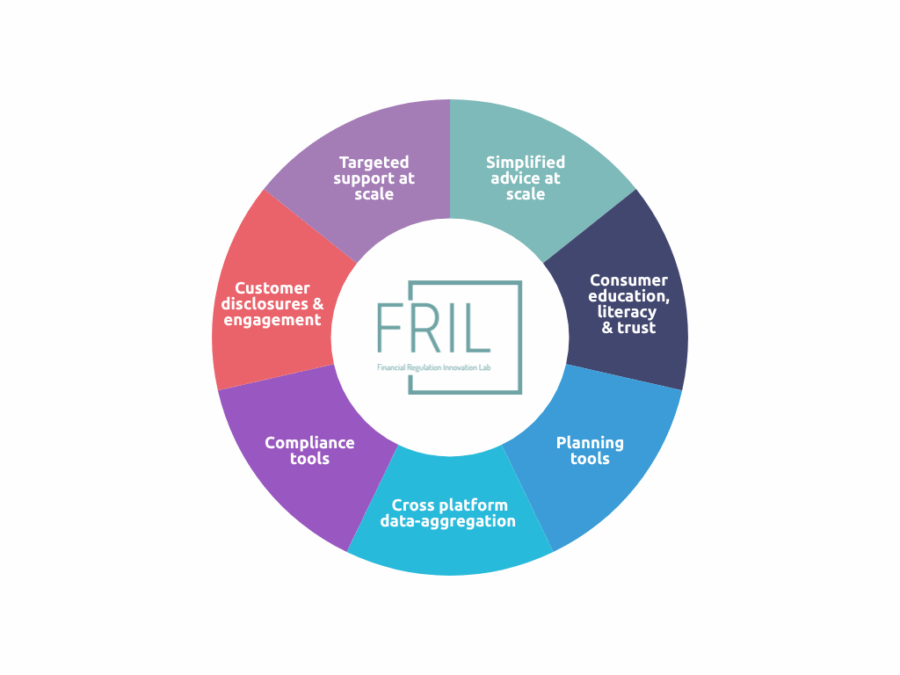

This is our sixth Innovation Call and will address challenges affecting the sector including:

Launch and next steps

The programme officially launched on 13 November at PwC’s Glasgow offices, where the fintechs met with industry leaders and academic experts to kick-start their collaborative journeys.

Over the coming weeks, participants will take part in workshops and deep dive insight sessions designed to refine their solutions and align them with real-world industry needs. The most promising ideas may also receive grants of up to £50,000 to accelerate development

Who is involved?

The Future of Wealth Call is hosted by the Financial Regulation Innovation Lab (FRIL) in partnership with SuperTech West Midlands

We are proud to be working with 10 strategic partners - PwC, Barclays, Lloyds Banking Group, Sopra Steria Financial Services, NatWest Group, M&G, BNP Paribas, Dudley Building Society, Wesleyan and Standard Life – alongside academic partners at the University of Strathclyde and the University of Glasgow. Their combined expertise ensures that innovation is rooted in both cutting-edge research and real-world regulatory priorities.

We are also delighted to partner with Growth Builders to support in the delivery of this programme.

Our 21 successful Fintechs include:

Afternoon Finance, Alessia, Alethica, Amplifi, Aveni, Aventur Wealth, CherpaAI, Complia, Doconomy, Etcho, Finspector, Glimzer, Guiide, InicioAI, Iress, Open Book Analytics, Planda, Snowdrop Solutions & Stratiphy [joint entry] and The Wisdom Council & DocStribute [joint entry]

Find out more about each of the fintechs in our fintech brochure.

What next?

If you’ve liked what you’ve read, follow us on LinkedIn where we will keep you updated. Or, for more information about getting involved in future innovation calls contact us at FRIL@fintechscotland.com

Consumers at the Heart of Innovation: Financial Health Evaluation in the UK Regulatory Landscape

This whitepaper examines the evolving landscape of financial services in the UK, with a focus on consumer-centric innovation and the regulatory framework supporting financial health. Against a backdrop of rising household debt and consumer vulnerabilities, we explore how innovative fintech solutions, enabled by emerging technologies, are reshaping the evaluation of financial health beyond traditional credit scoring methods.

The paper provides an in-depth analysis of the current regulatory environment, including the Financial Conduct Authority’s (FCA) Consumer Duty and other initiatives aimed at enhancing financial wellbeing. A case study demonstrates an AI-driven framework for intelligent credit scoring, illustrating the potential for more holistic financial health assessments.

We discuss the critical role of Open Banking and Open Finance as enabling infrastructures for innovation, while emphasising the importance of data protection and digital ethics. The paper also outlines key directions for fintech innovation that prioritise consumer needs.

Looking to the future, we examine emerging trends in consumer innovation, potential regulatory developments, and the long-term impact on the financial services industry. The paper concludes that by placing consumers at the heart of innovation, the UK financial sector can build a more resilient, inclusive, and sustainable future, setting a global benchmark for fostering financial health in an era of rapid technological change.

From Crisis to Prosperity: AI and Open Finance for Holistic Financial Health and Smart Future Planning

The financial services industry stands at a critical inflection point. Traditional credit-scorecentric frameworks, rooted in historical repayment data and broad demographic categories, are increasingly incapable of capturing the full spectrum of consumers’ financial health. The COVID-19 pandemic, successive cost-of-living crises and wider economic shocks have exposed deep vulnerabilities in reactive, one-dimensional risk models. Consumers and institutions require proactive, resilience-focused insights that span day-to-day cashflow management, medium-term debt servicing, and long-term wealth accumulation.

Open Finance – the consent-driven sharing of a comprehensive array of financial data (current accounts, mortgages, loans, savings, investments, pensions, insurance, government benefits), combined with advanced Artificial Intelligence (AI) and Machine Learning (ML) techniques, offers a transformational route to truly holistic financial health evaluation. By ingesting rich, multi-dimensional data and applying explainable models, financial firms can transition from static credit assessments to dynamic, personalised guidance and recommendation engines. These engines empower consumers to build financial resilience, make informed decisions and pursue life goals with confidence.

Building on Sopra Steria and Glasgow University’s joint whitepaper “Consumers at the Heart of Innovation: Financial Health Evaluation in the UK Regulatory Landscape” and inspired by R&D collaboration between Sopra Steria and Oxford University, this whitepaper:

- Examines the scope and expected data architecture of Open Finance, extending from Open Banking to full-spectrum data sharing.

- Presents a robust data modelling framework, encompassing data acquisition, cleansing, feature engineering, supervised and unsupervised modelling, scorecard design and persona segmentation. It culminates in a composite financial health score that blends aspects like credit risk and resilience evaluation.

- Explores explainability and consumer engagement, employing data science techniques to ensure transparency and mapping various persona archetypes to tailored, sequential optimisation plans.

- Demonstrates regulatory alignment, showing how non-product-specific, personadriven guidance and recommendation can fit within the Financial Conduct Authority’s (FCA) Advice and Guidance Boundary (FG15/1) and the Consumer Duty framework.

Creating Fairer Financial Futures

Advice Guidance Boundary Review Innovation Call

The Financial Regulation Innovation Lab (FRIL) launched its latest Innovation Call last week, which addresses one of the most important regulatory shifts in financial services and could reshape how millions of people access financial support.

The call is all about finding new ways to help consumers make informed financial decisions, delivering more accessible and tailored support while staying within evolving regulatory expectations.

The call focusses on the FCA’s Advice Guidance Boundary Review – a technical name for a very human issue: how to make financial help clearer, fairer and available to far more people.

To understand what all this means – and how it connects to creating a fairer financial future – we spoke with Kostas Oikonomakos, Programme Manager at the Financial Regulation Innovation Lab (FRIL), ahead of last week’s launch of the Innovation Call.

In Conversation with Kostas Oikonomakos

Hi Kostas!

Q: OK, let’s start with what is the Advice Guidance Boundary Review, and why does it matter?

Kostas: The AGBR is a really important development for the financial services industry. Right now, millions of people in the UK don’t receive any financial advice at all. Advice exists, of course, but it’s often too expensive for most people. The Review aims to make sure those people can finally get some form of support to help them make important decisions about their money.

Just 9% of UK adults took financial advice in the year leading up to 2022. While 64% hadn’t in five years. This highlights an ‘advice gap’ affecting an estimated 12 million people identified as non-advised but with need or potential.

*Stats from FCA’s 2022 Financial Lives Survey and the Financial Services Scheme.

It’s also good for firms. It gives them new ways to deliver support that is practical and can scale. And it brings clarity. Today, there are grey areas where a firm thinks they’re offering guidance, but the FCA might say it’s actually advice. AGBR will help define what is advice, what is guidance, and how new services like ‘targeted support’ and ‘simplified advice’ fit in. That clarity will help the whole financial system work better for everyone.

Q: Why does this matter to our everyday lives?

Kostas: The gap is real. The wealthy can afford advice, but millions of people don’t receive any support at all, so they have to navigate pensions, savings, and long-term planning by themselves. New types of guided support can help close that gap and improve confidence and outcomes for people who’ve never had access to anything before.

Q: At what points in our lives would we feel the difference created by AGBR, and how would it change the way we access advice or guidance?

Kostas: You’d notice it would make financial decisions easier. For example, when you’re getting close to retirement and need to understand your pension options, but you can’t afford full advice. With developments from AGBR, you could use a digital service that gives you targeted support based on the information you share, helping you make decisions with much more confidence. The same applies if you have a few small pension pots from different employers and don’t know how they fit together. Guided tools can help you navigate that without needing a one-to-one adviser.

You’d also see the difference much earlier in life. Let’s say you have a small amount of savings and you’re trying to work out how to make it grow, or you’re deciding whether to pay off debt or put money into a pension. Right now, most people in that situation get no support at all. New ‘advice-lite’ services would give clearer, personalised guidance at a price people can actually access. And in time, as open finance develops, firms could safely build a fuller picture of your financial situation and offer even more accurate guidance without you having to pull everything together yourself.

Q: What is the main challenge that the FCA is trying to address?

Kostas: The main challenge the FCA and HM Treasury are trying to solve through the AGBR is that too few people are getting the financial support they need. There are lots of people who could really benefit from help but don’t get it – that is the advice gap. Part of the problem is that firms aren’t always sure where the line sits between regulated advice and general guidance. The Review should clear up that uncertainty and create space for new, more affordable ways to help people, like Targeted Support and Simplified Advice, so that many more consumers can get the right help at the right time.

Q: What is the difference between advice and guidance?

Kostas: Advice is the traditional, regulated service where an adviser understands your full financial picture and gives you a personalised recommendation. It’s tailored to you and your long-term goals, and the firm takes responsibility for that recommendation. Guidance is different. It doesn’t look at your whole situation and it doesn’t tell you exactly what to do. Instead, it helps point you in the right direction based on the information you choose to share. It supports your decision, but it’s not a personalised recommendation.

Q: Why is FRIL taking on this topic right now, and what does it hope to achieve?

Kostas: The timing is ideal because the AGBR framework is still being developed. Final rules are expected by the end of 2025, with firms able to apply for the new targeted-support regime from Spring 2026. That means there’s still an opportunity to feed in insights before anything becomes enforceable.

This creates a safe space for firms to share challenges and explore potential solutions without regulatory pressure. Through this work, we can generate early evidence and practical ideas to help shape how the new regime operates in practice.

The kinds of ideas we expect to explore include digital tools for targeted support, simpler ‘advice-lite’ journeys, interactive disclosures, and even early work on open finance so firms can safely access a fuller picture of a customer’s finances. The goal is to produce practical, testable solutions that show how AGBR could work in the real world, to prepare for tomorrow and to improve outcomes for people who currently receive no support at all.

Q: Why is FRIL a good environment to help shape developments?

Kostas: More broadly, what FRIL wants to achieve is genuine collaboration around real problems. Large firms get early sight of new technologies and ideas that could help them support customers at scale. Fintechs get a clear understanding of what those firms actually need, and they can adjust or sharpen their solutions accordingly. The FCA is part of those conversations too, which is helpful for any fintech that might want to become regulated in future. And our academic partners bring research and analytical thinking that helps everyone look at these issues from different angles.

Q: OK quick summary – how does this help create a fairer financial future?

Kostas: By widening access. More people get the right kind of help, firms can serve broader audiences, and the rules are clearer. That combination improves confidence, access to financial advice and guidance, and ultimately, better outcomes for everyone.

Explaining the terminology

The Advice Guidance Boundary Review. Just what does it mean? A brief glossary:

- Advice: A regulated service where a financial adviser looks at your full financial situation and gives you a personalised recommendation.

- Guidance: Support that points you in the right direction based on limited information you share, without telling you exactly what to do.

- Boundary: The line that separates advice from guidance, defining how much information is needed and what a firm can or can’t recommend.

- Review: The FCA’s process of consulting industry and consumers, and government to create clear new rules that will shape how these services work in future.

What next?

Over the coming weeks, FRIL will be exploring new technologies, fresh thinking and real-world challenges with partners across the ecosystem. Watch this space for insights and thought leadership content from across the call – there’s much more to come.

Email the team at FRIL@fintechscotland.com if you’d like more information about our Innovation Calls.

Exploring the Digital Pound: The Bank of England’s Latest Update

The Bank of England and HM Treasury have shared their latest update on the progress towards a potential digital pound, a central bank digital currency (CBDC) that could serve as a base for the next generation of retail payments in the UK.

The two bodies are moving through the design phase, their focus remaining on developing a detailed blueprint for how a digital pound could work in practice. This includes rigorous experimentation through the Digital Pound Lab and continuous collaboration with industry stakeholders. Together, this work will inform a joint assessment by the Bank and HM Treasury, with a decision on next steps expected in 2026.

The update also introduces two new design notes that explore the technical and practical dimensions of a digital pound:

- Alias Service: Examines how using account aliases (such as email addresses or phone numbers) could simplify retail payments, enhancing usability and security. The paper also explores the Bank’s potential role in enabling such a service across the payments ecosystem.

- Offline Payments: Explores how the digital pound could support deferred offline transactions, including applications in transport, vending, and other unattended terminals. The paper also considers how device-to-device payments could operate securely without a live internet connection.

The exploration of a UK digital currency represents a great opportunity for innovation across the financial services sector. New payment architectures, trust frameworks and identity services will offer fintech innovators in Scotland and across the UK an opportunity to play a role in shaping and testing these emerging models.

We’re looking forward to collaborating on this initiative through the Digital TRUST Centre of Excellence that FinTech Scotland recently set up in collaboration with Edinburgh Napier University, the University of Edinburgh, the University of Glasgow and Scottish Enterprise.

Financial Regulation Innovation Lab (FRIL) Responsible Innovation Case Study: Inicio AI

FRIL: Supercharging Growth, Serving Society

At first glance, financial technology might seem like it’s all about algorithms, compliance, and data. But for Inicio AI, it’s about something far more human – empathy.

When FRIL launched its Optimising Consumer Outcomes Innovation Call, the goal was simple but ambitious: to put people, not processes, at the heart of financial innovation. The programme invited fintech startups, financial institutions, regulators, and academics to collaborate on solutions that would help customers make better, fairer financial decisions.

For Inicio AI, a company founded on inclusion and compassion, FRIL became the perfect catalyst. Through the programme, Inicio gained new commercial opportunities, accelerated product development, and deepened relationships with industry partners. But more importantly it did this while staying true to its mission of helping vulnerable customers in the most difficult of circumstances navigating financial systems with dignity, helping some to become debt-free more quickly and many more to find a way forward and out of their debt issues.

The Challenge: Smart and Kind Finance

The UK’s Financial Conduct Authority (FCA) introduced the Consumer Duty regulation to ensure financial firms act in the best interests of their customers. It raises expectations around transparency, fairness, and care – aiming to make financial services accessible and understandable for everyone, regardless of literacy or numeracy.

For many firms, meeting these standards is complex. Outdated systems and manual processes make it difficult to prove compliance and deliver consistently positive outcomes for customers. That’s where innovation and empathy come in.

Why addressing this challenge matters:

| For Industry | For Consumers |

| Consumer Duty means building trust, reducing risk, and designing services that genuinely support customers. | It means fair treatment, clear communication, and better support when it matters most – especially for those facing financial vulnerability. |

The Approach: Smarter Data, Smarter Solutions

FRIL’s Optimising Consumer Outcomes Innovation Call set out seven specific challenges exploring how technology, data, and analytics could help firms better understand their customers and improve outcomes.

By bringing together pioneering fintechs, leading financial institutions, regulators, and academics, FRIL created an environment for rapid experimentation and collaboration. Successful innovators like Inicio received early-stage funding and direct access to senior decision-makers inside major financial organisations – helping them test, refine, and accelerate their ideas for market.

For Inicio AI, this meant moving faster, learning more, and making a bigger impact than ever

before.

The Case Study: Inicio AI’s Story – Empathy in Action

Inicio AI was founded with a powerful human story at its heart.

“The company was originally founded because of a story involving a pregnant woman who was, sadly, trying to take her own life. She was in debt and struggling to fill in a financial form to confirm her affordability. She’d been sent paper and digital forms to complete on her own but found it intimidating. She’d also tried a phone call, but that was embarrassing. She abandoned it and became stuck”. — explains Rachel Curtis, CEO of Inicio AI

That experience inspired Budgie – a gentle, virtual agent that helps people complete affordability forms any time of day or night, offering the reassurance and support they need to get it done.

Budgie turns what can be an intimidating process into a supportive experience. It listens, guides, and reassures – empowering users to take back control of their finances.

Originally focused on debt management in the UK, Budgie’s reach has since expanded into new lending, mortgage applications, and financial advice nationally and in future will expand internationally.

And the impact has been profound.

“There was a young couple in their early 20s with about £1,200 of debt. They used Budgie, and through one of our partners – a benefits calculator – they discovered they were missing out on £340 a month in benefits. It meant they could be debt-free in four months. That customer outcome was fantastic”. — says Rachel.

The Impact of FRIL: Bigger, Better, Faster

At its heart, FRIL champions finance for good. This means supporting innovators who use technology to create positive social change. For Inicio, the programme offered access, insight, and momentum.

“It’s the faster pace of insights, innovation and collaboration that you get from being part of FRIL. What we achieved was bigger, better and faster than trying to do it on our own”. — says Rachel.

Through FRIL, Inicio gained direct access to major financial institutions – not through cold calls, but through open, honest conversations where senior leaders shared real challenges and insights.

“It brought together the companies we were trying to approach and sell our product to, but in a very honest environment. They shared their challenges, and these were senior people in those companies. Outside of FRIL, when you’re trying to make initial sales calls, it can be hard to get those conversations”. — explains Rachel.

That openness, combined with structured support, helped the team refine and shape Budgie to meet real-world needs.

“This challenge is a great opportunity to harness fintech innovation, and apply that in how we support customer outcomes at every stage of their financial lives”. — Will Kerr, Head of Good Customer Outcomes, NatWest Group.

“It ticked all the boxes. It was an efficient, focused resource for my team to really understand what challenges existed in the regulatory space, so we could come back with a clear proposal on how to solve

them”. — says Rachel.

And the collaboration didn’t end there. Inicio joined forces with fellow fintechs in the FRIL cohort, including TellJO, to combine their tools and tackle even bigger problems together.

“We ended up working with other fintechs such as TellJO, plugging our solutions together to solve bigger problems in better ways. It was a really lovely, positive outcome we didn’t expect”. — explains Rachel.

Inicio stats

| Sector | Fintech |

| Employees | 15 |

| Turnover | Early revenue, expanding into B2B and B2C markets |

| Location | England , Scotland |

The Ambition – Redefining what is possible

For Rachel and her team, FRIL was never just about funding. It was about growing within a supportive, purpose-driven ecosystem.

“It did fundamentally change our approach to partnerships. What FRIL helped us do was look at the broader problem the consumer was trying to solve, because we saw that very clearly through the eyes of the organisations. They were turning up and saying, ‘Our consumers are struggling with this,’ or ‘From a regulatory perspective, we’ve got to meet these requirements – but we have to do it in a way that delivers good outcomes”. — adds Rachel.

Inicio AI continues to expand Budgie’s reach, forming new partnerships and exploring wider use cases – all grounded in the same mission that started it: making financial life easier, fairer, and more human.

The Outcomes – Impact

In just a few months, FRIL enabled Inicio AI to refine their product, deepen their market understanding, and build meaningful partnerships across industry and academia.

Impact summary

- 1 x product refinement sprint completed in 12 weeks.

- New partnerships established (industry and fintech)

- New clients secured

- Increased confidence, visibility, and collaboration in the fintech ecosystem.

Case Study Conclusion

Inicio’s journey with FRIL shows what happens when innovation and empathy come together. Through collaboration, insight, and the courage to think differently, Inicio created technology that doesn’t just tick boxes – it changes lives.

For FRIL, this is exactly what “finance for good” means: empowering innovators to build a financial system that is smarter, fairer, and above all, kinder. Through collaboration, insight, and compassion, FRIL is proving that when innovation meets regulation – and when both start from human need – everyone wins.

Download the Inicio AI case study.

Financial Regulation Innovation Lab (FRIL) Responsible Innovation Case Study: CienDos

Shaping the future of ESG (Environmental, Social and Governance Measurement and Reporting) in Financial Services

In today’s world, doing good for the planet is no longer simply a personal preference moral it’s a business imperative. Financial institutions are increasingly being asked not how much they earn, but how they earn it.

That’s where CienDos, a Glasgow-based fintech co-founded by Jules Salmond, comes in. The company helps banks and businesses understand the environmental impact of their financial decisions turning complex data relating to carbon emissions into clear, actionable insights.

When FRIL launched its ESG Innovation Call, CienDos saw a chance to accelerate its mission. Through the programme, the team developed its Financed Emissions Calculator™ and created a Sustainable Transition Plan, collaborating with major players like HSBC, Virgin Money, and Equifax.

The impact was immediate, FRIL gave CienDos early access to the market, boosted its credibility, and opened doors to new partnerships. The company retained talented interns, expanded into European markets, and strengthened its position as a leader in sustainable finance innovation.

But beyond business success, CienDos is a testament to how FRIL is helping to root fintech growth in Glasgow, showcasing the city as a rising global hub for sustainability innovation.

The Challenge: Making Carbon Data Simple

As the demand for environmental accountability grows, financial institutions face new expectations. They must measure and report their ESGperformance, not just profits.

But collecting and analysing ESG data isn’t easy. It often involves navigating fragmented data sources, inconsistent standards, and complex reporting frameworks. The process can be time-consuming, costly, and resource-heavy, leaving many organisations struggling to turn their good intentions into measurable impact.

CienDos set out to change that, to simplify the way financial institutions understand their carbon footprint and make it easier to act on sustainability goals with confidence.

Why getting it right matters:

| For Industry | For Consumers |

| Reliable ESG data helps financial institutions understand their environmental risks, improve transparency, and strengthen relationships with regulators, investors, and customers. | It offers the clarity and confidence to make more informed choices, and helps protect against “greenwashing”, where sustainability claims don’t match reality. |

FRIL’s approach: Collaboration in Action

FRIL’s Shaping the Future of ESG in Financial Services Innovation Call brought together fintech innovators, global banks, regulators, and academic experts to explore how technology and data could simplify sustainability reporting and drive meaningful change.

Rather than working in silos, participants collaborated in a shared space for experimentation, testing ideas, sharing expertise, and co-developing solutions with real world impact.

FRIL supported successful innovators like CienDos with early-stage funding and direct access to senior decision-makers in major financial institutions. This combination of support and exposure helped companies rapidly test, validate, and refine their ideas, moving from concept to implementation faster than ever.

The Case Study – CienDos

Glasgow-based environmental data and analytics company, CienDos helps financial services institutions understand the environmental impact of their investments.

The team were a winner of the Innovation Call in 2024. As a result of taking part, CienDos has expanded their Glasgow team, as well as accelerated the development of their Financed Emissions Calculator™, which has now been launched in market with Equifax.

“As a result of the products we created through FRIL, we’ve moved into a revenue generating stage of the business, and have customers across Europe”. — Julia Salmond, CEO and co-founder of The Company.

Working in partnership with FRIL and strategic collaborators, CienDos built confidence amongst buyers and partners that their product would address real industry needs.

The team at CienDos worked directly with HSBC, Virgin Money and Equifax in order to develop both their finance emissions calculator ™ and Sustainable Transition Plan, which allows institutions to benchmark and monitor progress on their actions on sustainability.

“We were drawn to FRIL by the combination of funding opportunity and direct access to the buying power of the banks. We had direct access to test new products with potential buyers, and alongside that – an injection of capital as well”. — says Jules.

CienDos stats

| Sector | Fintech |

| Employees | 9 |

| Location | Glasgow / London |

The Ambition: Growth and Vision

CienDos is led by serial entrepreneurs and has a track record of intentionally building businesses in Glasgow. This commitment remains central to the company’s ethos, and collaboration with FRIL has helped it create local jobs and internships while scaling globally.

“I’m a graduate of the University of Strathclyde, and I had to go elsewhere to gain opportunities. At my stage in my career, it’s important to come back and create those types of career opportunities here in Glasgow. That’s absolutely critical to what we do as a business”. — says Jules.

The partnership with FRIL has enabled CienDos to take on two new FTE posts. The team have also taken on two interns over the summer, which they wouldn’t have been able to do without the new posts and customers acquired through the collaboration with FRIL.

“Ultimately, we are an international business, but we are headquartered in Glasgow, and we will remain headquartered in Glasgow”. — adds Jules.

The Outcome: Turning Ambition Into Action

Through FRIL, CienDos didn’t just develop new tools, it built a stronger foundation for growth. The programme helped the company expand its reach, solidify its reputation, and prove that innovation and sustainability can thrive together.

For FRIL, it was another step in showing how collaboration can drive meaningful change, connecting bright ideas with the people and partners who can make them real. Because when technology meets purpose, finance becomes a force for good, and cities like Glasgow lead the way.

“I think what’s really key about FRIL is that it is backed by real money. It’s not just a talking shop. It’s backed by real professionals that understand that getting money from the public purse is challenging for a SME or start-up”. — says Jules.

Impact summary

- New commercial relationships and expanded global network achieved.

- Development of Financed Emissions Calculator ™ which has been launched into the

- market with Equifax.

- Development of Sustainable Transition Plan.

- Two full-time jobs and two internships.

- Strategic partnerships with global organisations including Equifax established.

- International market expansion in UK, Europe and Asia achieved.

“FRIL really builds an environment of trust, with so much professional support in the background that made it completely different from anything else we’ve done before”. — concludes Jules.

Download the CienDos case study.