Research & Innovation opportunity in Open Finance data

Article written by Julian Wells, Director at Whitecap Consulting

FinTech Scotland recently published its 10 year Research & Innovation Roadmap. Whitecap worked in partnership with the FinTech Scotland team to support the development of this roadmap, and is discussing the key outputs in a series of blogs. This blog focuses on Open Finance data, which is one of the four key strategic priority themes.

In the first blog in this series, we discussed the purpose, value and impact of a Research & Innovation Roadmap. In this blog, we discuss Open Finance data which is a strategic priority itself but also a facilitator of FinTech innovation in wider areas, and an enabler for the three other strategic priority themes in the Roadmap.

The other three themes are Climate Finance, Payments & Transactions, and Financial Regulation, each of which will be the subject of a subsequent blog in this series.

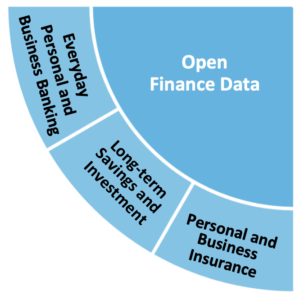

Open Finance data has the potential to significantly change consumers’ and businesses’ engagement with finance, and to deliver better outcomes. It spans the whole suite of financial products and services as we understand them today, including banking, savings, mortgages, pensions, investments, insurance, lending, and payments.

How can Research & Innovation support the development of Open Finance?

To help Open Finance achieve its potential, more leadership, actionable research, and innovation is required. FinTech Scotland’s Research & Innovation Roadmap sets out specific actions to help drive this opportunity ”“ through a collective approach that involves industry, innovators and researchers ”“ to create the future of finance.

Open Finance can create progressive change that will move the UK forward significantly, by moving beyond banking and asking other financial institutions (such as pension providers, asset managers and insurers) to enable customers to share their data with others.

This would open up a wider range of financial products and services to the transformative impact of third-party innovation through trusted data sharing. For consumers and businesses, it offers new ways to understand their finances, receive financial advice, and compare financial product features and prices.

Research and innovation are needed to facilitate the potential of Open Finance data, building economic growth and creating employment opportunities in high value sectors which in turn will make the UK an attractive destination for inward investment.

Furthermore, it will help us better understand, measure, and forecast the considerable impact that Open Finance could have on society and to shape future policy.

In the UK, one of the key enablers of research and innovation in Open Finance is the Smart Data Foundry (formerly The Global Open Finance Centre of Excellence), which has been established in Edinburgh to support the understanding and development of the capabilities of Open Finance. It has a leadership role in enabling the necessary research and innovation, and building confidence in Open Finance across the UK, and can encourage research and innovation by providing a highly secure environment that can host Open Finance data. The Open Finance data priority in FinTech Scotland’s Research & Innovation Roadmap supports and complements The Smart Data Foundry’s agenda.

Priority areas in Open Finance data

When developing the Roadmap, analysis highlighted three industry priorities that will benefit from more focused research and innovation on this topic. They involve shaping the future of:

Everyday personal banking and business banking

- Insights through Open Banking data

- Future banking business models

Long-term savings and investment

- Financial resilience and wellbeing

- Future living & the ageing population

Personal and business insurance

- New data and insights for insurance

- Data privacy

- Data ethics and governance

Roadmap next steps: Open Finance data

A range of proposed next steps are laid out in the published report, which specifically identifies 22 actions relating to Open Finance, and categorises each into one of three phases over the next 10 years. These actions are illustrated in the graphic below. the report also references 23 different stakeholders who can support the implementation of these actions, which are broken down into research projects and innovation calls.