Fortnightly FinTech Fuse ”“ Awesome FinTech Atmosphere!!

An awesome August atmosphere has been pervasive across Scotland and the fintech innovation activity, in its many guises, has contributed to this over recent weeks.

Since returning from a few days in the beautiful Mediterranean sun, there has been no respite in the breadth and depth of fintech initiatives which are creating this can do entrepreneurship.

The fintech community gathering at one of the new innovation hubs, The Green Room in Edinburgh, where a good number of us came together last Thursday is a great example.

Entrepreneur Atmosphere

The gathering was a mix of fintech entrepreneurs from across Scotland along with some seasoned investors, coming together to try a few glasses of summer wine.

Delighted that Alistair Forbes from Mercia and Ron Robson from Tavistock Group could join us and a huge thank you to Dag Lee and Sarah Ronald for being terrific hosts at one of Scotland’s newest fintech epicentres’.

We look forward to repeating the gathering during September’s fintech festival, watch this space.

The week before there was another wonderful atmosphere at the Virgin Start Up event in Glasgow which attracted entrepreneurs from far and wide across the country.

Terrific to share the platform with the inspiring Phil Grady of Castlight Financial and Loral Quinn of Sustainably, who brilliantly shared their experiences with entrepreneurs embarking on the innovation journey.

A massive thank you to Andy Fishburn, Alice Mulrooney and the Virgin Start Up team for their leadership as well as Stephen Pearson from Virgin Money for making all this happen.

We are looking to repeat a similar event with David Duffy, Stephen and the CYBG Virgin Money team on 12thSeptember in Edinburgh with the Scotland’s fintech community.

There are many other exciting activities being planned to build the entrepreneurial atmosphere, such as by James Varga, the awesome leader of The ID Co, in embracing the open banking opportunities.

Great to meet up with James a couple of weeks ago to discuss how we support the collaboration with fintech entrepreneurs across the ecosystem.

Similarly, terrific to meet up with Stuart Lunn and Darren Cairns from the market leading firm Lending Crowd and put the world to rights over a few glasses back in the Green Room in Edinburgh.

Thank you Stuart and Darren for your ongoing valuable insights and feedback, looking forward to building on this last eighteen months of Fintech Scotland into 2020 with you.

The awesome atmosphere is not confined to the evenings and it was great to meet up with long standing colleague and one of the very original fintech leaders (for over 30 year) Ian Mckenna for an early morning breakfast.

We were joined by new chief executive Billy Burnside of Criterion Tec, who we are delighted to welcome into the FinTech Scotland community as we lay down the tracks’ for a new data driven innovation future.

In between the Edinburgh fringe festival activity, it was terrific to meet up with Raymond O’Hare last week to share some of these developments and discuss collaboration opportunities.

Very excited about welcoming the Raymond and the Exception team to the FinTech Scotland community in the coming months.

The entrepreneurial atmosphere is also being fueled by a global energy and it is really exciting to meet with successful entrepreneurs bringing their firms to Scotland

Really enjoyed catching up with Gopal Hariharan of Black Arrow in Glasgow and very excited about this fintech enterprise being set up in Scotland

Then it was also fabulous to meet up with Paul Kiernan to hear about the fast developing plans for the innovative Decision Point enterprise in Scotland.

Looking forward to connecting Gopal and Paul into the community and ecosystem across Scotland and building the collaboration opportunities

Collaboration Atmosphere

This last few weeks I have been really enthused about the flourishing collaboration atmosphere and the opportunities to bring together the fintech community with innovative large enterprises.

For example, great to progress the development of opportunities with Sam Bedford, Gary McLellan and the CYBG Virgin Money team as they further extend their market leading innovation initiatives

Similarly, excited to be working with Ali Law, Julian Reichert, Ricky McKinney and the rest of the team at Royal London as they revolutionize long term savings sector.

Terrific also to engage with the Barclays team, Danielle Sheerin, Sonal Lakhani, Stuart Brown and Alex Ball to explore collaboration initiatives, including the Tech Stars programme during the FinTech Festival.

Delighted to be taking forward the collaboration with Aberdeen Standard Investments and working with Mario Cugini, David Scott, Geoff Aberdein and Ruari Grant to explore fintech collaboration in the asset management sector.

The retail banking sector has already demonstrated the value of closer fintech collaboration and my meetings with the inspiring Kristen Bennie of RBS highlight numerous good examples of this.

Sharing the examples of collaboration across the broader financial sector provides enormous opportunity to build the fintech innovation cluster in Scotland.

In this respect, the last few weeks has seen constructive conversation with Asif Abdullah, Cyndi Shettle and Martin Little of Franklin Templeton from the investment sector and David Skinn from the insurance sector.

It was also valuable to catch up with Tara Foley of Bank of Scotland to consider how we work more closely to progress specific initiatives on consumer engagement working with the fintech community.

On this note, thrilled to see the Chemistry’ Fintech Accelerator go live last week working with strategic partner Sopra Steria and the Edinburgh Innovations team of University of Edinburgh.

Terrific leadership by Kerry Nicolaides and Mingaile Vaisnoraite, exciting to be working with banks and fintech firms on this.

Brilliant to also talk through with Mags Moore of Sopra Steria on how we can develop the fintech collaboration across Government with similar initiatives to improve citizen and consumer outcomes

The engagement of consumers in fintech is a growing development and I was delighted to join Dave Shaw and the Tesco Bank team in sharing how they are taking a human design centred approach to customer engagement.

Fantastic to see the work with Chris Speed and team of University of Edinburgh come alive, all very much in line with the collaboration co-design atmosphere, and in a super festival setting at the University.

Another example of collaboration that serves social purpose is the great work lead by Nicola with the launch of the fintech customer panel announced today. This initiative will bring the innovation from the fintech firms together with consumer representative bodies to tackle societal and economical issues. You can read more about it here.

Festival Atmosphere

Talking of festivals, we have been overwhelmed with the support for the FinTech Festival in September, amazing engagement from so many people for the three weeks of activities.

Huge thanks to the wonderful Rory Archibald of Visit Scotland and Karen Craib of Scottish Enterprise who have worked tirelessly with Mickael to bring it all alive.

It was brilliant to meet up with Hazel Gibbens of Tech Nation recently to share plans for the Festival, I’m hoping Hazel will be joining me on the stage for a few events to highlight the support for innovative enterprises across Scotland.

It was super to talk about the growing festival atmosphere across the fintech community at my recent catch up with Huw Martin and Joseph Apted of Head Resourcing recently, very much appreciate their ongoing valuable support for fintech leaders.

Similarly, in meeting up with Graeme Jones of SFE to talk through the plans for the next cross industry and Government meeting, FiSAB, which will take place in the middle of the Festival programme.

It is very apt that the first festival showcase event will take place in Glasgow at the University of Strathclyde with the FinTech Future conference.

University of Strathclyde has led the way in both fintech knowledge and skills development on the global stage and I am hugely excited about the broader development of the fintech cluster as part of the Glasgow Innovation District

Fantastic to be working with Eleanor Shaw, Martin Hughes, Mick McHugh, Emma Stephen and the team at the University as we progress the strategic opportunities

Very much looking forward to taking forward the fintech engagement initiatives being led by Daniel Broby, Devraj Basu, George Wright and John Quigley amongst others.

Fintech and broader tech skills are crucial to the further success and progress of the cluster and economy, in this respect it has been a privilege to be working with the awesome teams at Skills Development Scotland and IBM.

A couple of weeks ago it was an excellent workshop session on developing the skills for young people across Scotland with the motivational Damien Yates, Neville Prentice and SDS team along with the inspiring Gary Kildare, Charlotte Lysohir, Nicky Cooper, Dominic Nolan, Mairi Cairney, Bill Hughes of IBM.

Many thanks to the magnificent Michael Young and Georgia Boyle and the MBN Solutions team for being wonderful hosts for the meet up with the senior IBM team from all sides of the Atlantic the day before.

Once again, the MBN Solutions team are hosting a range of terrific fintech meet ups as part of the festival and their valuable ongoing leadership makes such a positive difference across the community.

Running Atmosphere

The Kirkcaldy half marathon a couple of Sundays ago was probably the best running race atmosphere I’ve experienced from a local community ever, just amazing!

The Kingdom of Fife community turned out in huge numbers for a very special race and it was a privilege to savour the magnificent support throughout the 13.1 miles.

Thank you so much Kirkcaldy, I’m still buzzing from the race even now and I think the buzz will carry on to the Fife Fintech Festival event on 17thSeptember.

The half marathon was part of my training leading up to the Loch Ness Marathon in October and proceeded another half marathon the week before at Bathgate and a rural midweek eight mile race in the Fife countryside around Ceres.

Next up is the Kilmacolm half marathon as part of a 23 mile training run next Sunday followed by the Scottish Half marathon in east Lothian, all before the trip to Inverness for the marathon in early October.The next few weeks will be the real test on whether I can get back to my marathon racing best although the atmosphere from the forthcoming fintech festival in September should propel me one way or another!! Until next time!

Autorek and the Automation Revolution

AutoRek have just announced that they had partnered with Worldwide Business Research (WBR) to generate an industry report. The report will be focusing the state of automation and data management within the financial services sector.

The survey includes feedback from 100 individuals within the operations, IT, business change, finance and data management business functions. They were asked how automation will affect the financial services industry in the next 5-10 years.

Key findings include:

- The majority of those interviewed are implementing blockchain, semantic data management, machine learning and automation

- Respondents think that AI is likely to impact product development and innovation the most.

- 46% of respondents are looking for new technologies to assist data governance.

Investing in the Automation Revolution’ will launch at Sibos London between 23rd”“ 26thSeptember.

Scotland’s fintechs can unlock the power of open banking

There are over one hundred fintech companies thriving in Scotland’s fintech community with a range of new start-ups, existing firms developing their fintech offers and tech-driven firms re-locating north of the border. The launch of open banking last year has played a key role in fuelling the growth of this sector and the UK as a whole is now recognised as a world leader in open banking innovation.

So far, much progress in open banking has been made in the small business environment where innovative products and services are already in the marketplace such as tools for monitoring cash flow and accessing finance. An important contribution to this innovation was the first Open Up Challenge in 2017 and 2018 ”“ spearheaded by the Competition and Markets Authority (CMA) and run independently by Nesta Challenges. The Challenge was part of the CMA’s package of measures introduced to stimulate competition in the financial sector and help small businesses save time and money, find better services, reduce stress and discover the intelligence in their financial data. Winners included fast-growing fintech brands such as Swoop, Funding Options and Coconut whose products are frequently used by freelancers and small businesses across Scotland. However, as important as it is, the small business space is just the start of the open banking revolution.

When we consider the consumer market, while there are products that are already in use it’s fair to say that take-up has not yet been widespread – especially in light of research showing UK consumers stand to gain £12bn a year from open banking-enabled services[i]. Awareness of open banking is still low, with new research from Nesta Challenges showing that 55% of people in Scotland have not heard of it.

On the other hand, 46% of Scottish people say that they want to feel more in control of their finances and 33% want personalised information and guidance to help them manage their finances. For people in Scotland the two biggest benefits of using an open banking enabled product are seen to be: saving money and finding better deals. These findings present big opportunities for those fintech companies and start-ups in Scotland developing open banking-enabled innovations for consumers.

That’s why Nesta Challenges, in partnership with Open Banking Ltd, has launched the Open Up Challenge 2020 – a £1.5m prize fund to encourage fintech innovators to create solutions that will help people to make more of their money.

With Open Up 2020 we want to attract breakthrough innovations designed to support hundreds of thousands of people ”“ particularly the most vulnerable. We’re looking for fintech innovators that can unlock open banking’s potential to change the way that the UK manages its money ”“ especially for the 15.2 million who regularly run out of money each month.

Open banking represents a genuinely new way of empowering people with their data ”“ it is a key milestone on the journey to a digital economy, and the Open Up Challenge has an important part to play in encouraging people to make their data work for them. Open Up 2020 will not only help people better manage their money and take control of their data, but it will also support Scotland’s growing and thriving fintech sector by fast-tracking innovative new products and services. Applications for Open Up 2020 are open until October 2nd2019 and guidance on how to apply can be found at https://openup.challenges.org/apply/. In addition, the Open Up 2020 team will be holding office hours at Codebase, Edinburgh on Thursday 12thSeptember ”“ book your slot hereto benefit from tailored application support from the Open Up Entrepreneur-in-Residence Sarah Tierney.

[i]Consumer Priorities for Open Banking 2019

5 tips for transitioning from the finance sector to FinTech

Looking to move into the Fintech sector but not sure how relevant your background in finance is? Put simply, it is. Here, Chris Stappard, the Managing Director at Edward Reed Recruitmentshares his top tips for transitioning into this new industry.

FinTech is redefining the landscape, giving us all new innovative ways of managing our money. But, it’s not just the customers of these companies that are benefitting, but also the job market. While traditional financial institutions are automating their processes and using artificial intelligence to become more efficient, the FinTech sector is thriving and creating more job opportunities.

For many people, this means that they’re unsure of their future within traditional finance companies and instead are considering making the switch to FinTech. But, with this sector focussing on technology, how do you know if you’re a suitable candidate for roles in FinTech? Here, I will be sharing some of my top tips to help you seamlessly transition between finance and FinTech.

Identify your transferable skills

Though it may seem like new technology is changing the way we approach finance, don’t let this put you off from applying for FinTech jobs. There are plenty of useful skills you’ll already have picked up from your current job that will be key for success in this new field. For example, being able to efficiently crunch numbers and get your head around complex data to make a business decision is particularly valuable in FinTech.

Similarly, being equipped with regulatory knowledge about the financial industry, and more importantly what GDPR is and why it’s important, will also be expected by any FinTech company you apply to. Not only does this ensure you’re protecting their customer base, but also the company’s reputation.

Decide which roles are most suitable for you

While you’ll already have taken the time to note down your transferable skills, you’ll also need to think about your strengths and weaknesses. This can include looking at your hard skills, like language, numeracy and your ability to communicate, which are key to any job, as well as more finance-based skills. FinTech roles are very varied and can specialise in anything from financial analysis to accounting and risk management, so knowing which sub-sector your skillset corresponds with best will be crucial.

You’ll also need to think about where you should apply. The speed at which the sector is expanding means that there are plenty of companies you could get involved with, however, be aware that not all of them are likely to last. A start-up FinTech firm can present plenty of opportunities for you but are more likely to fail than established companies.

If you’re looking for more job security, it’s worth knowing that plenty of traditional financial institutions are also looking to remain competitive by improving their FinTech focus. Just remember that there is never guaranteed success, even for the biggest of financial firms.

Go the extra mile with technology training

While some skills from a financial background will be enough to help you get your foot in the door, it’s always worth knowing as much as you can about the sector you’re moving into. You don’t necessarily need expert-level knowledge, but, having a simple understanding of core aspects will pay off.

There are plenty of training providers that offer courses in data and business analytics, so, if you’ve identified these as your weaker points, you can work on them. Not only will it impress future employers in interviews, but it’ll also show your willingness to learn about the industry and make it easier to adapt to any new role.

Network with like-minded people

Networking is one of the most powerful tools for boosting your career, so it’ll pay to look up interesting FinTech-related events that you can attend. At these, you can make inroads with new connections, who may be able to help you now or in the future. You might even be able to use these events to find somebody to mentor you through the job search and application process. If you get too carried away chatting to get essential contact details, don’t be afraid to reach out through LinkedIn.

It’ll also be worth reaching out to old finance friends and colleagues to catch up with where they’re at. Who knows, maybe they’ll own their own FinTech start-up now or know a company with a vacancy that sounds perfect for you!

Perfect your personal sales pitch

It’s not always a given that the person interviewing you for your potential FinTech role will have as much experience or knowledge as you do about finance. And, while it’s a must to be able to talk about these things with confidence, interviewers will also be looking for someone who has shown initiative and enthusiasm about joining the business.

Taking a look at the job description and thinking of an example for each of the necessary skills can ensure you tick all of the boxes in the interview. Plus, suggesting any ideas you think they could incorporate into their business model or services could make you stand out ”” just don’t give away all of your great ideas at once!

Your background in finance can put you in good stead for a career in FinTech. Follow my top five tips to set yourself apart from other candidates and use your existing skills to impress the interviewer for future roles.

Interview with Revolut – Challenger bank set to disrupt business banking

We spoke with James Gibson, Senior Product Owner at Revolut to speak about how the company is looking at disrupting the business banking sector.

We hear a lot about disruption in banking but that’s very often for consumers, do you expect the same happening to Business Banking?

Consumer experience has always been at the centre of disruption and as long as there are innovations or improvements that can be made to that in any industry – they will continue to be disrupted. Business banking is no different. Rubbish exchange rates, hidden fees and lengthy on-boarding times are issues we’ve already been able to solve and now we’re working on delivering innovative solutions to our business customers.

How would you rate the state of business banking at the moment in terms of experience and offering?

Products and services can always be better. What we can comment on is the surge of start-ups in the space – that just means there’s so much work to be done. Everyone is working to solve fundamental problems and deliver the basic solutions but soon we’ll see start-ups experiment with niche features and thats what will be exciting to watch.

How do you hope to change this at Revolut?

We’ve already impacted thousands of businesses across Europe by helping them with massive savings on exchange rates and avoiding any hidden or confusing fees. We’re now looking at building a one stop shop so that businesses can do almost everything in one place. For example, expense management with even more accounting tools to add to Xero and FreeAgent and even looking into launching acquiring in the near future.

Are there other examples around the world of companies who got it right according to you?

There are a lot of start-ups around the world disrupting industries and changing the way businesses and consumers think about product experiences. Companies like Uber, AirBnB, Apple have customer experience at the core of what they do and that’s a philosophy that we share as well. Of course, it is difficult to pin-point any companies that are doing everything perfectly which is great because it shows that even these established companies recognise the importance of continued progression and disrupting their own processes.

What does the future look like for business banking?

Bright and with lots of Revolut cards! Our vision remains similar to the quest we embarked on 4 years ago: ease of use for clients, automated processes where possible, fair and transparent pricing and technological developments that directly impact the finances of any business in any industry. We’ve done well on all of these points so far but we have much more to do!

What’s the next functionality you’re exciting about pushing to the market?

We’re super excited about the work that we’re doing around acquiring and we’re hopefully going to make some major announcements in the next year. We also listen closely to the feedback of our existing 100k+ businesses clients and it’s clear that UI and even more control over company spending are key topics so we will have some exciting updates on this area soon!

Fortnightly FinTech Fuse ”“ Here Comes the FinTech Summer!!

Yes, the FinTech Summer’ has certainly arrived but there has been no letup in the continuing momentum across the country when it comes to a plethora of innovation and collaboration initiatives.

Whilst each of the Fintech Scotland team has managed to grab a few days from the heat of fintech activity for a bit of summer sunshine to recharge batteries, the pace of activities has not waned

Summer of Innovation

Just before my summer vacation it was brilliant to catch up with Andy Smith and Jason Forsyth of Iceflo, the terrific fintech enterprise from Melrose.

The Iceflo team are now embarking on the next stage of their innovation journey and I’m looking forward to our trip soon down to the Scottish Borders to see the rest of the team.

Another wonderful fintech firm to reach a major milestone is the Sustainably and it was fantastic to see the inspiring Loral and Eishel Quinn announce their official launch at the start of July.

We used part of the Fintech Scotland board meeting to hear valuable insights from three awesome and market leading innovative firms from the community who are moving with amazing momentum.

Jude Cook and Andrew Pickett from Sharein, Callum Murray and Laura Bosworth from Amiqus and Colin Hewitt from Float all gave very engaging presentations, highlighting how Fintech Scotland can help firms who are scaling up.

This week it was great to meet up with entrepreneurs Ed Broussard and Craig Mackay of Mudano, a very exciting fintech data innovation enterprise which is growing at pace from its home in Edinburgh.

It’s fabulous to have the magnificent Mudano team part of the fintech community and looking forward to working with them on a number of collaboration initiatives

Similarly, excited to meet up with Eddie Curran and David of the very new fintech firm Open Banking Reporting (OBR) and hear about their exciting innovative proposition.

Also, great to see how OBR are part of the Addleshaw Goddard Elevate cohort, the prestigious growth programme along with the Amiqus team.

On Tuesday, I had the opportunity to meet up with Paul Coffey to hear about the innovative Birnham Wood and the plans Colin Green and Paul have to set up the exciting proposition from Australia in Glasgow

Great also to hear about how they are developing the enterprise in collaboration with the innovative David Lanc and Cyborn to develop the opportunity from Scotland.

Fantastic to have the innovative Andrew Duncan of Soar and John McHugh from Gigly from the fintech community at the Glasgow Economic Leadership meeting at the end of June.

This was a brilliant example of the power of collaboration across the range of financial services participants in ensuring that Glasgow is rightly recognized as a fast growing fintech hub.

Super leadership of the evening by Mark Napier of JP Morgan and looking forward to progressing the various collaboration initiatives.

Summer of Collaboration

Collaboration with the fintech community continues to be a hot subject in these summer months and one example of this is the new fintech accelerator programme we are working with University of Edinburgh and Sopra Steria on.

Great to meet up with Kerry Nicolaides from Sopra who is leading on this as they make terrific progress in moving to the initial launch with some valuable customer focused themes.

Mingaile Vaisnoraite from Sopra and I had the opportunity to share some of the details with Stephen Pearson and Scott Brunton from CYBG plc recently and how this collaborative fintech development could focus on the vulnerable customer considerations.

Thank you Stephen, for connecting me with Andy Fishburn and Alice Mulrooney of the Virgin Start Up team, we are very much looking forward to participating in the Glasgow fintech start up event in August along with the fabulous team from Castlight Financial

Over the summer weeks it has also been great to develop the collaboration with the inspiring Sam Bedford who leads the brilliant innovation team at CYBG. We very much looking forward to progressing our partnership with CYBG in engaging with the fintech community.

I’ve really enjoyed meeting up with the engaging Kristen Bennie of RBS over the summer weeks to explore how we further develop the collaboration with RBS in the months ahead. Also thank you Malcom Buchanan for RBS support of FinTech Scotland.

Many thanks also to Andrew Whyte and Maggie Craig of the FCA for the recent terrific catch up on FinTech Scotland’s ongoing collaboration with the regulator in supporting fintech developments.

As a forward thinking regulator, the FCA is a hugely important stakeholder as reflected by their valuable secondment of the brilliant Nicola Anderson to Fintech Scotland.

The early part of the summer has also seen meetings with a range of financial institutions to explore the further collaboration with the fintech community.

For example, great to catch up with Geoff Aberdein of Aberdeen Standard and Julian Ide of Martin Currie in Edinburgh then in Glasgow, Robert Keenan of Morgan Stanley to talk through connecting into the fintech developments.

Last week, Nicola and I very much enjoyed meeting David Durlacher, Duncan Jamieson, Ella Riesco and Calum Brewster of Julius Baer to consider mutual opportunities to work more closely in developing strategic fintech collaboration in wealth management.

Whilst we were in London, we had the chance to meet up with the inspiring Liz Brandt to hear about the fantastic strategic data innovation and collaboration work at Ctrl-Shift Ltd.

This was hugely exciting, and we are looking forward to seeing Liz in Scotland and taking this forward in the near future as it will be enormous value with fintech innovation and new enterprise.

Summer of Strategy

The strategic conversations have been very prominent over the Summer and I am very excited about the developing relationships which will support the fintech community growth

For example, valuable meetings with the team at BT, Michael Woodman, Dan Thomas, Craig Muirhead and Emma Cadzow.

Very much looking forward to the mutual strategic opportunities of working with the BT team in Scotland and globally across financial services to progress fintech opportunities.

Super strategic discussions also with John Innes of Leonardo as well as John Fraser and Madhan Murugesan of Cognizant, we very much valued their engagement and interest in working with FinTech Scotland.

Then I was more than happy to interrupt my summer holiday road trip south to catch up with Gary Kildare of IBM to talk through a very exciting strategic people skills initiative which it would be great to bring to Scotland. More to come on this soon, I hope.

On fintech skills and wider people opportunities, I am also hugely excited by the work with Eleanor Shaw, Martin Hughes and team at the University of Strathclyde as we develop the strategic fintech cluster in Glasgow.

This will certainly reinforce Scotland position on the global fintech map, watch this space!

Summer of Global Opportunities

The progress of the fintech community across Scotland is certainly getting global recognition and numerous international opportunities have emerged over the summer weeks

It was great to see leading European fintech commentator Martin Best give an overview recently on how Scottish fintech is thriving and brilliant examples of LendingCrowd, Money Dashboard and Modulr.

I was able to share these developments with Andrew Davis and colleague Stephanie Poon of Hong Kong Invest to develop the mutual opportunities. Thanks Andrew for a lovely catch up mixing fintech talk with all things running and music!

Great to be working with Gillian Docherty, Steph Wright and the DataLab team on the opportunities for fintech firms in a visit to Singapore and with Lorraine Mallon of SDI on the trade mission to USA in the Autumn

This alongside the fintech trade opportunities coming up with Ireland, France, India amongst others further demonstrates the growing interest in Scotland’s fintech developments.

Brilliant leadership by Graham Hatton a number of the inward opportunities, for example, the meeting with the team from Samsung Life a few weeks ago.

Closer to home it was great to have the inaugural meeting of the FinTech National Network in Manchester a few weeks ago with the teams from Fintech North and Innovate Finance as well as Tom Helm from the DIT.

It was brilliant to welcome Philip Creed for Fintech Northern Ireland as well as Gavin Powell from FinTech Wales who I’d meet up with a few weeks previously on a visit to Edinburgh.

Very much looking forward to building on a productive session and developing the collaboration across the fintech hubs further.

Many thanks to Julian Wells and the CYBG team for excellent hosting of the meeting and Peter Cunane and for arranging everything behind the scenes and Ali Griffths for the follow up..

Very much looking forward to hosting the next Network meeting in Glasgow in October as part of the fintech conference being organized with the fabulous Whitecap Consulting team.

Before then we hope to see many of our friends from the UK and the rest of the world come along to the Fintech Festival in Scotland over three weeks in September.

There will be many meet ups and events taking place including the two day showcase FinTech Summit organized by the super team at DIGIT led by the super Ray Bugg, Duncan Macrae and Pete Swift who we met up with recently.

More to come on the exciting range of activities taking place during the festival, including a fintech running race’ and a fintech wine tasting’ event, thanks to Sara Ronald of Nile on this who I caught up with recently!

Of course, events are happening all the time across Scotland. For example, I was delighted to present at the recent Faculty and Institute of Actuaries knowledge event, thanks Barry Shannon and team for making me so welcome.

Then delighted to get along the Tech Nation meet up Bayes Centre last week and listen to the engaging Hazel Gibbons as well as inspiring Leah Hutcheon of Appointed, all perfectly chaired by the awesome Steve Ewing.

Great to see so many of the movers and shakers of the Scottish innovation world at this event and very much looking forward to working with Hazel in the new Tech Nation role in Scotland.

Summer of Running

I just love running during the summer, even with the sweltering heat although my performances have been a bit up and down!

The Kirkintilloch10km and Edinburgh Parkrun both gave me my best times at these distances for two years but then the Cumbria marathon last Sunday was six minutes slower than planned!

I put this down to the strong coastal breeze and getting carried away in the sunshine early on!

Anyway, training quickly resumed for the next marathon which is Loch Ness in October and early preparation will be races in Livingston, Ceres, Irvine and Kirkaldy during August!

Then not forgetting the fintech 2 mile race as part of the Festival in September in Edinburgh, combining my two joys, running and fintech. I hope to see lots of you join in for it!! Until next time

7 Key trends in the P2P lending industry to prepare for

Photo by Maciej Pienczewski on Unsplash

Author: Vit Arnautov, Chief Product Officer, TurnKey Lender

According to Statista, by 2025 the P2P lending market is going to be worth 1 trillion dollars while just in 2015 it stood shy at 64 billion. The industry develops astonishingly fast and it’s not just hype (unlike Bitcoin in 2017). I believe the reasons for lenders and borrowers to switch to P2P are logical and pragmatic, which is exactly why the market will keep growing. As a Chief Product Officer at TurnKey Lender, a company that creates intelligent lending automation solutions, I have to stay alert to any new trends and developments and I’ll be happy to share what I foresee for the P2P lending industry in the near future.

1. More small to midsize lenders will enter the game

For many, the rise of the P2P model opened the doors into the world of financial services. Nowadays, it costs less than ever to get into the lending niche. No need for enormous investments and staff. Even the regulations aren’t as complex as the ones conventional banks go through.

This means that the old-school financial institutions now have a swarm of smaller and hungrier online competitors. But despite being small, the new P2P lenders often provide better service due to recent advances in lending technology and fully automated lending processes.

2. Banks don’t intend to give up

Large institutions have a harder time adjusting to the realities of the digital world and it takes them a ton of time to change their gears. But the boards of directors do see market trends and understand the need to go P2P. Slowly but surely banks worldwide start to introduce P2P functionality.

One of the pioneers in this regard was the N26 direct bank which struck a partnership with auxmoney, a German marketplace lender. Another example would be Monzo with their new peer-to-peer functionality. As of now, it’s mostly digital banks who are willing to start offering peer-to-peer lending. But the old-school banks also have to adjust as they go through their own digitalization. And it’s not just a theory. A prime example would be the Royal Bank of Scotland. All the way back in 2015 the company started to formally refer clients to Funding Circle and Assetz Capital for p2p loans. We can also look at two community banks, Titan Bank and Congressional Bank, who are buying loans through the Lending Club platform.

Traditional institutions often choose to develop their own solutions instead of using and customizing the existing and tested products that are already on the market. This route takes more time, the systems often turn out slow, clumsy, and not user-friendly. This means that only the banks with a more agile approach will adapt to the market to compete against the light-on-their-feet competitors.

Keep in mind, that for many people big banks still bring a sense of security and reliability. So in the nearest future small and midsize lenders will need to work a little harder and to market a little more aggressively to prove to the customers that they are every bit as good or even better. But P2P lenders are already doing really well and the big players in the field show that the success if very real to attain. Here are some growth stats of some of the leaders in the field:

- Lending Club – In Q4 of 2017 the company had issued $33.6bn in loans, while in Q4 of 2018 they were already at $44.5bn.

- RateSetter – The company announced that their 2017 to 2018 revenue growth reached 47%.

- Funding Circle – As of September 2018, Funding Circle has issued £6.3bn in loans. To reflect upon its growth the company has gone through an IPO.

3. Financial inclusion for underbanked areas

Take the two previous points into consideration and you’ll see that the market wins when a ton of smaller lenders compete with big banks. The loan prices go down and the businesses do their best to reach the previously underbanked areas and demographics. Global financial inclusion is the overarching goal of all the responsible members of the lending community and this competition serves this purpose perfectly.

The lending software providers create better solutions to process more of the right loans safer and faster and the lenders try to tap into new markets and demographics. For example, the AI-powered models used by Upstart (a p2p lending startup by ex-Googlers) result in 75% fewer defaults and 175% more approvals than those of traditional banks. The smart approval processes allow serving the people who were previously underserved in addition to providing a more flexible and fast online experience.

4. More markets and jurisdictions

The more governments see that P2P lending works, the more of them make it legal and start to work with it as they work with other financial instruments. Just last April the Central Bank of Brazil authorized P2P lending across the whole country and new governments join in all the time. For example, in Malaysia authorities introduced a P2P scheme for first time home buyers and in the US peer-to-peer lending is recognized and regulated by the SEC just as well as other financial instruments.

Some countries even go the route of Australia where financial startups can work without a license for a year which is called creating a FinTech sandbox. Jurisdictions that used similar mechanisms to stimulate the growth of the FinTech sector include UK, Switzerland, and Singapore.

5. Regulations

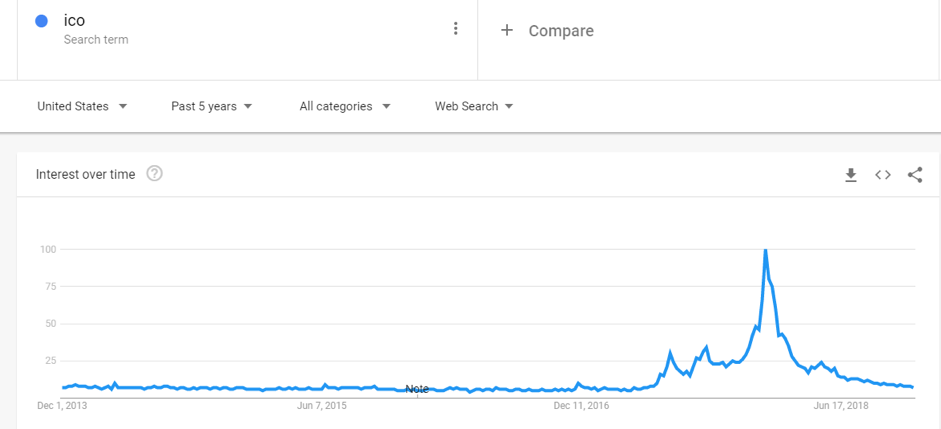

Don’t expect P2P lending to be the new “Wild West” where lenders can do whatever they want without any consequences. Governments have learned the lessons uncontrolled ICOs taught them.

In addition, authorities have seen China’s bitter experience of letting P2P function without sufficient control. There it led both to drastic growth and to dramatic fall of the industry. So in 2019 more governments won’t only allow and encourage P2P lending, but will also come up with specific ways to control the niche.

FinTech is still very young and governments often have troubles figuring out how to work with it and regulate it. But it’s safe to say that in 2019 the authorities will be far more focused on P2P lending. No one is really arguing that P2P lending is a good thing which should be allowed and encouraged. But at the same time, there are many influential voices who call for proper regulation, which is not necessarily a bad thing. As long as the rules are written to realistically reflect the state of the market and technology, any regulation should only do good in protecting both lenders and borrowers. Some examples that already apply come from the UK, with the ongoing updates from the Financial Conduct Authority to regulatory framework related to the P2P lending market. Also, in Canada, peer-to-peer lending is regulated under the same laws as securities. And in China, the government’s reaction to the meltdown of the industry was to tightly regulate the niche and weed out any wrongdoers before letting it grow any further.

6. The go-to choice for younger audiences

In Europe, over half of the P2P market is comprised of people aged 22-37. That’s no news that young people don’t want to deal with stuffy corporate organizations and choose the more user-friendly and up-to-date options when they can.

In addition to that young people often simply can’t get a loan on decent conditions from conventional lenders. Mostly since they simply don’t have the financial background baby boomers have. So the trend of young borrowers preferring the P2P lenders will continue.

7. Fiat currencies prevail in 2019

For a while there it looked like every FinTech project needed to hold an ICO. P2P lending was no exception. But the trend is down for the best.

Either the public wasn’t ready for such a drastic shift of the paradigm or the technology and concept weren’t solid enough. Anyhow, it looks like we’re over ICOs for the time being. Even though projects may still effectively use blockchain as data storing and operating technology, there will be fewer crypto coins and more dollars and cents.

Final thoughts

It’s a great time to be in the P2P lending business. Not only are there still 3 billion unbanked people around the globe with no credit bureau score, but the technology we have makes it possible to get in the game without the huge investments. Now more than ever, all it takes is an entrepreneurial spirit and an idea.

A Meeting of Coins!

Blog by (Prof) Christine Bamford Founder Women’s Coin

For readers who didn’t know ”¦

Scotland is the first country in the UK (possibly Europe) to be home to 2 global digital currenciesWomen’s Coin and Scotcoin! How cool is that!

It can’t be a consequence that 2 digital currencies have emerged from Scotland. It’s the foresight of the Scottish Government, Scottish Enterprise and Fintech Scotland as a hub for innovation in financial technology. Not to mention active support for emergent technologies by Kate Forbes, Minister for Digital Technologies. Who I think is just fab!

Left: Kate Forbes, Minister for Public Finance & Digital Technology, (Prof) Christine Bamford and Dr Jane Lewis, Women’s Coin

Fintech Scotland, Napier University and other key stakeholders such as Virgin Money, Zortrex, Money MatiX, CU Apps and Payment Centric were so welcoming that we decided to establish Women’s Coin here in Edinburgh. There is no doubt that Scotland makes stuff happen and has a real entrepreneurial spirit.

So how did we connect with Scotcoin? Well it’s all down to Fintech brokering service. It took a couple of meetings to establish a trusted relationship but now we feel that there is power in a collective approach

Temple Melville, Director. Scotcoin commented “There was synergy between our coin offerings and a mutual desire to move towards a ICO (initial coin offering) through a legal regulated framework” Dr Jane Lewis, Strategic Director, Women’s Coin added “We have a track record in successful partnership working – So it made sense for us to explore how we might jointly raise our profile and collaborate on trading”

What is Women’s Coin? It is a digital currency for women (& men) with a humanitarian arm using blockchain to deliver charitable giving to the point in need without third party intervention. Every time you use women’s coin payment you support another woman to survive in the most hostile environments on earth. Supporting United Nations SDF 5 (Women’s Empowerment) A coin with a heart

See website http//womenscoin.com

Scotcoin does what is says on the tin. A digital currency for everyone ”“ anywhere!

To celebrate “Coin Collaboration”Fintech supporters will be invited to learn more about our “Coins” blockchain and crypto currencies during September Fintech Festival 9th-27thSeptember

Fortnightly FinTech Fuse ”“ Action Packed Fintech Community!

This has certainly been another action packed few weeks with the fintech community as the financial innovation continues at pace across Scotland.

What makes meeting with the amazing fintech community of firms so exciting is the diversity of action orientated entrepreneurs across the country.

This was very much the case on Wednesday evening with our community FinTech Scotland Fusion evening in Edinburgh.

Action Packed Entrepreneurs

Awesome spotlight sessions from fintech entrepreneurs Daniel of Listing Ledger, Tynah from Money Matix, Adam from Sage City, Dave from The ID Co and Bhairav from Avrium to a very engaged audience.

Once again it was a wonderful buzzing atmosphere of fintech talk, all magnificently overseen by our very good friend and seasoned entrepreneur Aleks Tomczyk.

Big thank you to Kirsty Irvine and Ewan Fleming of Johnston Carmichael for their great hosting of the evening and being such fabulous supporters of the fintech community.

It was a more formal format but just as action packed for the two Fintech Practitioners meetings we held in Glasgow and Edinburgh in the last fortnight.

A great range of conversations on key topics from funding to commercialisation to people development with a spectrum firms from across the fintech community.

Some really key actions from these meetings for FinTech Scotland which we will follow through with the FinTech Network Integrator team at Vivolution and Scottish Enterprise.

Thank you to our strategic partners Anneli at Dentsu Aegis and Yvonne at Pinsent Mason for hosting these valuable meetings with the fintech community.

Prior to this, we had the opportunity to share some of the fintech developments with Government Minister Kate Forbes at Scottish Parliament, who takes a keen interest in the fintech innovation.

The meeting gave us the opportunity to mark the fact that the Scottish fintech community is now over one hundred innovative firms in Scotland.

Fantastic to have some of the newer fintech firms Xpand Access, CU Apps, Womens Coin, Money Matix, Zortrex join us for fabulous session at Parliament along with the fast growing team from Amiqus.

Later that week I really enjoyed catching up with James Gumble to hear about the terrific innovation development by the Xpand Access team, playing a huge role in demonstrating the value of innovation and collaboration.

Another wonderful example of this is from the team at Soar who have recently won the Scottish Edge award, big congratulations to entrepreneurial Andrew Duncan and colleagues.

Similarly, with my catch up on Tuesday with the terrific Rab Campbell of Wallet Services as we plotted how to extend the entrepreneurial action across a range of collaboration initiatives. Thanks for the much need almond biscuit Rab!!

Action Packed Collaboration

The action packed collaboration was very much alive with the fintech community and a diverse range of participants at the European Innovation and Technology event at University of Edinburgh this week.

Brilliant action sessions as always from exciting entrepreneurs Loral from Sustainably and Phil Gillespie.

This was alongside hearing from the engaging Kate of Sainsbury Bank, David from Lloyds Bank and Anurag of Baillie Gifford on their approach to fintech collaboration.

Also joined by Damien from University of Edinburgh to share insights on the crucial role of academia as part of team Scotland in developing fintech.

Great to work with our European colleagues Fergie Miller in delivering the event to a full house and super enthusiastic audience.

This European collaboration also came alive when we hosted a fintech day with fifty executives from the large French bank, Banque Populaire a week or so ago expertly organised by Mickael.

Terrific sessions in sharing their innovations from James of The ID Co, Chris from Nexves, Jim of Renovite and Laura from Amiqus.

Many thanks also to Mark Curran of CYBG for joining us as well to share the fast moving open banking developments with our French friends.

Earlier this week, we were delighted to work with Kevin and the SDI team and Erin Ellis and the World Congress Team in hosting a trade mission of seven fintech firms from Toronto.

Wonderful to hear from the exciting Canadian entrepreneurs and their interest in working in Scotland and becoming part of our vibrant community

It was great to bring them together with some of the Scottish community such as entrepreneurs Bryan Eldridge of Qwallets and Nick Jones of Blockstar at an engaging session with Simon and the IBM team.

This was followed by a super reception at Bute House, home of the First Minister, hosted by Minister Jamie Hepburn.

Global collaboration opportunities are stretching far and wide. It was brilliant to meet up with the inspiring Radoslaw Szmit and Kamil Kwecka of CShark Ventures to discuss the mutual opportunities in Scotland building on their great expertise from Europe.

Thank you also to Kent Mackenzie for inviting me to share the fintech collaboration opportunities with the Deloitte Global Digital Council members recently, great to have the engagement and support.

The global interest in Scotland is certainly growing and it was great to meet with Martin Rueda from fast expanding London fintech firm Iwoca recently and share how the Scottish community is developing.

This was also the discussion with Avere Hill of Singapore fintech firm Cynopsis as well as Andrus Alber, the founder of Bankish from Estonia, both of whom we look forward to seeing in Scotland very soon

Similarly, when meeting up with Consul General Andrew Jackson from the UAE Embassy this week to discuss the potential international trade opportunities for Scottish firms building on the success of firms such as Qpal and IceFlo in this region

Thank you to Hamira Khan and Grace Glass for setting up.

The global opportunity was one of the key themes for the event at Scottish Parliament earlier this week on the plans for the exciting new Scottish Stock Exchange

Always inspiring to hear from Tomas Carruthers who is leading the initiative and also meet up with team making Project Heather come alive such as Edwin Hamilton, Michelle Thomson and Martha Walsh.

The event was also valuable in catching up with some key friends from across the broader ecosystem in Scotland including David Clarke of SIFI and Frazer Lang of SABE as well as media guru Terry Murden of Daily Business

Action Packed People Events

Events with action packed people has certainly been a major theme this last fortnight.

For example, thank you to Nicola Anderson who expertly took the platform recently for FinTech Scotland at the recent SFE event on cyber security

Another example was the impressive Digital Scotland conference in Glasgow a few weeks ago and it was a privilege to be invited to participate on the stage with so many brilliant speakers.

I really enjoyed our afternoon session with the awesome Cat Leaver of Brand Scotland and fabulous Melinda Matthews of CodeClan along with the wise heads of Gerry McCusker and Donald McLaughlin.

Thank you to expert leadership chairing by Alisdair Gunn and super engagement by Hamish Miller, Will Peakin and the super Future Scot team

This carried on to the weekend when I was asked to contribute to the Executive Women Leadership Programme at University of Edinburgh with the fabulous Maeve Gillies and Jacqui Gale on Saturday.

Thank you to the wonderful Judy Wagner and Susan Murphy for the opportunity to join many great leaders such as Sam Bedford, Clare Carswell and Ailsa Sutherland amongst many others.

On the subject of people inspiration, it was terrific to meet up with the brilliant Dr Susie Mitchel and Laura Bell who are leading on the CanDo Innovation Summit plans for Glasgow later this year.

We are delighted to be involved with the Future of FinTech session which will showcase a number of people from across Scotland leading on financial innovation.

This is something I shared with the brilliant chair of FinTech Scotland, David Fergusson this week as we talked about the plans for the coming months and longer. I always value the insight feedback from these sessions with David.

Last week I had the pleasure of sharing the progress of the fintech innovation being driven by a diversity of people in Scotland with Executive Chair Ian Campbell and Bob Martin of Innovate UK.

The engagement with senior figures from across financial services is so important to FinTech Scotland taking forward its plans and it was excellent as always to have a catch up with Philip Grant and of Lloyds and Colin Halpin of HSBC this week.

Action Packed Innovation

On Wednesday I very much enjoyed meeting up with the brilliant Kristen Bennie to hear about the action pack innovation with fintech community across RBS.

We are delighted we will be working more closely with Kristen and the team on this in connecting with the innovative activity across Scotland and wider.

Another example of driving this action packed innovation is the plans with Sopra Steria and University of Edinburgh to develop a new fintech accelerator programme.

Very much value the great ongoing strategic support of Craig Wilson and Rob McElry from Sopra Steria on this

This last couple of weeks has seen a number of strategic meetings with organisations looking to support and engage with the breadth of fintech innovation across Scotland.

For example, we very much enjoyed the conversation with Alex Foster, Michael Woodman, Daniel Thomas at BT on the mutual innovation opportunities.

Thank you, Craig Muirhead, for arranging and we are looking forward to progressing your relationship with the fintech community

Similarly, great to catch up this week with Kevin Spence and Gary Fegan to consider potential strategic innovation actions we can work on together with Fujitsu.

Action Packed Running

Action packed running has also been a theme over this last couple of weeks after the Edinburgh marathon.

This has included a challenging trail race in Denny near Falkirk on a Thursday evening as well as a fabulous 10km race at Kirkintilloch on a perfect summer evening this week.

Both of which have helped me up my pace along with my fastest Parkrun race of the year last Saturday!!

All of which I am hoping will produce a faster marathon time in July when this race comes along in a few weeks time.

In the meantime, it is the Glasgow 10km race on Sunday through the glorious city which is always so special and a father’s days treat for me! People certainly do make Glasgow. Until Next time!

Keeping up with digital lending in 2019-2020

Photo by Philip Veater on Unsplash

Blog written by Vit Arnautov – Chief Product Officer at TurnKey Lender

Customers become more and more demanding. Especially as millennials become a bigger fraction of the financial products’ users, businesses should be prepared to work for their loyalty. The onboarding process for getting a new vendor of anything gets so easy that lenders can’t stay still. There are market trends no one can ignore and here are the ones lenders worldwide should take into account.

AI and machine learning

For lending niche, artificial intelligence and machine learning aren’t just hype words anymore. Neural networks are the real deal and lending businesses globally already use them to make credit decisions faster and more accurately. Adobe has carried out a research in which makes it clear that over 20% of financial services companies are already using artificial intelligence to streamline their business processes with 41% planning to use it in the nearest future.

One might think that both AI and machine learning sound like the most expensive technological solutions you can get for your lending business because of their complexity. But software vendors are often the first to adjust to the trends and there already are ready-made LAAS (lending as a service) platforms that utilize custom-tailored algorithms and AI for decision automation and almost instant credit scoring.

Blockchain

It’s a real pity, that this tech got so deeply connected just with cryptocurrencies in many people’s heads. But FinTech industries never perceived blockchain so one-sidedly. For them, it really does grant a more secure way to store and operate data. So businesses will keep on developing new ways to use this tech. The truth is that the vast majority of digital lending is still reliant on old-school relational databases. Putting that same data on distributed ledgers of blockchain will often mean much stronger security. At the same time, this can increase operational costs for bigger businesses.

There’s no doubt that in 2019 blockchain will be implemented in many more financial services and products. But it doesn’t mean that everyone should use it because this really isn’t always the right choice. So before you choose blockchain for your company, consult with experts on whether it’s the right way for you. Overall, now that the crazy bitcoin hype is gone, I think we’ll be seeing a lot more seasoned and rational use of blockchain. Which will, in turn, bring way better results.

Alternative lending to keep growing

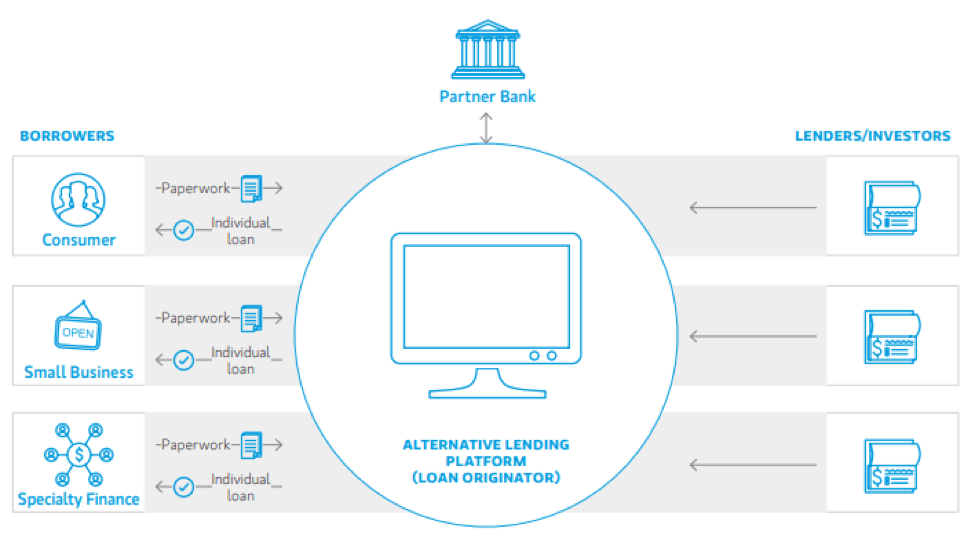

During the rise of the sharing economy, it’s only logical that alternative, or peer-to-peer, lending will be gaining more traction.

Image source: Morgan Stanley

Even though some bigger banks worldwide try to adjust and reach the underserved demographics, alternative lending firms still tend to do it better. Often, because they adjust to the market quicker and many clients don’t have a credit score that would let them get a loan from a big bank. At the same time, we have investors who are actively looking for attractive yield-generating ways to make their money work. So the trend looks up for P2P lending in the years to come. But the Achilles’ heel of the smaller alternative lending companies continues to be regulatory compliance. Which brings me to my next point.

Regulations

The continuous rise of regtech

Just as the digital lending niche grows, the number of regulations does too with new notices from regulating bodies published every day. Regulations are scary even for the big players, even though they often have whole dedicated departments working on compliance. In 2019 the trend will continue with governments taking a closer look at the FinTech in general and lending in particular. The problem is that small and midsize businesses often don’t have the budgets to have a compliance staff. And all of this would be quite depressing for the people eager to enter the lending market if it wasn’t for the developments in the RegTech sphere.

RegTech, as a separate branch of FinTech, will be of special interest to lenders in 2019 since these solutions will be the ones to both save the businesses operational costs and protect them from the enormous fines that may hit at any moment.

New regulatory sandboxes

At the same time, there’s hope for more regulatory sandboxes to arise in 2019. For example, Norway wants to open up to FinTech innovation by means of a sandbox, about which I’m sure local entrepreneurs can’t be happy enough. As more tier-1 legislations test this approach to innovative tech, more join in. So in 2019, we can keep our fingers crossed and wait for a regulatory sandbox snowball effect freeing FinTech entrepreneurs of the need to think about compliance at least for a little while.

PSD2 directive in full effect

Europe is a huge lending market. And in 2019 the long-anticipated PSD2 directive is supposed to take full effect. For those out of context, PSD2 is a directive that works across the EU and it’s aimed at increasing financial competition for conventional banks through lowering entry barriers into the field. At the same time, it will dictate the usage of reliable identification systems and strengthened data protection. The main point though is that now customers will be able to use services of third-party financial services company through their bank, through an obligatory open API.

Focus on millennials

Even though baby boomers still hold the largest capitals, millennials are quickly becoming a bigger demographic in terms of using the financial services. In addition, they are more likely to switch to a new lender or choose a digital P2P lender as their first one for that matter. So companies in 2019 will keep their focus on younger audiences by means of creating better products, interfaces, and offers.

Striving for financial inclusion

The trend of trying to serve the unbanked or underbanked regions and demographics will continue. While that’s an important mission on its own, it’s also dictated by the fact that customer acquisition cost in developed countries is getting higher and the competition stronger. At the same time, there are billions of people without proper access to financial instruments. So in the years to come it’s reasonable to expect businesses actively working to reach new locations and demographics with lending products.

Digital only lending companies

Even with today’s state of technology, it seems very unnecessary to go to a brick-and-mortar branch to get a loan. The future of lending is without a doubt digital and there is plenty of companies proving it on their example. In 2019 the trend will continue with businesses creating personalized flows and experiences for online borrowers.

Final thoughts

In terms of technology, it’s now easier than ever to get into the lending business. Barriers are low, good lending solutions have all the needed functionality out of the box. And this is a big reason why overall, the competition in the lending field will continue to grow. New businesses join the race all the time and win users over by offering better interfaces, faster processing, more personal support and of course better interest rates. As a result, users are getting more demanding. On a high-level everything that’s going on is great everyone involved: for the industry, for the borrower, and for the lenders.