How AI helped Interactive Investor with Customer engagement

Photo by Markus Spiske on Unsplash

Blog by Michael Mauchline, Industry Leader, Marketing Automation & Personalisation at Watson Marketing

Very often when AI and investment are mentioned together it is about Robo Advice or high frequency trading. However, in the case of Interactive Investor AI proved useful for customer engagement.

IBM Watson Marketing works with Fintech clients to improve customer engagement as well as boost digital revenues. Interactive Investor deployed the technology in 2018 and have since been able to inspire thousands of customers to actively engage in their portfolios:

- increased newsletter open rates by over 80% through personalising content based on a customer’s segment

- improved clickthrough rates more than 70% by sending emails to customers at optimal times based on an individual’s behavior

Those results were achieved by the personalization of investment content based on customers’ segments. Going beyond segment, personalization was achieved for each individual.

Personalisation isn’t all to do with the content itself but also about send time. By learning about people’s habits IBM Watson was able to send email at the most appropriate time for each individual.

Head of CRM at Interactive Investor, Phil Ireland explains how this happened:

“IBM Watson has been an integral tool over the last six months in helping my team achieve specific objectives set by our business. The platform has allowed us to dynamically target our customers with personalised information. For example, the platform has allowed us to target customers who hold any of the top 20 stocks within our business dynamically with news relating to that stock and provide updates on the performance of each stock.”

“The platform has allowed us to automate our new customer welcome journeys and provide trigger based campaigns dependent upon customer behavioural actions. We’ve seen considerable uplifts in our KPI’s due to the impact of the IBM Watson platform.”

Read the full story at:

https://www.ibm.com/case-studies/interactive-investor

About Watson Campaign Automation

Watson Campaign Automation is a SaaS-based digital marketing automation platform that puts the power of data insights in the hands of the marketer to design smarter campaigns that exceed your customer expectations. Use behavioural data from any source to create consistent campaigns across email, web, mobile push, SMS, social, group messaging and more. Marketers can work smarter with an AI powered Watson Assistant for Marketing’.

- Improve Customer Engagement

- Boost customer engagement and conversion with personalised experiences and offers that connect with your customers, when and where they expect it.

- Increase Customer Loyalty

- Leverage AI-powered insights and capabilities to deliver the right message and offer at the right time in the right channel to grow customer loyalty and, ultimately, revenue.

Any questions? Contact Michael Mauchline 07764 666 813 mauchline@uk.ibm.com

What the heck is that on my Bank statement?

We have all asked that question at one time or another, fretted and then called our Bank to see if it is fraud. Unfortunately, Banks know less than we do because the payment processors do not tell them what a transaction was for. The majority of these calls are about online purchases so friendly call center staff request that we check our email for a receipt.

For this reason I opened my pitch at EIE19 with the statement, With purchasing going on line, there are now 200x more email sent than there are Google searches’, grabbing the attention of the packed University of Edinburgh’s McEwan hall (my thanks to Danny Helson and the EIE team for an amazing event). It went down well, two days later I was pitching to a smart bunch of investors at ESM Investments.

The cost of not knowing

Finding an email receipt for the corresponding Bank transaction is almost impossible, email has become a dumping ground for spam, phishing and promotions. But it’s not just Fraud we worry about, we often want to find the receipt to return goods or use it to process a business expense. Banks also suffer, they field 6 million calls a year from customers concerned about online fraud (UK Finance.org reported that 78% (£393.4 million) of all fraud was online), at an average cost of £5 per enquiry, this costs the industry in excess of £30m a year. If Banks knew what was purchased they could make our customer experience better, for example, offering personalised Travel insurance to someone travelling abroad or putting an Uber button in their App to book the onward taxi and pushing the Uber receipt to the Expenses system to be automatically paid back.

Fixing the problem

As a Data Science business we wanted to find a solution to the problem, we decided to use Machine Learning to extract the data in email receipts and enrich the corresponding Banking transaction, we pursued this route for four reasons;

- Email was dead (email is dead – inc.com), it is becoming just another data source. It was plain that the world had moved on from Email and now prefers Whatsapp, etc for private communication but we all need an email address (and card) to buy things online.

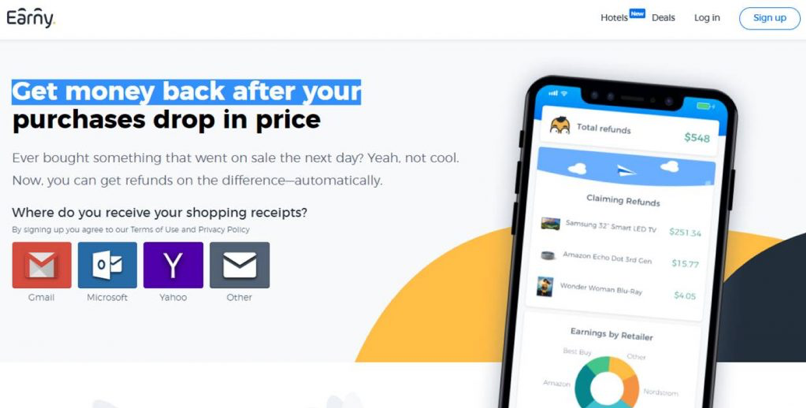

- US financial services were already doing similar stuff, companies like Capital One , Earny.co and Siftwallet.com had been at this for years – they read email receipts, obtained refunds and have amassed millions of users.

- Concerns about Privacy were not founded, especially in Millennials and Gen Zs, as this article Online value exchange by the Populus consultancy showed in The Drum.

- Apple and Google already use Machine Learning to auto add things to a Calendar (iOS 10 Siri auto adds events from email) or Wallet, Google now pulls Tickets and Loyalty data from Gmail and puts it in Google Pay (The Verge – April 16 2019).

Security and Application

Monily uses the same Machine Learning technology as Apple and Google to extract the data from the email receipt found on your Smartphone and populates the Bank transaction with the items you purchased, with no data going to the cloud. This makes it completely secure, safe and private. At first we developed our own App (Shoppa) but we came to realise the real benefits were for Retail and Business Banking, Personal Financial Management applications and Accounting solutions. Using our Splinter solution, we can help to reduce fraud enquiries by 50%, assist in selling personalised financial products and cut expense processing times down by 30%.

After years of development we are now actively selling the product and are pleased to be collaborating with Money Dashboard, pioneers in Personal Financial Management, and others to reduce fraud and improve expenses processing. If you would like to know more please email me on Adrian.James@moni.ly or visit Monily.co and I’ll get right back to you.

Launch of the UK Fintech National Network

Innovate Finance, FinTech Scotland and FinTech North have today announced the launch of a national fintech network. Its aim is for innovators to connect all around the country.

The FinTech National Network will increase collaboration between fintech hubs focussing on initiatives such as skills, investment and diversity.

Because innovation is coming from all parts of the UK it is vital to have a unified message that can be taken to a global audience and attract even more Foreign Direct Investment (FDI).

FDI is still flowing into the UK fintech sector. In 2018, the UK had its highest year in terms of investment, with over $3.3 billion, split roughly 50/50 between growth PE investment and VC investment. Compared to 2017, it’s 18% higher. Between 2016 and 2017 FDI had already doubled. These growth levels put the UK third only to China and the US.

Stephen Ingledew, CEO of FinTech Scotland said:

“Innovate Finance is leading on valuable work in areas such as attracting investors, access to skilled people and international engagement, so we are delighted to be working in collaboration with them in supporting the development of FinTech enterprises. With our shared values of encouraging diversity and inclusion in financial innovation, we are looking forward to developing our partnership in supporting FinTech growth.”

Chris Sier, Chairman of FinTech North & HM Treasury FinTech Envoy, said:

“Innovate Finance is a globally respected and recognised brand. As the FinTech sector continues to develop at pace outside of London, it is really encouraging to see Innovate Finance taking more proactive steps to engage on a truly national basis.

London’s role in the global FinTech economy is a significant one, but I strongly feel the regional cities of the UK have much to offer on a national and international basis, even more so if they can collaborate with each other via initiatives like the FinTech National Network.”

Charlotte Crosswell, CEO of Innovate Finance, said:

“I am delighted that we will be working closer with the FinTech Scotland and FinTech North across the UK. Clearly, momentum is growing within the UK’s national FinTech scene outside of London and Innovate Finance is committed to ensuring that FinTech is supported and represented across the entire breadth of the UK.”

Can technology help the crucial impartial debt advice sector?

Photo by Alice Pasqual on Unsplash

The first blog in a series connected to FinTech Scotland’s consumer inclusion work. Nicola Anderson shares her reflections on work we’ve been doing with the impartial and independent debt advice sector. There is no doubt technology and fintech can play a role in the future of this crucial sector and we’re keen to support more collaboration and finding ways to build needed solutions.

Recent research and studies have found that 51% of consumers run out of money before payday; 23% report they are finding it difficult to manage; one in five consumers have no savings and almost 16% of the population can be described as over-indebted.

Recognising demand for debt advice services is rising, we invited representatives from a range of debt advice agencies and Scottish Government to discuss the current problems facing the sector and the potential for seeking technology-based solutions to practically improve the experience for those both providing and receiving debt advice.

Working collaboratively and across sectors the aim of the initiative was to identify priority issues that, if addressed through technological developments, would benefit the debt advice sector, building efficiencies and putting users at its heart.

The input from these experts has shaped three main problems and we’re pleased to share details of these in this blog. Of course, the next stage is to find solutions for these issues! Ever the optimist I’m hopeful that collectively we can do that, starting with sharing what this vital sector thinks its main problem are!

Unanimously, the experts agreed that the problem top of their list was the sectors limited ability to access available data efficiently or to its fullest extent. They shared examples where it can often take weeks to have a fully verified understanding of a clients circumstances, due to time consuming nature of the range of data and documentation checks needed to verify the position. Understandably this can exasperate the stress for people but in addition there can be circumstances where it also can limit the appropriate options for debt advice solutions.

Second problem held by the experts in the room was that current debt solutions and repayment plans are inflexible and do not reflect the reality of people’s lives – which exacerbates problem debt. Current solutions, more often than not, seem to force people into a set date repayment plan with little of no flexibility to reflect the fact that income could be variable or paid at different points each month. The view in the room was that there seemed to be little room for flexibility once a plan was in place and there was a general desire to see all creditors think about the benefits of greater flexibility in repayment plans not just when someone enters a problem debt scenario.

The third problem centered on the lack of pre-emptive engagement options to enable earlier intervention in a developing debt scenario. Experience shows that general recognition of the tipping point’ into problem debt is poor, increasing in the numbers of people moving from debt to problem’ debt scenarios. The inability to recognise the tipping point’ happens across a range of vested stakeholders including, Consumers/Citizens, Financial Organisations and Statutory bodies.

Money Advice Scotland in particular, are hopeful that technology solutions plays a key role in the debt advice sector of the future and have plans to work with FinTech Scotland and the fintech community to help develop and raise further awareness on financial inclusion issues impacting today’s society.

The insights coming directly from the experts who work with people at the heart of this issue are invaluable. Are there any quick wins available to any of these issues ”“ we’d love to know!

In the meantime, thank you to all those who shared their views, its good to know the debt advice sector will continue the focus on this initiative.

Digital Technology Employer Survey

Photo by Branko Stancevic on Unsplash

Skills Development Scotland and partners are conducting an employer skills survey which will help shape the correct future skills provision for digital tech jobs in a number of sectors. If you manage a digital technology business/a business which has need of employees with digital skills, complete the survey; and share your skills issues and recruitment needs and challenges.

The Digital Technologies sector is important to Scotland as it plays an underpinning role in driving the competitiveness of Scotland’s other growth sectors as well as being a significant employer in its own right.

As part of this an employer skills survey is being conducted which will assess the current and likely future skills needs and issues in the digital technologies workforce. Ultimately, the research will deliver a strong and robust evidence base with which to inform skills investment planning for the digital technology sector and other sectors with a growing need for digital skills.

The objectives of the study are as follows:

- Detail the size and scale of the sector, and its economic importance to Scotland

- Detail the size and scale of the sector in Glasgow and Edinburgh

- Detail the size and scale of the Fintech sector

- Present the current composition and forecast changes in the sector’s business base

- Establish the current and likely future skills needs of employers

- Map the education supply pipeline for the sector

Income Verification: The Next Stage in Open Banking

As I’ve iterated more times than I can remember over the last two years, the implementation of Open Banking has changed the face of finance for ever.

To my eye, most financial institutions have now reached base camp’ with Open Banking, that is to say, the development of account aggregation within mobile apps. This is nice, and I’m sure consumers are enjoying having access to all their accounts in one place.

The next stage will be for banks and financial institutions to begin deriving value from its use. Within the next year I fully expect to see new services being launched by banks and FinTech’s that will allow financial institutions as well as consumers to reap the rewards from Open Banking.

To that end, we here at The ID Co. have been working with banks and lenders over the last year to bring a new proposition to market.

The ID Co.’s Income Verification solution offers banks and lenders the opportunity to capitalise on the Open Banking opportunity.

We work with numerous banks and lenders. On top of that we’ve spoken to many more over the course of the last year, both in the UK and Europe, and across the globe.

As such, I have a fairly good idea in my head of some of the challenges that are witnessed in the banking sector. One of the biggest that we’ve witnessed is the need to cut operating costs in order to stay competitive.

It’s no secret that the sector is far more crowded than it was just 10 years ago. And some of the Challenger banks now boast healthy customer acquisition, impressive UX across their apps and the web, and innovative new services.

Banks and lenders therefore have the dual pressures of bringing to market new services that will make their core offerings stickier’, while also attempting to streamline back office solutions.

It’s for this reason that I’d suggest exploring an income verification solution.

Verifying income is vitally important for banks and lenders, ensuring they have an accurate view of applicant’s financial income prior to awarding credit in order to ensure they are lending responsibly and offsetting any future risk of bad debt.

Operational Costs

Having an applicant’s income calculated within seconds of them making an application for a loan or credit totally negates the need for paper-based bank statements. The savings in time and resource here are enormous. It could take a few weeks for an applicant to submit their bank statements. And in that time, there’s plenty of opportunity for them to decide not to proceed, or to find an alternative.

We’re sympathetic to the hurdles that banks and lenders need to jump through in order to grant a loan. As well as AML and KYC checks, there are new rules on affordability to consider. For these reasons and more, it is vital that a sound lending decision is made, and not only that, be able to demonstrate why it was a sound decision.

Income verification allows you to do just that. With a solution such as ours, banks and lenders can know an applicant’s income exactly and can then calculate their monthly disposable income accordingly.

Thin Credit Files

Many of us will have friends and colleagues who are not British by birth. It feels a long time since I made the long journey from Canada to Scotland, but it is one that I remember well.

With individuals moving homes and countries with such frequency why is it that when beginning life in a new country, you also start with a blank credit file? Those with a thin credit file, perhaps because they’ve just moved into the country, can now illustrate their earnings and therefore capacity for credit through income verification.

Credit Risk

It’s a difficult challenge because most people aren’t paid monthly, or consistently. With the gig economy, students, retired, and others, those that get paid monthly are in the minority. To make a decision around credit risk, Underwriters or others need some context on which to base a lending decision. We need to understand what kind of income applicant have ”“ frequency, recency and more are all critical factors.

And this works both ways. While those with thin credit files can demonstrate why they might be right for a loan, it also gives the creditor more protection as they can protect themselves from applicants unable to practically make repayments or those that pose a bad credit risk.

Fraudulent Applications

When we were conducting research into loan applications and how Open Banking could support banks and lenders, I was struck by the volume of fraudulent activity that financial institutions needed to filter out in order to service genuine applications. Open Banking removes any opportunity for fraud as through APIs, direct access is made with an applicant’s bank account. Our Income Verification solution then looks back over many months to calculate income, not just the last one or two.

Conclusion

Income verification is the first of the services that will allow banks and lenders to derive value from Open Banking. The savings in time, cost and resource through its use are enormous and as its such reception from those who have trialled it use has been universally positive.

Reducing fraud, servicing customers with a thin credit file, widening prospect pools of potential customers, and illustrating good governance are all vitally important to lenders in 2019. We think that the introduction of our Income Verification solution will give financial institutions the answers to these questions.

Pensions Dashboards ”“ a positive step forward for the nation’s financial wellbeing

By Anthony Rafferty, MD of Edinburgh-based Fintech, Origo

Improving the overall wellbeing of citizens is becoming and ever more important focus of government, an important element of which is financial wellbeing ”“ the vision being a society where people make the most of their money and pensions through being more financially aware and equipped.

Technology has an important part to play in this, notably in respect of the implementation of the Pensions Dashboards. Primarily, dashboards are about enabling individuals to find and view all their pensions in one place, thereby increasing engagement with their long term savings and retirement planning.

Last week the DWP published its Pensions Dashboards paper, which is the Government’s response to the consultation that ended in December 2018. It sets out the practical steps necessary to implement Dashboards, starting with the establishment of an industry delivery group by the end of the summer under the new Money and Pensions Service (MPAS).

Some initial commentator reaction to the paper suggested the project wasn’t being moved on fast enough, but the paper is what we expected at this stage in the project and we see it as a positive step forward. In the paper, government clearly stated its intention to introduce Dashboards as quickly as possible’.

The four key elements necessary to make the Pensions Dashboards a reality are governance, compulsion to provide data, state pension and digital architecture. Next steps for all of these elements have been addressed in the paper, which we see as good news.

What’s more, through the consultation, government was able to test its proposals with the industry, consumer groups and other interested parties. Some 125 organisations gave feedback and the paper says the vast majority’ of them agreed with the suggested approach.

This approach includes establishing a single Pension Finder Service ”“ the core architecture that orchestrates an individual’s search for their pension data across all pensions companies and which displays their data on the dashboard they have chosen to use.

Origo has taken a leading role in the project from the start, quickly demonstrating how the technology could meet the government’s policy intent and objectives. We have built and scale-tested the central components to more than handle the 15 million and more potential requests the service could receive. Furthermore, we believe that the digital architecture can be deployed quickly to meet the stated timescales.

Through the DWP paper, government has given dashboards the green light. The task now is for the industry to help MAPS and the delivery group take the project forward to launch. It is a most exciting challenge and one that can have a significant positive effect on the wellbeing of this nation’s retirement savers.

Can fintech help employees engage with their work pensions?

Manuel Peleteiro, CEO of Scottish fintech Inbest.ai, Ed Owens from Pension Wise and Gavin Marshal, Senior Financial Wellbeing Consultant at HSBC will be on a panel discussing how technology, amongst other things, can help with engagement when it comes to workplace pension.

This panel will be part of a series of event organised around the latest behavioural research into employee engagement with workplace pensions schemes by Dr. Robertson-Rose of the University of Edinburgh. Her research shows how HR practices influence employee behaviour and explains what employers can do to help increase pension scheme engagement.

Each seminar will last approximately one hour and will be followed by refreshments and an opportunity to network.

These free seminars will be of interest to employers seeking to improve the financial well-being of their employees

Book your tickets

| Locations | Dates | Venues | Tickets |

| Edinburgh | 15 May, 17:00 ”“ 19:00 | University of Edinburgh | Book here |

| Dundee | 16 May, 16:00 ”“ 18:00 | Gallery of Contemporary Arts | Book here |

| Glasgow | 21 May, 16:00 ”“ 18:00 | University of Strathclyde | Book here |

| Aberdeen | 23 May, 16:00 ”“ 18:00 | Society of Advocates Library | Book here |

Fortnightly FinTech Fuse ”“ Embracing our role in the European FinTech Team!

My travels and meetings over this last few weeks have again reinforced to me that Scotland’s fintech developments are very much embracing being much part of a wider European team.

With our shared values and ambitions, there are enormous opportunities to work with our European team partners in reinventing financial services through fintech innovation.

This was certainly brought alive on Wednesday evening in Edinburgh with the launch of the ground breaking European Innovation and Technology (EIT) Digital Office with its focus on fintech.

European Collaboration

The new fintech digital office based at the Bayes Centre will deepen relationships between Scotland and Europe, increase innovation and investment in new fintech initiatives, grow knowledge exchange across the continent and attract inward investment.

Working with the EIT team along with Scottish Enterprise, University of Edinburgh, Scottish Funding Council and Highland & Islands Enterprise, it has been terrific to see this initiative international come alive.

It was a privilege to share the platform with Willem Jonker and Morgan Gillies at the launch along with Scottish Government Minister Ivan McKee and Charlie Jeffrey from the University of Edinburgh to explain how the collaboration will boost innovation and investment in fintech.

The atmosphere for the launch was made special by having a packed diverse audience with us representing all corners of the Scottish ecosystem.

Including some of the exciting fintech enterprises such as Tynah and Helene from MoneyMatix, James from Xpand, Loral from Sustainably, Rab from Wallet Services, Daniel from Listings Ledger as well as Kevin from Hylomorph.

The event was a great opportunity to catch up with some of the inspiring people making things happen across Scotland driving innovation such as Poonam Malik, Jude McCorry, David Robertson, Jasmina Lazic, Martin Hughes, Amanda Fergusson and Daniel Broby, Terry Murden.

Thank you to Courtney Garner from SciTech Europa for making the long journey to be with us and to the terrific EIT and Edinburgh Innovation teams for making it all happen on the night.

The European collaboration opportunities were also very much in evident for my recent visit to Brussels with Graeme Jones and Clare Carswell of Scottish Financial Enterprise for a range of very constructive meetings at the EU.

There is so much mutual common ground in developing fintech collaboration opportunities and a huge thank you to the magnificent team at Scotland Europa, Sarah English and Marija Ivoninaite and Fraser Clark from SDI.

It was great to have the opportunity to present on Scotland’s fintech progress with an engaged European audience on the Tuesday evening along with Graeme and John Maciver from Pinsent Masons.

We made a number of great connections and I’m sure there will be many more visits to our European friends in the near future as we commit to work even closer.

I flew back from Beautiful Brussels directly to Glorious Glasgow to present at the Institute and Faculty of Actuaries to speak at their knowledge sharing session.

It was wonderful to have a very engaging full house with so many of the profession interested in the role of fintech in shaping the future of financial services.

Thank you, John Taylor and Barry Shannon for inviting me to present as well as to Ji-Hyang Lee and Alan Watson for being terrific hosts for the session. I look forward to repeating in Edinburgh in June!

European Innovation

Europe was very much part of the discussion at the asset management dinner on Tuesday evening with Ministers Derek Mackay and Kate Forbes along with senior members of the investment world.

It was good opportunity to share the examples of how the Scottish fintech community is progressing innovation with the major financial institutions in these uncertain times and highlight the growing global interest in Scotland’s fintech sector.

Thank you to Graham Laybourn and the Baillie Gifford team for hosting the engaging evening as well as for the ongoing support from Anurag Agrawal in exploring new ways to develop fintech innovation in asset management.

There are a growing number of global fintech with a focus on asset management looking at setting up in Scotland due to the depth of Scotland’s investment sector.

Talking last week with Hamish Croll of Singapore based fintech BlueFireAi, there is no doubt the potential in Scotland is very much getting recognized.

The opportunities for fintech enterprises are also rapidly evolving in banking and it was great to catch up with Gary McLellan of CYBG this week to develop how we progress the collaboration opportunities

Thanks also Gary for allowing me to be one of your guinea pigs’ for your innovative approaches to online fintech innovations for personal data security, great to experience at first hand.

The RBS fintech accelerator demo day a week or so ago was another fantastic example of a large institution supporting new fintech innovators.

Inspiring pitches on the day including by Adrian James from Monily, Chris Herd from Nexves, James from Xpand.

It was great to be on the stage with Matt Perkins from FreeAgent and Karen Bird of RBS in sharing insights on developing fintech innovation through collaboration

Fantastic leadership by the RBS team Steve Chown and Janice Cunningham for running such a constructive event.

Unfortunately, I could not stay for all the fintech demos as Nicola and I had to dash off to Glasgow for the University of Strathclyde Enterprise Network event.

Another amazing evening listening to the budding entrepreneurs. I was particularly struck by the innovations coming from the Fing & Pay and Hotei fintech teams, both expertly mentored by our friend and fintech guru Nick Cousins.

Many congratulations to the always inspiring Eleanor Mackay, it is no surprise that Strathclyde has an enviable reputation across Europe when it comes to fintech innovation.

This is invaluable in developing the collaborative innovation opportunities for fintech entrepreneurs across Europe and the world.

European Entrepreneurs

It was super to catch up with entrepreneur Derick James, the founder and CEO of Symphonic, to hear about the brilliant progress his team has been making in Europe and wider alongside the move into the new office in Edinburgh.

Very much looking forward to sharing the Symphonic international innovation story with the fintech community in the coming months.

Similarly looking forward to working with experienced expert innovator George Kelsey with what he is brewing up for the fintech world! Reflecting on my catch up coffee with George this week, I must introduce to Derick James.

I’m thinking it could be another example of one plus one equals five in creating even more fintech innovation in collaboration and what a story that would be!

Last week we shared the awesome entrepreneurship story of FNZ who are a fabulous example of a Scottish based fintech expanding in Europe and worldwide in helping consumers manage their long term savings.

Another inspiring innovation example I learnt about in this last fortnight was Cortex Worldwide.

Terrific conversation with founder and chief executive Peter Proud and such a truly inspiring journey in scaling a market leading technology enterprise. Peter’s experience is invaluable, and I am keen to share to many budding entrepreneurs.

The European and global innovation can come in various forms and I really enjoyed meeting Jordan Stewart of AlbaFX in Glasgow recently and hear how his proposition can help small firms gain the most from international trade.

Very much looking forward to connecting Jordan with the growing fintech community to develop mutual valuable connections.

I had the opportunity to meet Craig Anderson of venture capital firm Pentech in this last fortnight as well and talk through how the fintech community was evolving and the emerging investment opportunities.

In this respect, I also had a very constructive conversation with Andrew Wilson of Charlotte Street Partners on how we could do more to help fintech firms present themselves to potential investors.

I’m hoping that talking about the how the Scottish fintech community of firms is developing will encourage more of the entrepreneurial activity across the country.

So, it was good to be interviewed on Monday by Kim McAllister for a new BBC Radio show which will give live in May on the exciting fintech developments and the impact on people’s lives.

Meeting the engaging media professional David Lee on the same day, who is writing the Scotsman supplement on fintech for May, was a good time to reflect the whirlwind of activity over this last twelve months.

I shared with David that a major strength of Scotland’s fintech progress is our diverse range of people.

Whether this is the data analytic expertise being developed by DataLab and the MBN Solutions team, something which was showcased at Aviva a couple of weeks ago in growing their data centre of excellence.

Then there is the fintech entrepreneurial expertise being developed in our universities

In this respect it was wonderful to share joint plans with Claudia Cavalluzzo and Georgia Goodall of Converge Challenge who do amazing with new entrepreneurs from our universities

The enterprise spirit was very much demonstrated to Nicola and me recently when we were asked to present to the University of Stirling fintech postgraduate students.

A terrific group of people and thank you Andrea Bracciali for arranging the session, really enjoyable and insightful as was the visit to Newbattle Community Campus to see first hand the wonderful progress of this new digital’ school environment

Newbattle is very progressive educational role model for the future and it was absolutely fantastic to spend time with Gib McMillan and leadership team and the inspiring students, in their hands we have a very bright future.

The conversation with David Lee also gave me the opportunity to reaffirm the ambition to be a top five global fintech centre one year into the journey and the importance of working with European and global partners to achieve this goal

European Partners

One such group of partners are of good friends in Ireland and it was just absolutely wonderful to spend a few days in Dublin as part of Scottish Irish Finance Initiative (SIFI) conference on fintech.

Such a warm and welcoming reception from our European partners and the mutual relationships being developed though the SIFI team are going to be invaluable going forward.

Massive thank you to magnificent SIFI trio David Clarke, Pete Townsend and Terry Quinn for organising as well as to the brilliant Dublin Business School team, Andrew Quinn, Andrew Conlan-Trant and Rory Mo-ran.

It was great to hear from so many new friends such as the inspiring Hesus Inoma and the amazing Susan Sweeney as well as Scotland’s leading fintech guru Daniel Broby of University of Strathclyde.

The trip to Ireland also gave the me the opportunity to meet up with Peter Oakes, the highly respected global fintech leader and founder of FinTech Ireland. Thanks Emma Shiel from SDI for arranging and joining us.

It was fantastic to hear first hand the story behind FinTech Ireland and the significant presence Peter has established in Europe and across the globe. Peter’s next trip was to help with the formation of FinTech Cyprus, another European partner for is to collaborate with.

It was poignant that we met Peter in the Hibernian Club and sat in the very chair that FinTech Scotland was conceived five years ago.

Looking forward to developing closer collaboration with Peter and the FinTech Ireland team as European partners.

My return from Dublin was via Hampshire (and Reading to see my mum) as I had the opportunity to meet up with Mark Hanson, Managing Director of Simply Health who provide valuable health insurance plans for millions of consumers.

The worlds of fintech, insurtech, healthtech all overlap, and we had a super conversation on some emerging innovations in this space and the potential to work in partnership with University of Edinburgh and entrepreneurs to explore further.

Collaborative partnership is also very much at the core in developing a Global Open Finance Centre of Excellence in Scotland and we are delighted the joint FinTech Scotland, University of Edinburgh, Scottish Enterprise and FDATA proposal has been shortlisted for funding.

A huge amount of credit for this must go to our very own European and Global Open Finance presidential’ leader, Gavin Littlejohn who is instrumental in the strategic development.

I’m looking forward to seeing Gavin next week when he returns from formidable open finance mission trip to Hong Kong, Australia and India.

The Open Finance initiative is facilitating further collaboration with partners and this is also true of the Ethical Finance Hub team based at Heriot Watt University

It was valuable to catch up with Chris Tait recently and talk through the fintech contribution to the Global Ethical Finance Forum which will take place in Edinburgh in October with many distinguished international partners.

Barry Wingate it would be super to work in partner with you on this following our chat a week or so ago!

International partnerships were the focus of the conversation with James Bernard of the Dubai DMMC, the enterprise agency, when we met in Edinburgh last week, thank you Russell Dalgleish for making the connection.

Encouraging a European and global innovation and growth mindset with the Scottish entrepreneurial community as a key focus of the conversation for the executive dinner of fintech organized by FWB Park Brown last Wednesday evening.

I very much valued the challenge and constructive feedback from the diverse group of successful business leaders from sectors outside of financial services and fintech and thank you to those who have reached out to follow up.

Big thanks to Graham Burns and Michael Dickson for expertly arranging and professionally hosting the engaging evening, I look forward to the next one, maybe in Aberdeen or even another European city?

Running Europe

Unfortunately, and to much frustration, my toe injury has not cleared up which means my running opportunities in Europe have been somewhat curtailed.

Whilst the buzz of the exciting fintech activity with so many fabulous people has kept me occupied, I am a bit of a bear with a sore head’ as I have not been able to get out and run.

I have tried swimming, but my limited breaststroke ability does not replace the three hour runs I so much enjoy!!

I know I will need to be patient in recovering but if I look angst when you see me you will know why!

Let’s hope I am going to be ready for the Stirling, Livingston and Lock Leven half marathons in the run up to Edinburgh marathon in May!! Until next time.