Fintech Previse, finalist in Innovator of the Year Awards

Fintech Previse announced today that they have been named a finalist in The Spectator’s Economic Innovator of the Year Awards. The awards recognises the companies that will rewrite the rules and help rebuild the economy in 2020.

This is a very prestigious award and the winners will be announced after digital presentations made today by the various businesses to the judges.

Paul Christensen, CEO of Previse, said:

“Being named a finalist for Economic Innovator of the Year by The Spectator is a testament to the team at Previse, who have been working day-in-day-out during the pandemic to ensure that SMEs get the support that they need. This year, we have been accredited as a CBILS lender, and our £2.5 million grant from the BCR to accelerate growth, along with the partnership with the FSB, has been an exciting new chapter in our story. However, the hardest work is yet to come as the global economy must innovate its way out of a depression unapparelled in modern economic history. What we are building here goes beyond just a great product: we’re creating a movement that ensures that every SME has the option of instant payment whenever they issue an invoice.”

EedenBull now with PSD2 licenses – ready to drive change in commercial payments through Open Banking

The Norwegian Financial Supervisory Authority has formally approved EedenBull’s PSD2 extension to their E-Money Institution (EMI) license, and the FinTech is now a fully licensed PIS and AIS provider, enabling the access of data and the initiation of payments from bank accounts throughout Europe.

The Payment Services Directive 2 (PSD2) was introduced in Europe in 2018 and regulates payment services and providers in Europe. PSD2 enables open banking by allowing customers to use the services of third-party providers to access account information or initiate transactions on their behalf. PSD2 gives providers a regulated, open market to compete in, while providing customers more payment options and increased security.

Says Nicki Bisgaard, CEO of EedenBull:

New technologies, new regulations like PSD2 and new players entering the payments space changes forever the way consumers and businesses think about payments. At EedenBull, we’re not only embracing change, but seeking to work with our partner banks to drive change and leverage the opportunities provided. With our E-Money License extended to include the right as an Account Information Service Provider to pull data from our customers’ bank accounts and as a Payment Initiation Service Provider initiate payments directly from bank accounts, we are in a unique position to develop and launch truly unique payment services.’

EedenBull was founded in 2018 and has recently launched it’s Q Business® programme with 65 banks in the Nordics and are now expanding the platform to include full commercial cards issuing capabilities across all segments from small business to large corporates and across all B2B spend categories. EedenBull is a fully licensed and regulated e-money institution under EU/EEA legislation, AISP & PISP licenses and is uniquely also holding principal issuing licenses from Mastercard, Visa and UnionPay. The company is targeting bank partners in select markets around the world and are aiming to launch programmes in multiple regions over the coming 12-24 months.

Further information:

Nicki Bisgaard ”“ nicki@eedenbull.com

Photo: Nicki Bisgaard, CEO EedenBull

Photo by: Debra Hurford Brown

Zumo launches crowdfunding campaign via Seedrs

This article was written by Nick Jones, CEO at Zumo. Fintech Scotland doesn’t give financial advice and only help Scottish fintech firms with relaying their messages. As with all investment your capital is at risk.

Approved by Seedrs.

We’re delighted to announce that we’re working with Seedrs on our crowdfunding campaign.

This is an exciting investment opportunity and we’ve already had a lot of interest from investors from all walks of life. We’d love it if you could join us for this limited opportunity to own a piece of Zumo!

You can access the pre-registration page here.

Here’s a recap of the opportunity:

Our digital wallet has already gained significant recognition in the form of funding, user feedback and extensive press coverage in the UK. Further funding will enable us to expand our marketing efforts to make Zumo available to everyone, everywhere and to start rolling out our B2B offerings – the ZumoKit software development kit and our payments platform, ZumoPay.

Our main source of revenue is our in-app currency exchange. We charge users 0.5% for any exchange transaction, across all currencies available within the Zumo wallet. This makes us one of the most cost-effective as well as secure ways to buy and sell cryptocurrency.

Our convertible debit card, which is planned for launch next month, will allow users to make card payments in both cryptocurrency and GBP. As time goes on, we’ll be adding more traditional and cryptocurrency options.

If you know of anyone else that might be interested, we would appreciate it if you could share the link.

Zumo: Smart Money for Everyone

https://www.youtube.com/watch?v=SUuyI40dxDE&feature=youtu.be

Scotcoin announces the launch of its new ERC20 token

Scotcoin’s new token uses the Ethereum blockchain, the second largest distributed ledger network in the world by market capitalisation after Bitcoin. Adoption and use of the Ethereum blockchain assures that Scotcoin remains a bona fide distributed ledger cryptocurrency whose future sustainability is not in the hands of a few.

Temple Melville, CEO of The Scotcoin Project CIC said:

“I am delighted that we have finally reached this milestone in the evolution of Scotcoin. We have worked hard to meet the condition laid down by our stakeholders and funders that the durability and sustainability of the token would never be in the hands of the few. Use of the Ethereum blockchain assures that that objective is met”.

The Scotcoin Project is a not for profit community interest company that seeks to educate and inform the public on digital currencies and blockchain technology. It occupies the ethical space and is developing a program of initiatives designed to help improve the personal and financial prospects of those with the fewest opportunities afforded by the current economic landscape.

Moving to an ERC20 token means that our coin is basically acceptable on any exchange, and in fact we will be having an IEO (Initial Exchange Offer) over the next year. The move will enable us to engage with nearly everyone who has an interest in digital currencies. As an aside, digital currencies are most definitely now an asset class but are also a hedge against the massive quantitative easing that has taken place world-wiide during the Corvid-19 pandemic. We are already seeing inflation creeping into our daily lives in contrast to the mildly deflationary effect of digital and crypto currencies.

For further information please contact Temple Melville on temple@scotcoinproject.com

Why fintech Hubb Insure chose Glasgow

When we set about building our business one of the first questions we look at was the location, what was important to us?

Hubb firstly was a challenger to the commercial insurance space, built on modern management structures and a technology stack, built around flexibility and efficiency, our objectives where simple, cheaper more efficient solutions for our clients, happier more focused staff.

Homeworking was always going to be a major part of the mix, but we still needed a base for a head office and training, so we landed on London, Manchester or Glasgow.

London- The heart of the global insurance market, great public transport and connections all over the city, very expensive everything!

Manchester- Cheaper than London, two hours on the train from London, local public transport not so great.

Glasgow- Great flight links to London, good public transport, Scottish Enterprise are great to deal with.

When we had these discussions, it became clear that Glasgow was the perfect home for Hubb over and above the obvious, we have sourced local partners and found that the skill sets in sales, marketing and flexible office space in Glasgow a real positive.

DirectID Launch Collections & Recoveries Solution

Scotland based FinTech, DirectID just announced the launch of its Collections & Recoveries solution.

DirectID has built a solution to make the collections process easier and faster in collaboration with the UK’s leading banks, lenders and debt collections agencies,

Using Open Banking data, agents will be able to access accurate customer’s financial statement and an assessment on their disposable income, and how much they can afford to repay.

The new solution combines DirectID’s categorisation engine with the categories defined within the Standard Financial Statement.

For individuals who have built up large amounts of debt, it removes a lot of the stress and uncertainty. The use of bank data negates the need for them to supply lots of details around financial commitments with existing creditors.

Currently, collections agents can spend a large volume of time with a customer assessing how much income they have, and what their discretionary and non-discretionary spend looks like. This process is also prone to customer error, downplay spend, or deliberately mislead, in an attempt to keep repayments low.

DirectID’s product circumvents the often unpleasant collections process from a period of weeks to just minutes.

Collections & Recoveries uses an individual’s bank data to help lenders streamline the collections process. This supplies the lender with an up-to-date and accurate view of an individual’s debt commitments and subsequently their capacity to repay debt.

DirectID’s Collections & Recoveries solution identifies income streams; expenditure; insight into a customer’s profile; including discretionary and non-discretionary; and summarises payments to lenders.

James Varga, CEO of DirectID, said:

“I am immensely proud to be today launching our new Collections & Recoveries solution. This is an extremely important proposition which will help both collections agents and their customers, during which can be a difficult process.

“With the launch of this product, and because of the impact of bank data, DirectID now covers the whole customer lifecycle, from onboarding, portfolio management, and now Collections & Recoveries.

The launch of DirectID’s Collections & Recoveries product marks an important step for DirectID, as we not only launch our first product of this year, but the first of several that we have completed, or are near to completion. Now that we can cover the whole product lifecycle with bank data, we are in a position to work with businesses across industry, and differing needs and challenges.”

LendingCrowd approved for accreditation under CBILS

Scottish fintech LendingCrowd, just announced it had been approved for accreditation by the British Business Bank as a new lender under the Coronavirus Business Interruption Loan Scheme (CBILS).

This accreditation will allow the fintech to distribute UK government-backed loans to SMEs impacted by the Covid-19 pandemic. LendingCrowd will provide loan product from £50,001 to £250,000 across either a three or a five-year term to SMEs who are experiencing lost or deferred revenues, leading to cashflow difficulties.

SMEs will have nothing to pay for the first 12 months so they can focus on bringing back their company to a healthier position.

Stuart Lunn, founder and CEO of LendingCrowd, said:

“We appreciate the stress and struggle that SMEs are going through and that time is of the essence in providing support. Our agile and flexible approach means that we can distribute funding responsibly to those who need it quickly. We have already spoken to every existing borrower, implemented repayment holidays for qualifying borrowers and changed repayment dates to better suit their cashflow patterns at no cost. In offering CBILS loans, LendingCrowd can play its part in supporting the survival and resurgence of as many SMEs as possible.”

If you’d like to apply for CBILS funding through LendingCrowd go to https://www.lendingcrowd.com/cbils

LendingCrowd will begin offering CBILS loans imminently and they will be available to new and existing borrowers, subject to eligibility.

EedenBull and Mastercard Asia Pacific partnership

Mastercard and Scottish fintech EedenBull have announced the extension of their strategic partnership from Europe to the Asia Pacific region to support the fintech’s new digital platform launch. The platform will allow banks and businesses to process spending and payments more efficiently.

Building on a partnership in Europe, this relationship will enable Eedenbull to tap into opportunities in the Asia Pacific business-to-business payments market.

For banks and their business customers, the new service provides innovative commercial payments services, including EedenBull’s spend management platform Q Business® that offers a sophisticated yet easy-to-use solution to digitise the slow and costly processing of checks and cash. With Q Business now offered by a network of banks in the Nordics, more than 10,000 registered businesses are benefitting from the process efficiencies and control of spend provided.

Yunsok Chang, Executive Vice President, Market Development, Asia Pacific, Mastercard said:

“Following Europe, Mastercard is delighted to partner with EedenBull in Asia Pacific and to support its unrivalled expertise to leverage the commercial payments space in the region. With Mastercard’s leading advisory experience, sophisticated commercial solutions and wide network of customers and partners, Mastercard will be able to help EedenBull thrive in this market of significant opportunities.”

The extension of the partnership beyond Europe is a testament to Mastercard’s strategy of working with fintech firms to drive innovation and create opportunities for other partners in the Asia Pacific region. As a frontrunner in payments technology, Mastercard is continuously developing new solutions catering to the evolving demands driven by rapid digital transformation.

Nicki Bull Bisgaard, CEO of EedenBull said:

“At EedenBull, we uniquely combine specialist commercial payments expertise with tech-savvy talent, making us the ideal partner to banks. While payment products and services are now more user-friendly, product management is growing more complex and requires access to specialists in marketing, revenue management, IT, legal, regulatory and many other areas. Selecting Mastercard as our preferred partner to support us in creating real value for our partner banks and their customers and to support our expansion in Asia Pacific was easy as we share the same view on what businesses require and how we can best meet those requirements in an ever-changing world.”

Operational Resilience by Mihir Joglekar Business Analyst, AutoRek

Globally, organisations’ operational resilience is currently being tested as key members of staff are working remotely. The need to access data in real time has increased and reporting accurately has become more critical than ever.

Operational readiness can be defined as an organisation’s ability to anticipate, prepare, respond and adapt to uncertainties and disruptions to successfully deliver services to its client base. It requires both tactical and strategic thinking.

The Financial Conduct Authority (FCA) suggests organisations follow these three steps to support operational resilience (CP19/32):

- Focus on continuity of its most important business services.

- Conduct an extensive impact vs threshold exercise of all business services, and the levels of disruption that could be tolerated. This exercise should be conducted and reported at the highest level of seniority of organisational management i.e. board level.

- Consider disruption as a certainty and ensure adequate plans have been agreed to mitigate its impact to services.

The FCA reinforces the need for firms to develop and improve capabilities so that any systemic impact event is contained. Focus should be on time taken to respond, effective internal and external communication, particularly with customers. The FCA have also linked operational resilience as part of its objectives involving Consumer Protection, Market Integrity, and Effective Competition by ensuring resilient firms can support ongoing availability of services, thereby reducing harm to the consumer.

While operational resilience is not a new concept to the business community, what is missing is a complete approach to address resilience. Organisations may already have components like crisis management plans, disaster recovery plans and secondary sites etc., but unfortunately over the last two decades there have been a number of stress factors that have contributed to this subject being relegated as more pressing issues have taken priority mainly due to:

- 2000-02: Dot-com bubble and the impact due to its crash i.e. only 48% tech companies survived post event

- 2007-2010: Financial crisis trigged by subprime loans and reduced oversight of the industry at that point

- 2010-15: European sovereign debt crisis due to EU Member States taking on unsustainable levels of debt

- 2014-17: Chinese financial crisis with the popping of the stock market bubble

- 2019-21: Corona virus (COVID 19) related lockdown and economic downturn

The current “Great Lockdown” due do COVID 19 has simply functioned as a catalyst for serious action, triggering management and leadership team to renew efforts.

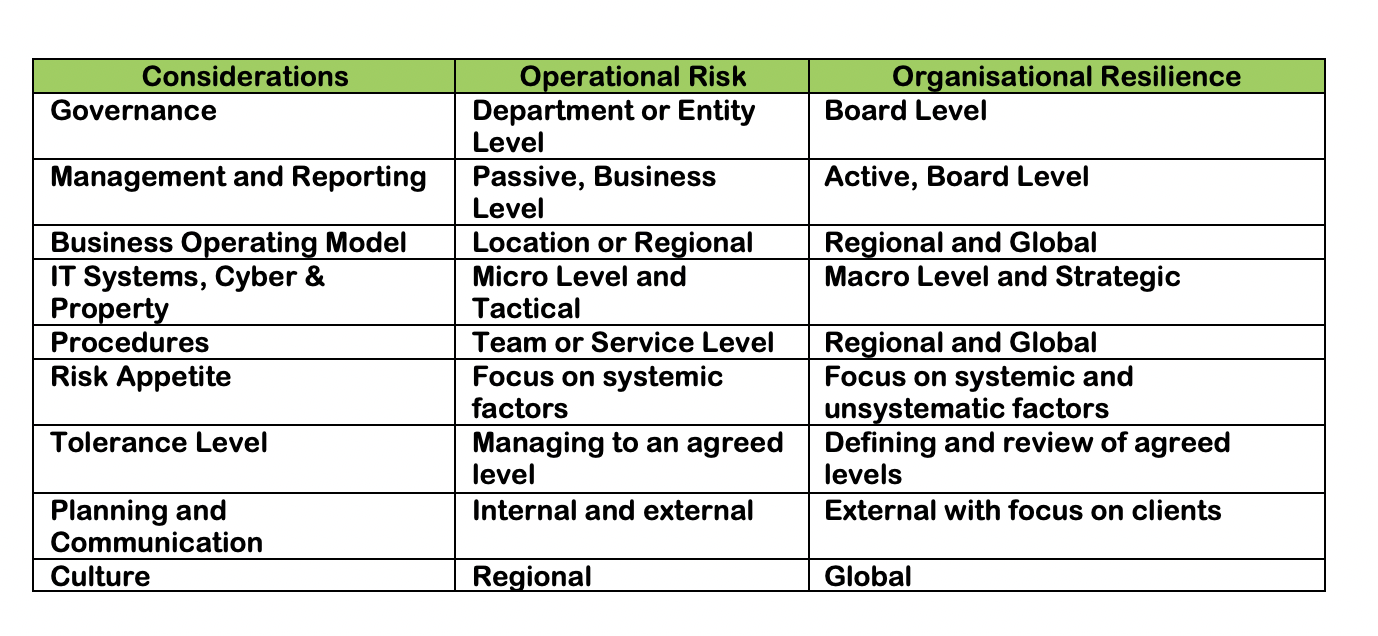

One way of differentiating operational risk from operational resilience is to consider the internal vs external force perspective. Operational risk is largely internal to an organisation due to a blend of systemic and non-systemic risks associated at micro level of business processes, while resilience is an organisation macro level initiative where all business units contribute towards establishing a resilient business and is inclined more towards external circumstances. Both risk and resilience are intrinsically connected and an organisation’s ability to effectively address operational risks across business functions will contribute to its overall resilience. The table below outlines these differences.

Following the publication of the discussion paper, Achieving Operational Resilience and the conclusion of the consultation process, the FCA has communicated its intention to review and where applicable, consider all feedback received as part of its final policy statement.

The FCA proposal include that firms:

- Identify and Categories their important business services.

- Set Impact Tolerance for each of these services.

- Test their ability to support these services across a range or scenarios

- Conduct active lessons learnt exercises

- Develop internal and external Communication plans

- Establish self-assessment and reporting documentations

Within the context of the current crisis our economic engines must start to fire up again and business must ramp up at the earliest safest opportunity. This is where AutoRek sees its innovative software making a significant contribution towards business, who still need to deliver service excellence to their clients in an unified manner, utilising new and innovative workflow and people management practices more than ever are reliant on distributed and remote team work.

In conclusion, organisations are now actively progressing their operational resilience programmes that will continue to evolve around new set-ups as leaders and managers gradually commence the return to a new and adaptive business as usual.

www.autorek.com

More on Autorek

An interview with Nicki Bisgaard, CEO at EedenBull

Congratulations on your recent announcement about the extension of your strategic partnership with Mastercard. Can you tell us a bit more about what it means for EedenBull?

Thank you. The strategic partnership with Mastercard is key as we continue to develop our new and innovative payment programmes, making it easier and safer for businesses to pay and get paid in an ever changing world. Both Mastercard and EedenBull service banks and their customers and seek to secure competitive advantages for the banks we service together. Having a partner like Mastercard strengthens our ability to innovate through direct access to Mastercard’s assets and expertise, it significantly strengthens our distribution power and it creates significant awareness throughout the European marketplace for who we are and what we can do. That said, there are obvious benefits to Mastercard too. Through EedenBull they gain access to highly specialized expertise particularly in commercial payments as well as an extremely committed team of developers.

Can you speak to us about some of the new developments at EedenBull?

As you know, we have already launched our Q Business payments and spend management platform which is a direct response to universal requirements of small and medium sized businesses, organisations of different sizes and the public sector for enhanced control, spend visibility, and streamlined payments processes. The programme is currently being distributed by 65 banks in Norway with several thousand businesses already using the service. We are continuously developing new and exciting features and functionalities, always with a customer centric approach, understanding and responding to customers’ real issues and challenges.

With the current COVID19 situation have you seen more companies approaching you to manage expenses remotely?

The short answer is yes. We are seeing a great interest in our services from exisiting and potential new partner banks around the world as well as from their customers. The pandemic has certainly brought about an increased awareness of payments related issues facing businesses of all categories and sizes. Even prior to the outbreak, we already had a situation where new regulations, new technologies and new players were changing the way businesses and consumers were thinking about payments. Many of the trends we saw emerging towards the end of 2019 have been accelerated by the pandemic. Think about contactless payments, e-commerce, cashflow, need for working capital to mention but a few.

You opened your Scottish office last year; can you tell us about what your experience of the Scottish fintech cluster has been so far?

It’s been great. Ever since setting up shop in Edinburgh, or even way before, we have enjoyed the support we have been receiving from the Scottish fintech community in general and FinTech Scotland in particular. The access to likeminded businesses and organisations, the government in Scotland and the many extremely talented people we have been lucky enough to employ has quite frankly been instrumental in securing the momentum and successes we have enjoyed thus far.

Are you looking to grow your presence in Edinburgh in the next 2 years? How many people will you be recruiting?

Just to make one thing clear: We are staying in Edinburgh, no question about that at all. We love being a part of the fintech scene in Scotland and are committed to continuing over years to come. We will be growing our presence in Edinburgh over the next 2-3 years for sure and will be investing further in attracting talent to work in our team in Scotland. I would be surprised if we by end of 2022 had not increased the number of team members by any less than 100%.

What are the main differences between scaling up a fintech in Edinburgh and Oslo?

What a great question. Upon reflection I would have to say that I think scaling up in Edinburgh isn’t very different from scaling up in Oslo. In fact, probably much more similar than compared to many other locations we could have chosen. We find that the cultural differences are fewer than the similarities, the talent pool is similar, the governmental support on the same levels and the fintech scene is energetic in both cities. There are some obvious current and historic bonds between the two small nations which made it easy for us to come to Scotland and has made it easy for us to stay and to grow in Scotland. We love being here.