Why is the FinTech Research & Innovation Roadmap so important?

Article written by Julian Wells, Director at Whitecap Consulting

FinTech Scotland, the cluster management body, recently published its 10 year Research & Innovation Roadmap. Whitecap worked in partnership with the FinTech Scotland team to support the development of this roadmap, and in the first in a series of blogs we discuss the fundamentals behind this important document.

FinTech is driving change in one of the most important parts of our economy. It presents a significant disruptive force in financial services, and will shape the future of the digital economy. It has the potential to radically change the way people and businesses engage with money, and to create a new financial system that is more effective and resilient.

FinTech Scotland’s Research & Innovation Roadmap is a 10 year plan which has been developed as an industry-led and action-focused tool to increase the positive impact of FinTech innovation across Scotland and the UK. It creates a framework and an environment to drive greater collaboration, and to build the connections that will enable responsible innovation for the future of finance.

The roadmap builds on foundations that were already established through the FinTech Scotland cluster, and sets out the cross-sectoral strategic priorities that – through collective and collaborative action – will shape the future of financial services, and enable Scotland and the UK to further advance FinTech innovation. It was published on the anniversary of the HM Treasury commissioned Review of Fintech led by Ron Kalifa OBE which set out a number of recommendations, including the opportunity for research and innovation to accelerate the development of cluster excellence.

Why do we need a Research & Innovation Roadmap for FinTech?

The financial services industry contributes £132 billion to the UK economy – almost 7% of total economic output. It is an essential part of the full UK economy that enables prosperous outcomes for businesses and people across the UK. Its significance was highlighted by the Chancellor of the Exchequer in the recent HM Treasury report ‘A new chapter for Financial Services’. Working with others across the economy, his vision is for “an agile and dynamic approach, one which enables those in the financial services industry to evolve and thrive as they embrace the new opportunities of the future.”

Research and innovation play a key role in the vision for the future of financial services in the UK and beyond. However, financial services and FinTech have, compared to other industries, generally not been aligned with the academic research communities. Recent analysis highlighted that research funding into these fields is as low as 3% of total UK funding1 for research and innovation.

In addition, there is a general acknowledgement in financial services, FinTech, and the academic community that current engagement has had a relatively narrow focus. The result is limited exploration of research and innovation, which means an important part of the economy is not fulfilling its full potential.

There is an opportunity to close the gap between the economic productivity of UK financial services and the current scale of UKRI investment in FinTech and financial services R&I. This can be achieved via more strategic and systematic collaboration, which can help develop the necessary FinTech innovation between the range of stakeholders. Importantly, this should be driven by a true desire for effective change, and by an industry-first ‘real-world’ approach to the challenges ahead.

This work also supports the strategic HM Treasury Review of UK Fintech led by Ron Kalifa OBE. It recognises the value of collaboration, and the leadership that is needed to create the right conditions for FinTech to innovate, accelerate and grow.

How will the Roadmap be implemented?

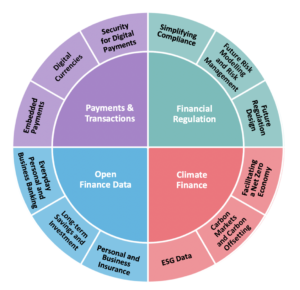

The priority themes form the building blocks of the Roadmap are: Open Finance data, Climate Finance, Payments and transactions, and Financial regulation. In subsequent blogs in this series we will focus on each of these four themes individually.

The roadmap will be led and facilitated by FinTech Scotland. However, wider stakeholder participation is required to implement the R&I actions set out in this Roadmap.

Actions will be progressed through two key types of activity:

Unleashing Innovation: A series of Open Innovation Calls, using technologies and data to develop new and improved financial products and models.

A rollout plan will be developed to implement a programme of innovation calls. This will include developing a sponsorship proposition to maintain the commitment for an industry-led programme.

The initial steps for the Roadmap innovation calls include:

- Work with the Smart Data Foundry to start the implementation of the priority innovation calls identified in the Roadmap.

- Continue the work with industry stakeholders to refine a series of problem statements for each theme, ensuring industry value in the future solutions.

- Market the innovation calls across UK and international FinTech clusters, raising the profile of FinTech innovation in Scotland.

Actionable Research: Research, using technologies and data to create actionable insights that can be applied commercially using FinTech.

FinTech Scotland will engage with academic community in respect of the research topics proposed. FinTech Scotland will also engage with research funding organisations such as UKRI / Innovate UK to ensure this roadmap is fed into future funding calls.

The initial steps for research topic actions include:

- Work with university leaders to generate research briefs that directly respond to the actions identified in the roadmap.

- Establish relevant steering groups demonstrating collaboration across industry and the research community.

- Monitor and review progression (including a KPI scorecard).

Twice a year, the FinTech Scotland Cluster Management Board will measure and review the Roadmap’s progress of the Roadmap. This will be reported publicly to stakeholders in Scotland and the UK.

What will the impact of the Roadmap be?

In this blog we have outlined the requirement and benefits to bringing industry-led approach to research and innovation, but describing the impact the Roadmap can have on the Scottish and UK economy is perhaps the most compelling way to explain why this is such a vital document.

The overarching economic ambition for the Roadmap is to do two things:

- Create up to 30,000 extra jobs in Scotland.

- Increase economic value (GVA) by more than 330% – from £598 million to more than £2 billion – over ten years.

Taking a broader perspective, the impact of the Roadmap will be:

- To tangibly help improve lives for citizens, by tackling inclusion and health- related issues.

- To further develop Scotland as part of the UK in being a global ‘engine room’ for FinTech and a desirable location for international FinTech companies.

- To drive innovation, supported by a world-leading reputation in regulation and compliance.

- To use Scotland’s and the UK’s natural strengths, making them a global enabler of ‘greener’ FinTech.

A blueprint for the future

FinTech Scotland’s Research & Innovation Roadmap outlines actionable research and innovation activities that can help develop economic, environmental, and societal value for Scotland and the UK through FinTech. Successful implementation will require the engagement and co-operation of key stakeholders within the FinTech Scotland cluster, and stakeholders from across the UK and internationally. The Roadmap is the first of its kind in the UK, but the aspiration is that it has created a framework that other countries, regions or indeed FinTech sectors can learn from and adapt.

More information about FinTech Scotland’s Research & Innovation Roadmap can be found here, where the full Roadmap can also be downloaded.