Operational Resilience by Mihir Joglekar Business Analyst, AutoRek

Globally, organisations’ operational resilience is currently being tested as key members of staff are working remotely. The need to access data in real time has increased and reporting accurately has become more critical than ever.

Operational readiness can be defined as an organisation’s ability to anticipate, prepare, respond and adapt to uncertainties and disruptions to successfully deliver services to its client base. It requires both tactical and strategic thinking.

The Financial Conduct Authority (FCA) suggests organisations follow these three steps to support operational resilience (CP19/32):

- Focus on continuity of its most important business services.

- Conduct an extensive impact vs threshold exercise of all business services, and the levels of disruption that could be tolerated. This exercise should be conducted and reported at the highest level of seniority of organisational management i.e. board level.

- Consider disruption as a certainty and ensure adequate plans have been agreed to mitigate its impact to services.

The FCA reinforces the need for firms to develop and improve capabilities so that any systemic impact event is contained. Focus should be on time taken to respond, effective internal and external communication, particularly with customers. The FCA have also linked operational resilience as part of its objectives involving Consumer Protection, Market Integrity, and Effective Competition by ensuring resilient firms can support ongoing availability of services, thereby reducing harm to the consumer.

While operational resilience is not a new concept to the business community, what is missing is a complete approach to address resilience. Organisations may already have components like crisis management plans, disaster recovery plans and secondary sites etc., but unfortunately over the last two decades there have been a number of stress factors that have contributed to this subject being relegated as more pressing issues have taken priority mainly due to:

- 2000-02: Dot-com bubble and the impact due to its crash i.e. only 48% tech companies survived post event

- 2007-2010: Financial crisis trigged by subprime loans and reduced oversight of the industry at that point

- 2010-15: European sovereign debt crisis due to EU Member States taking on unsustainable levels of debt

- 2014-17: Chinese financial crisis with the popping of the stock market bubble

- 2019-21: Corona virus (COVID 19) related lockdown and economic downturn

The current “Great Lockdown” due do COVID 19 has simply functioned as a catalyst for serious action, triggering management and leadership team to renew efforts.

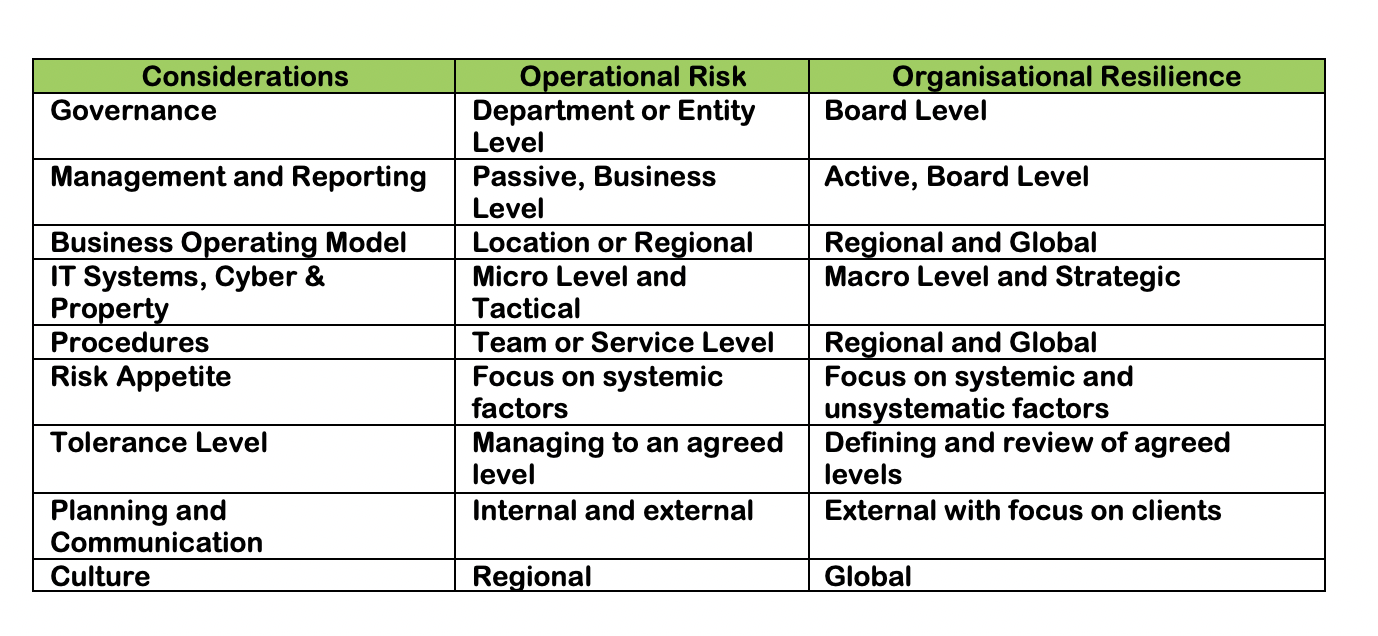

One way of differentiating operational risk from operational resilience is to consider the internal vs external force perspective. Operational risk is largely internal to an organisation due to a blend of systemic and non-systemic risks associated at micro level of business processes, while resilience is an organisation macro level initiative where all business units contribute towards establishing a resilient business and is inclined more towards external circumstances. Both risk and resilience are intrinsically connected and an organisation’s ability to effectively address operational risks across business functions will contribute to its overall resilience. The table below outlines these differences.

Following the publication of the discussion paper, Achieving Operational Resilience and the conclusion of the consultation process, the FCA has communicated its intention to review and where applicable, consider all feedback received as part of its final policy statement.

The FCA proposal include that firms:

- Identify and Categories their important business services.

- Set Impact Tolerance for each of these services.

- Test their ability to support these services across a range or scenarios

- Conduct active lessons learnt exercises

- Develop internal and external Communication plans

- Establish self-assessment and reporting documentations

Within the context of the current crisis our economic engines must start to fire up again and business must ramp up at the earliest safest opportunity. This is where AutoRek sees its innovative software making a significant contribution towards business, who still need to deliver service excellence to their clients in an unified manner, utilising new and innovative workflow and people management practices more than ever are reliant on distributed and remote team work.

In conclusion, organisations are now actively progressing their operational resilience programmes that will continue to evolve around new set-ups as leaders and managers gradually commence the return to a new and adaptive business as usual.

www.autorek.com

More on Autorek